A couple months back I stated there’d soon be an excellent entry setup in food commodities.

Sticking with my “buy reality” theme, focused in commodities, that time has come.

One And Done #12 will comprise of 3 holdings in equal parts, which for purposes of tracking here I’ll enter tomorrow with no sell stop in place until further notice.

Charts for CORN and WEAT don’t look very good as shown below, however all three of these instruments currently meet my “Special Situations” criteria which boasts a 100% hit rate of quick significant profits.

You can find a recap of Special Situations here. Note at the time Japanese yen was an outlier, which has since turned profitable.

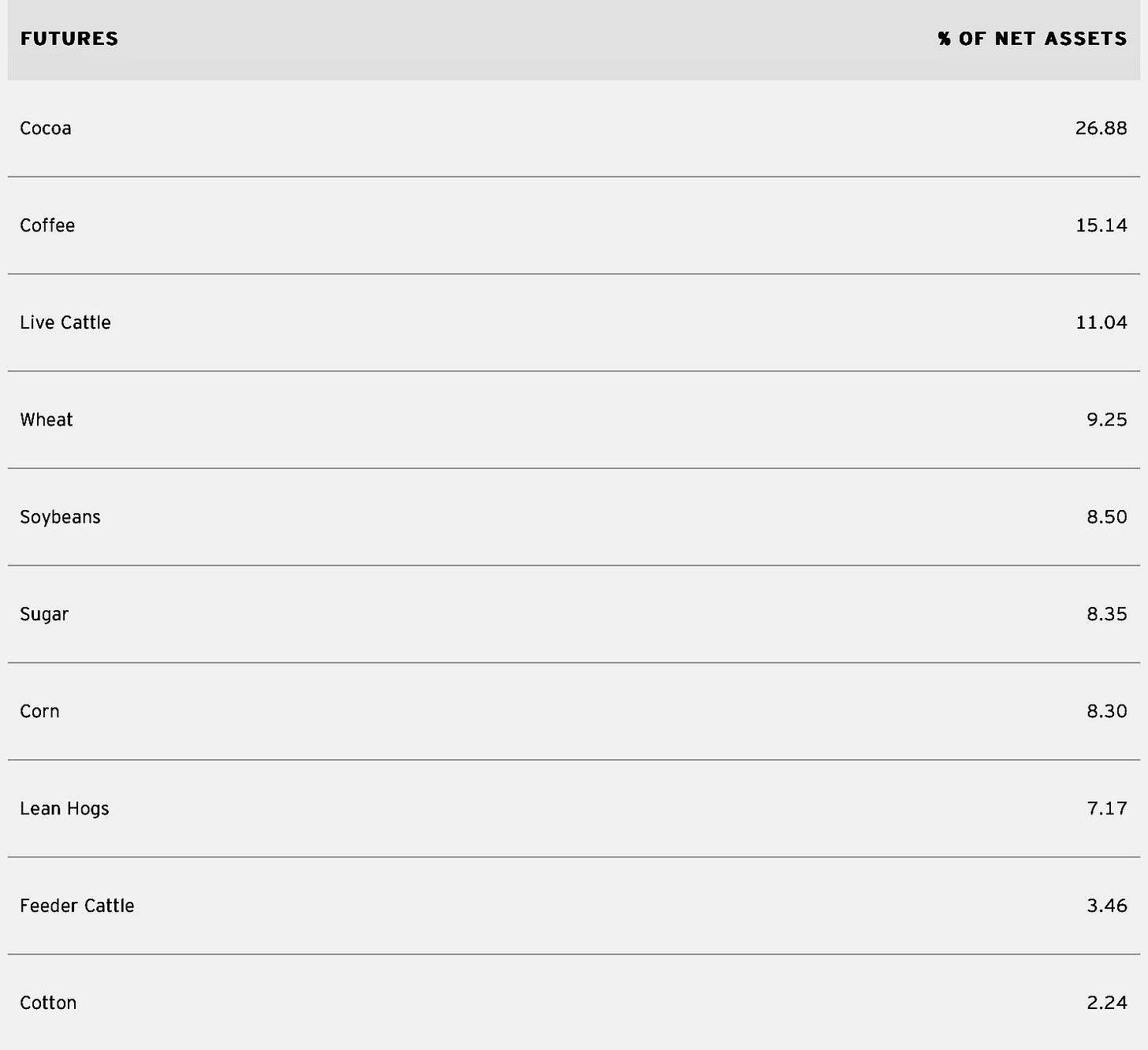

Ticker DBA is the Invesco DB Agriculture Fund

The Invesco DB Agriculture (Fund) seeks to track changes, whether positive or negative, in the level of the DBIQ Diversified Agriculture Index Excess Return™ (DBIQ Diversified Agriculture Index ER or Index) plus the interest income from the Fund's holdings of primarily US Treasury securities and money market income less the Fund's expenses. The Fund is designed for investors who want a cost-effective and convenient way to invest in commodity futures. The Index is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities. You cannot invest directly in the Index. The Fund and the Index are rebalanced and reconstituted annually in November.

This Fund is not suitable for all investors due to the speculative nature of an investment based upon the Fund's trading which takes place in very volatile markets. Because an investment in futures contracts is volatile, such frequency in the movement in market prices of the underlying futures contracts could cause large losses. Please see "Risk and Other Information" and the Prospectus for additional risk disclosures.

Its current composition:

Read more here: https://www.invesco.com/us/financial-products/etfs/product-detail?audienceType=Advisor&ticker=DBA

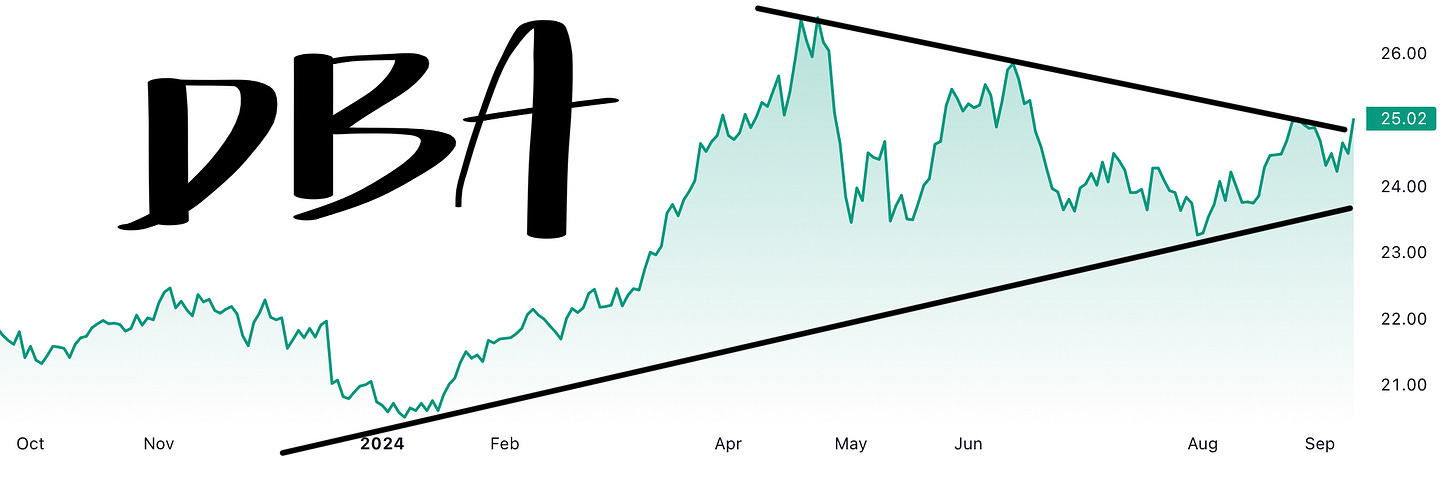

DBA closed today, September 11 2024, at $25.02

Its 1-year chart shows a very bullish breakout in progress:

Ticker CORN is the Teucrium Corn Fund

The Teucrium Corn Fund (CORN) provides investors an easy way to gain exposure to the price of corn futures in a brokerage account.

CORN: Did You Know?

Corn is one of the most important agricultural commodities, used throughout the global economy as feed, fuel, starch, sweetener and plastic.

Demand for corn is rising exponentially due to world population growth and the expansion of the global middle class.

Corn prices have a historically low correlation with U.S. equities making CORN a potentially attractive option for portfolio diversification.

Corn in Your Portfolio

Commodities typically behave differently than other asset classes and can help enhance portfolio diversification.

Returns of individual commodities may be driven by multiple differing factors.

You can segment your commodity exposure (like you do with other asset classes) among various categories such as: Energy, Precious Metals, Agriculture, Industrial Metals, etc.

CORN may be held as a core component of your overall exposure to agriculture.

Read more here: https://teucrium.com/etfs/corn

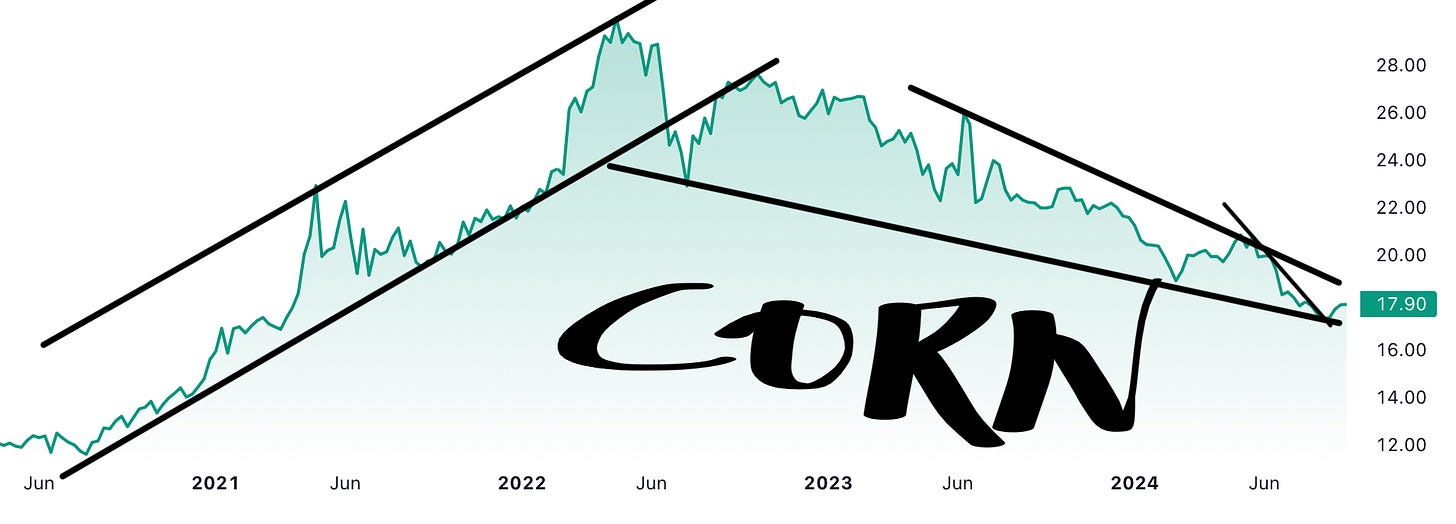

CORN closed today at $17.90

4-year CORN chart:

Ticker WEAT is the Teucrium Wheat Fund

The Teucrium Wheat Fund (WEAT) provides investors an easy way to gain exposure to the price of wheat futures in a brokerage account.

WEAT: Did You Know?

Wheat is one of the most important agricultural commodities, used throughout the global economy as food, animal feed, fuel, starch, paper, particleboard, and plastic.

Demand for wheat is rising exponentially due to world population growth, and the expansion of the global middle class.

Wheat prices have a historically low correlation with U.S. equities making WEAT a potentially attractive option for portfolio diversification.

WEAT in Your Portfolio

Commodities typically behave differently than other asset classes and can help enhance portfolio diversification.

Returns of individual commodities may be driven by multiple differing factors.

You can segment your commodity exposure (like you do with other asset classes) among various categories such as: Energy, Precious Metals, Industrial Metals, etc.

WEAT may be held as a core component of your overall exposure to agriculture.

Read more here: http://www.teucrium.com/etfs/weat

WEAT closed today at $5.17

12-year chart: