+ 3rd URA. Tech Turned Over, Uranium Set To Explode

FNGD, TSLA, URA, uranium, gold

Seven weeks ago, on tech I noted:

i26 (down from a recent 28), m29 (both out of a possible 30)

Madness reigns, so I’m doubling my FNGD position, last at $8.90

FNGD closed the week at $9.46 while FNGU scores have further decayed to i16, m24

My measures indicate being short big tech is the correct positioning over the coming 3-6 months, or at least until i is another 10 points lower at which time I’ll probably close the 2nd FNGD position.

Given the extreme mania in the sector so far this year, there’s a lot of speculative excess to unwind which makes this a great risk / reward proposition as I see it.

WSJ headline a harbinger: Boomers Got Hooked On Stocks, Now They Can’t Let Go. Nearly 2/3 over age 65 have money in stocks.

All manias end the same, and it’s not different this time.

Below is a chart of the Dow / gold ratio, showing large caps peaked vs. gold 5 years ago within the typical range, while the Dow’s all-time high was January 2023, and it’s a very long way down if history is any indication.

The grey areas are periods declared officially as recessions:

When might the next recession occur? Well, we’re already in it. “Officially” however, a major recession typically coincides with yield inversions unwinding.

Recently the 10-2 year treasury yield spread was inverted to an all-time record degree. Though it could become inverted to an even greater historic extreme, it appears that a double-bottom is in evidence and the unwinding has begun:

The most speculative sectors tend to lead major long-term moves across asset classes.

In 2023 so far small-caps (Russell 2000 index) peaked in January, with the all-time high back in November of 2021. Most cryptos topped in April, with bitcoin seeming to have peaked in July (just slightly above its June high, marking a possible double top), also with an all-time high in 2021.

Tech appears to also have peaked for 2023 in July, with an all-time high in 2021, while extreme rot in the EV sector and sundry grifts attached to it is slowly becoming more widely known only now.

Headline: Ford Will Lose $4.5 Billion On EVs This Year, Up From $2.1 Billion Last Year

The Telegraph: ‘Strong customer reluctance’ forces Volkswagen to slash electric vehicle production

And that’s despite the massive subsidies stolen from taxpayers and funnelled into the pockets of buyers of these vehicles and the innumerable fraudsters in the sector.

WolfStreet: The Collapse Of EV SPACs: Another Goes Bankrupt, Others On The Verge

The SPAC boom will surely go down in history as one of the biggest stock-market heists ever, made possible by Consensual Hallucination […]

Tesla is not part of this list. It is kicking the ICE vehicle makers in the nuts and is taking massive share from their ICE vehicles! And it’s very profitable, after a decade of losing tons of money.

Very profitable, is it? Perhaps, if one trusts its accounting treatments.

Tesla‘s CFO suddenly resigned recently, as is normal for any key executive who becomes too aware and uncomfortable wth how the proverbial sausage - or “profit” - is made there.

The parade of defectors in key roles from engineering to legal to finance is unprecedented in both scope and speed for any legit company anywhere near its size.

The company has had four CFO’s in six years, three in the past four years. The new CFO is yet another operating under Musk’s micromanaging thumb, who was previously in accounting at Tesla and the Musk family’s alleged scam SolarCity.

Foreshadowing?

Zero Hedge: 500 EVs Among The 3000 Cars On Burning Ship Off Dutch Coast

Nathan Habers, spokesperson for the Royal Association of Netherlands Shipowners, told Reuters, "When transporting electric cars powered by batteries - which when they catch fire can't be extinguished with water, or even by oxygen deprivation."

One significant risk for lithium-ion batteries is "thermal runaway" during a fire that is hard to extinguish and can spontaneously reignite. Yet another risk emerges as governments set decarbonization targets for the transportation sector.

Zero Hedge: Nikola Issues EV Truck Recall, Halts Sales After "Thermal Incident" Probe

Struggling electric vehicle maker Nikola announced a recall of its battery-powered electric trucks after a third-party investigation revealed a "thermal event" was the probable cause for a June 23 truck fire at the company's Phoenix, Arizona, headquarters.

CBS News: "You can't put them out": Tesla bursts into flames after Wakefield crash, raises concerns for firefighters

The lithium-ion batteries under the car pose a major hazard when the car is on fire. "If those battery packs go into thermal runaway, which is just a chemical reaction, then they get super-heated and they run away. You can't put them out. They don't go out. They reignite. And they release tremendously toxic gases," he said.

Flames can reach up to 2500 degrees, Purcell explained. And no matter how much water you put on the car; the batteries will reignite.

This particular fire took firefighters hours and required more than 20,000 gallons of water to be put out.

Similar to an EV fire that can’t be easily extinguished, and surprisingly reignites after it seems over, a historic speculative mania and epic government malfeasance worldwide cannot be unwound by a slight dip lower like what we experienced economically in 2022.

Magical thinking, irrational hope, and mania behavior isn’t easily extinguished, and tends to flare back up after it should’ve stopped, which is why charts of major tops in all things tend to look the same.

Look again at the major tops in the dow / gold ratio chart above, and notice similarities of a secondary and lower “nah, it’ll be fine!” top before equities went into free-fall coinciding with a recession.

Nominal prices and “values” might keep going up if denominated in fake fiat money, but in real money terms - in gold and commodities - it’s only reasonable to expect the usual so I’ll continue to short fantasy while investing in reality.

In that spirit I’ll probably be adding FNGD or TZA soon-ish, while adding more URA now.

Soft landing?

Central banks have things under control?

Big Brother loves you?

In times like these we can only align financially with power-mad voraciously greedy and egomaniacal charlatans or against them. Easy choice for me, comfortable in the knowledge that history repeats and the majority is always wrong at major inflection points.

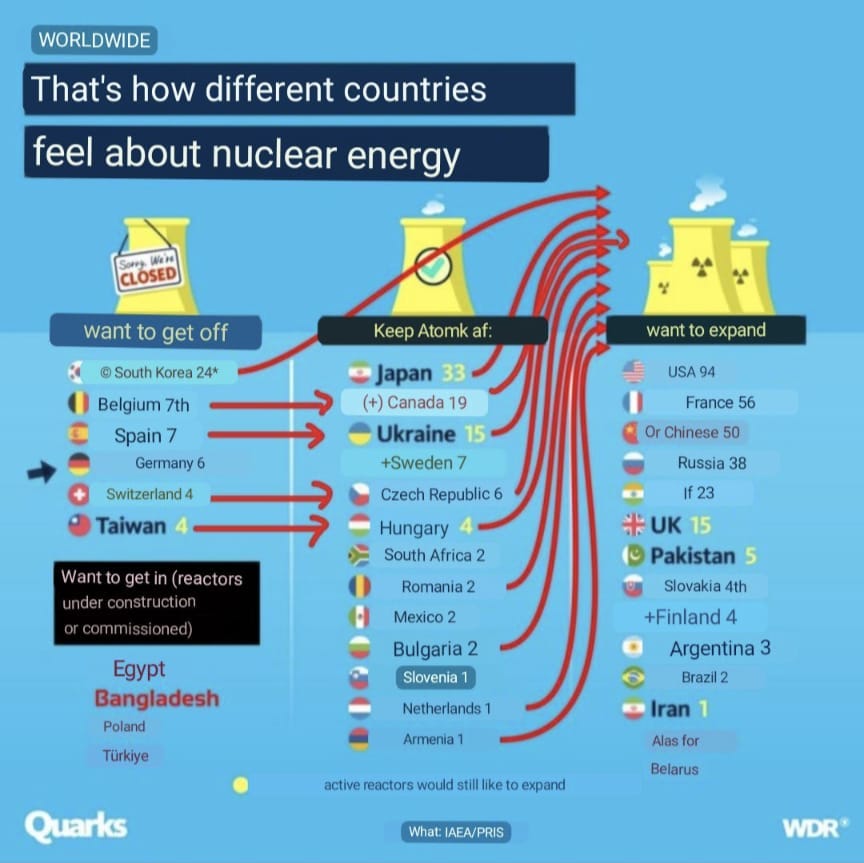

That’s an irrefutable fact the world is only slowly waking to in so many facets of society, from politics to finance and very much including what actually constitutes clean, safe, efficient and reliable energy.

The green-scammed will be begging for nuclear power expansion and chasing related stocks at far higher prices than today’s. As someone that’s tracked the energy sector closely, focusing on uranium, for nearly 20 years, I believe we may not have much longer to wait given the technical setups across the sector could not look more bullish.

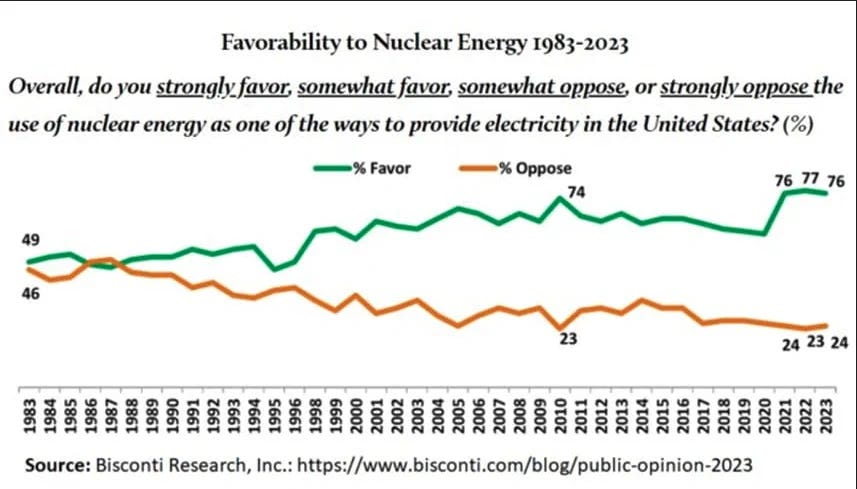

Sentiment seems headed in a sane direction too.

Mish: Wind Energy Projects Suffer From a Multi-Pronged Blow

Subsidies are not enough to make wind energy projects viable. Onshore and offshore projects are delayed or scrapped.

CBC News: 6 of 10 turbines out of commission at P.E.I. wind farm, government says

"When you have an asset that looks like that, that works like that, it's really hard to convince people that this is a positive thing for their community or a positive thing for Prince Edward Island," he said.

That’s because visually-violent scams against taxpayers that destroy animals and the environment are not positives other than for the grifter community.

MSN.com: SNP admits to felling 16 million trees to develop wind farms

Almost 16 million trees have been chopped down on publicly owned land in Scotland to make way for wind farms, an SNP minister had admitted amid a major drive to erect more turbines.

Mairi Gougeon, the Rural Affairs Secretary, estimated that 15.7 million trees had been felled since 2000 in land that is currently managed by agency Forestry and Land Scotland (FLS) - the equivalent of more than 1,700 per day.

Bloomberg: EU Looks Into Blocking Out the Sun as Climate Efforts Falter

The European Union will join an international effort to assess whether large-scale interventions such as deflecting the sun’s rays or changing the Earth’s weather patterns are viable options for fighting climate change.

Please take a few minutes to peruse this compendium of great news:

Reuters: Biden's carbon proposal is unworkable, US power sector warns

Aug 8 (Reuters) - U.S. power plant owners warned the Biden administration on Tuesday that its sweeping plan to slash carbon emissions from the electricity sector is unworkable, relying too heavily on costly technologies that are not yet proven at scale.

Top utility trade group the Edison Electric Institute (EEI) asked the U.S. Environmental Protection Agency (EPA) for revisions of the proposed power plant standards, which hinge on the widespread commercial availability of carbon capture and storage (CCS) and low-emissions green hydrogen, adding the agency's vision was "not legally or technically sound."

New Hampshire Union Leader: The fake climate consensus

We are told climate change is a crisis, and that there is an “overwhelming scientific consensus.”

“It’s a manufactured consensus,” says climate scientist Judith Curry in my new video. She says scientists have an incentive to exaggerate risk to pursue “fame and fortune.”

She knows about that because she once spread alarm about climate change.

Bloomberg: The US's largest power grid, which serves more than 65 million people from Washington, DC to Illinois, has declared a level one emergency

Paul Krugman hypes renewables in the New York Times, but the Iron Law of Power Density won’t be repealed

The Iron Law of Power Density explains why Siemens Energy just reported a $2.4 billion loss on its wind business in the latest quarter. It explains why offshore wind projects here in the U.S. and in Europe, are being canceled left and right. It also explains why, all around the world, rural communities and landowners are fighting back against the landscape-blighting encroachment of massive wind and solar projects.

Power density is perhaps the most important, and least understood, metric in physics. Power density is the essential metric for understanding our energy and power systems. Indeed, the global history of energy over the last 250 years, from the steam engines designed by Newcomen and Watt to the latest nuclear reactor designs and computer chips, can be grasped by seeing them through the lens of power density. So what is power density?

If only we had clean, efficient, reliable, animal-friendly, inexpensive and legitimate energy sources.

76% of the US public favors nuclear energy in 2023 compared with 49% in 1983.

Uranium explained

Click, read, learn & share.

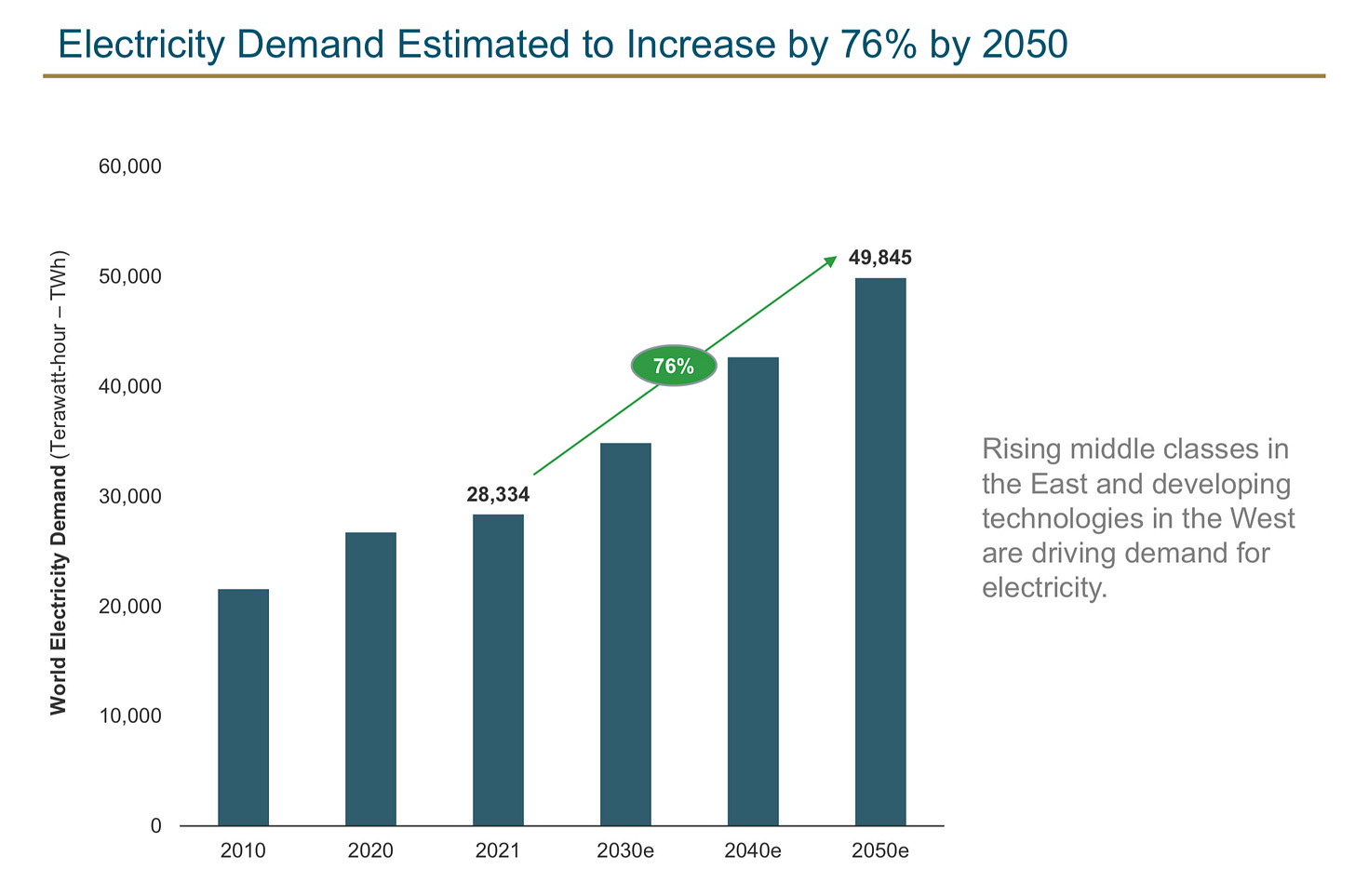

Nuclear power is a clean, efficient, and essential source of electricity used to meet the world’s growing energy demands. Nuclear power can produce electricity at a greater scale while minimizing greenhouse gas emissions. This helps countries expand their electricity grid and usage, while limiting air pollution.

Key Questions Answered Here

1. What is uranium?

2. How is uranium extracted?

3. How is uranium used to generate electricity?

4. What are the advantages of uranium?

5. What is the outlook for uranium demand?

6. What is the status of the uranium supply?

7. Are uranium prices expected to recover?

8. How can you invest in uranium?

Continued ignorance of nuclear power and waste will cost people, society & the planet immeasurably.

Here’s another key question answered: No, you do not own enough uranium nor do I.

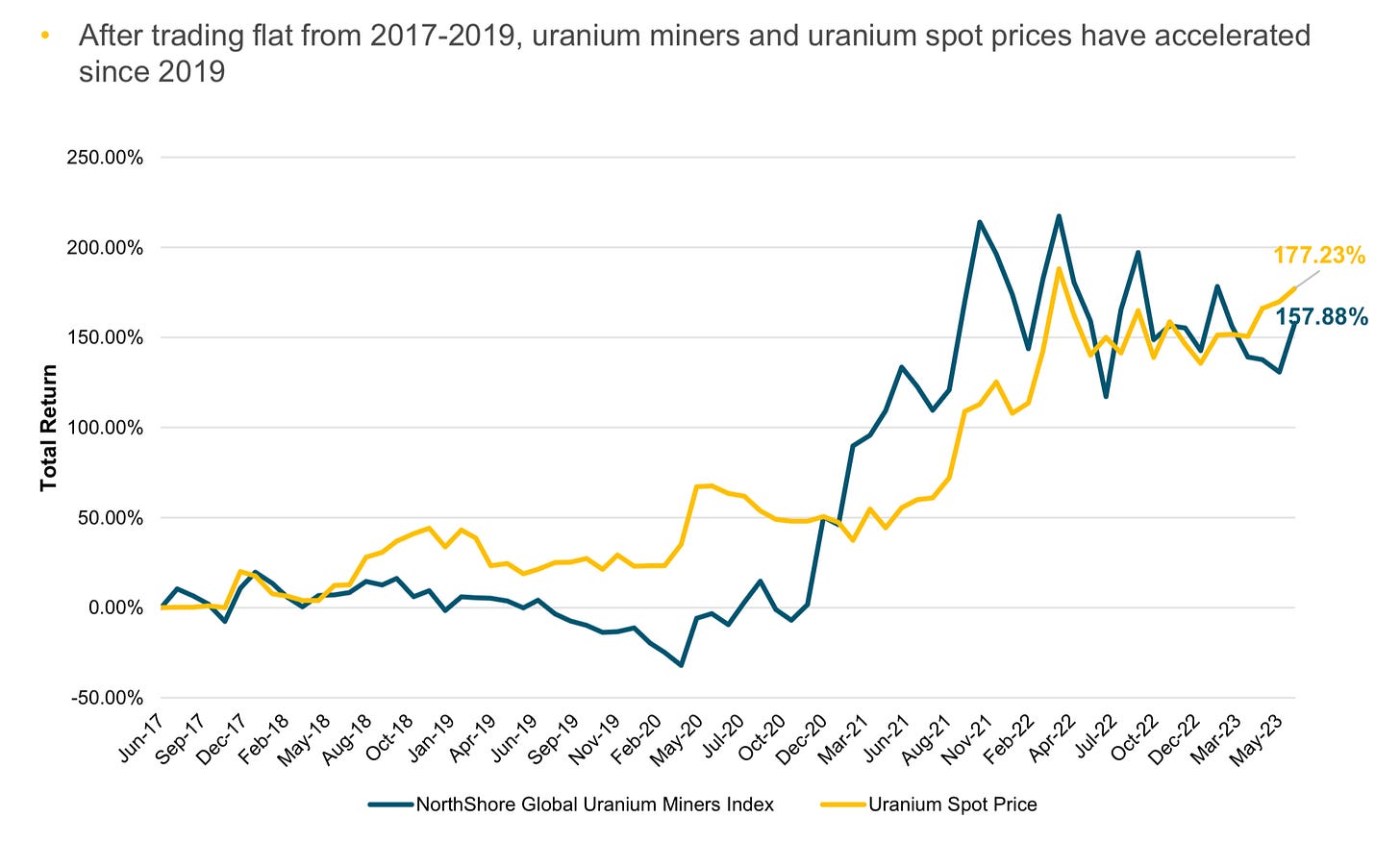

URA, the Global-X Uranium ETF, closed the week at $22.87

This is its hyper-bullish 10-year chart, showing a major pennant pattern (in blue) resolving upward after more than a year of consolidation above a well-established level of support and resistance (yellow):

I’m adding a 3rd position in URA tomorrow morning, planning to hold all three while above the yellow line at roughly $17.20

That represents about 32% risk. I see the upside as far greater, and far more likely based on this technical setup and bullish news from every angle. Meanwhile virtually no one recommends investing in the sector and few even mention the sector exists, suggesting much higher prices when “dumb money” momentum chasers come rushing in.

These are the top holdings in URA:

Read more about it by clicking here.

Forbes: It Sounds Crazy, But Fukushima, Chernobyl, And Three Mile Island Show Why Nuclear Is Inherently Safe

… the main lesson that should be drawn from the worst nuclear accidents is that nuclear energy has always been inherently safe.

The Shocking Truth

The truth about nuclear power’s safety is so shocking that it’s worth taking a closer look at the worst accidents, starting with the worst of the worst…

CBC News: Hydro-Québec mulls reviving province's nuclear reactor, 10 years after shutdown

In its quest to increase electricity production in Quebec, Hydro-Québec is contemplating a move back to nuclear power.

The government-run utility confirmed Thursday that it is considering the revival of Gentilly-2, the province's only nuclear power plant, which was shut down in 2012.

"An assessment of the plant's current condition is underway," a Hydro-Québec spokesperson said in a statement.

The company says it's hoping to "inform our thinking on Quebec's future energy supply," considering it's globally analyzing the various options for increasing electricity production to decarbonize Quebec.

Headline: German Green Party Politician Powerfully Denounces Nuclear Closures

Translation:

Dear people, I was a (rather active) nuclear opponent for decades. Now it's time to take note of a few facts: No other country shut down its nuclear power plants prematurely in the middle of the climate and energy crisis. The trend is towards extending the term. Numerous industrialized countries see nuclear power & renewables as complementary. Massive investments are again being made in R&D for the further development of nuclear energy.

Powermag.com: Miss America Talks Importance of Nuclear Power

Grace Stanke, who is set to graduate from the University of Wisconsin-Madison with a degree in nuclear engineering, is using her platform as Miss America 2023 to spread the word about the importance of nuclear power to the U.S. electricity sector.

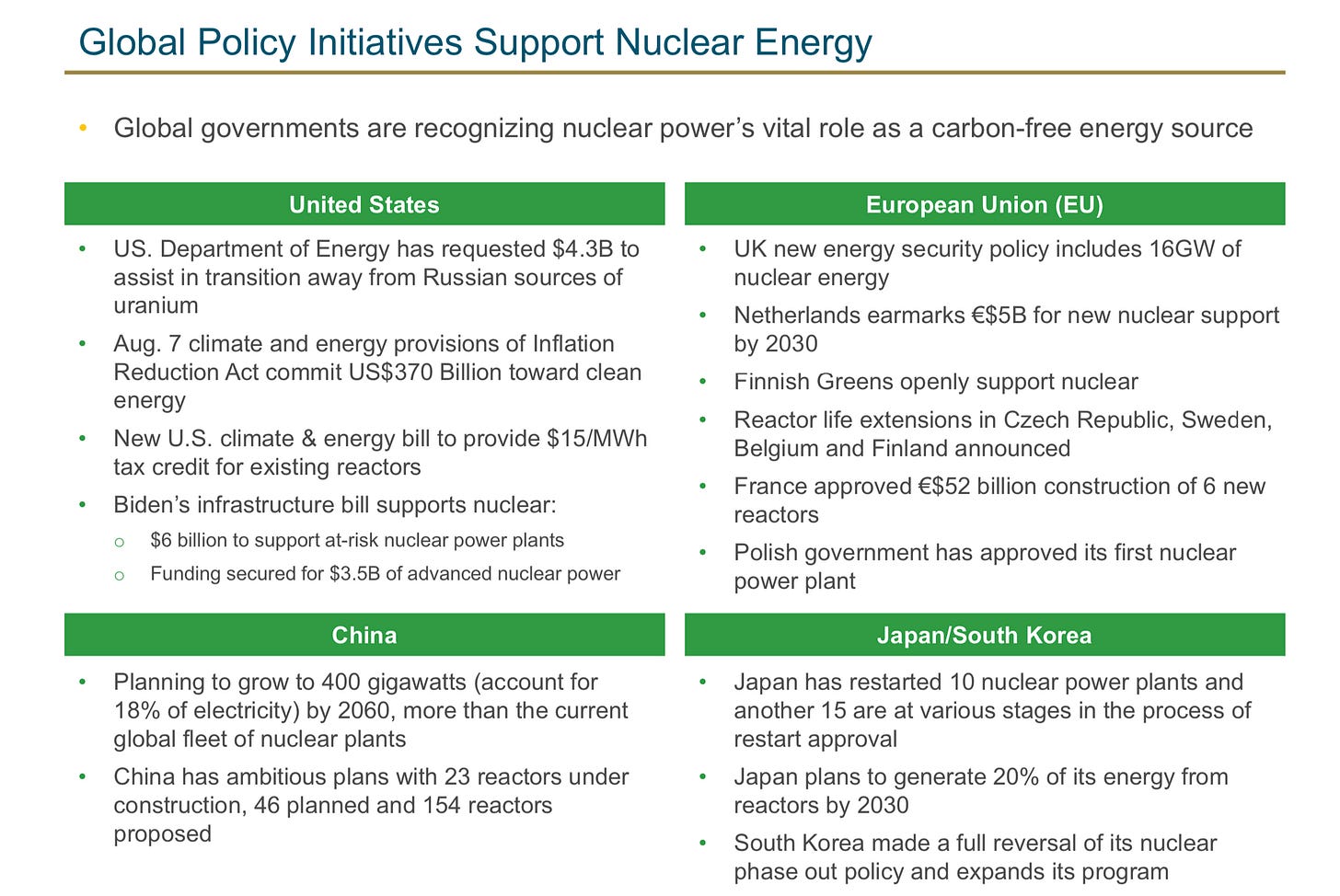

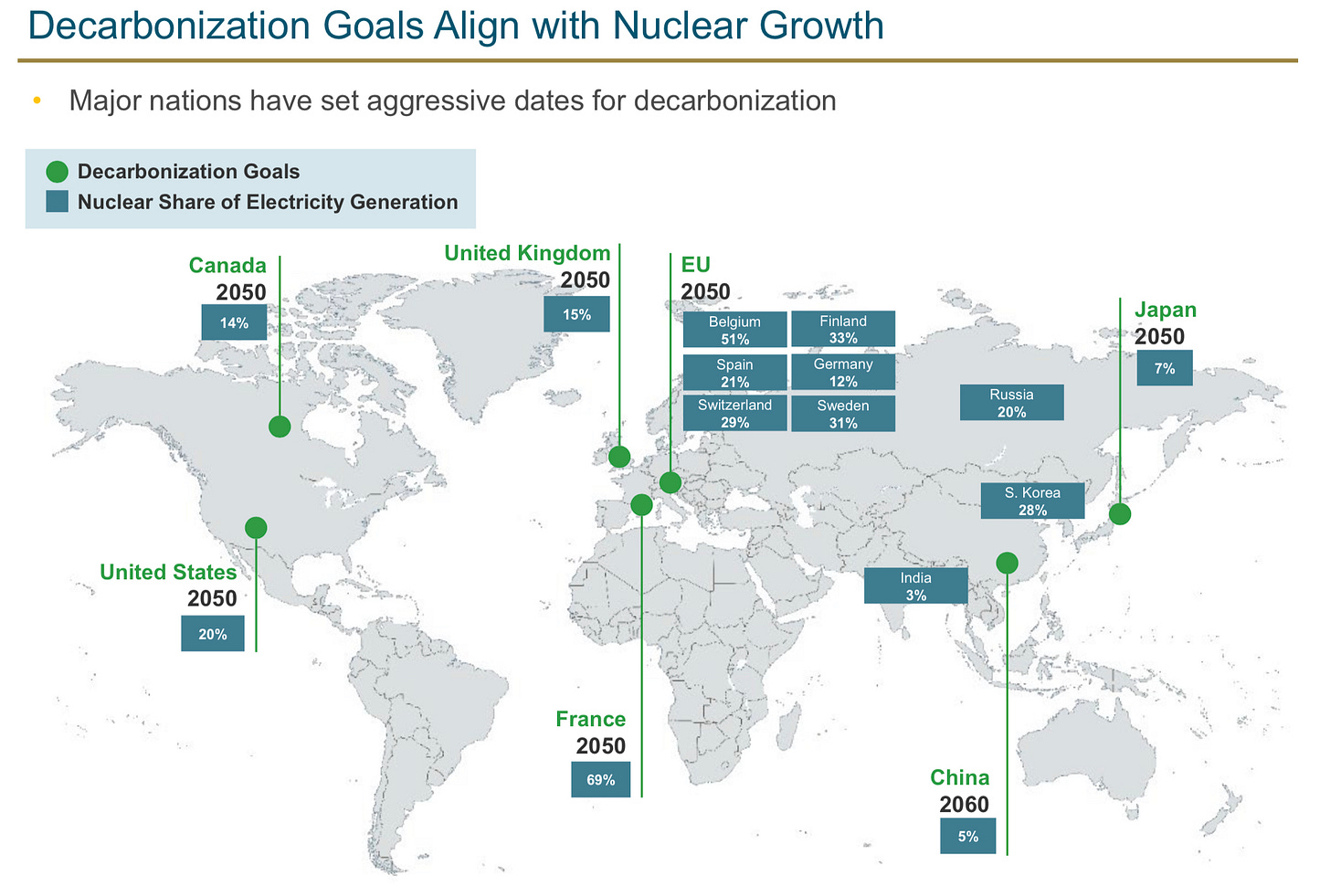

The following graphics are from a Sprott presentation.

The first depicts reactor requirements consolidating before a near-certain swing much higher.

This chart similarly shows consolidation likely to burst higher: