REMX - Special Situation, and Sitka Gold

It’s finally time for rare earths, and it’s always time for gold

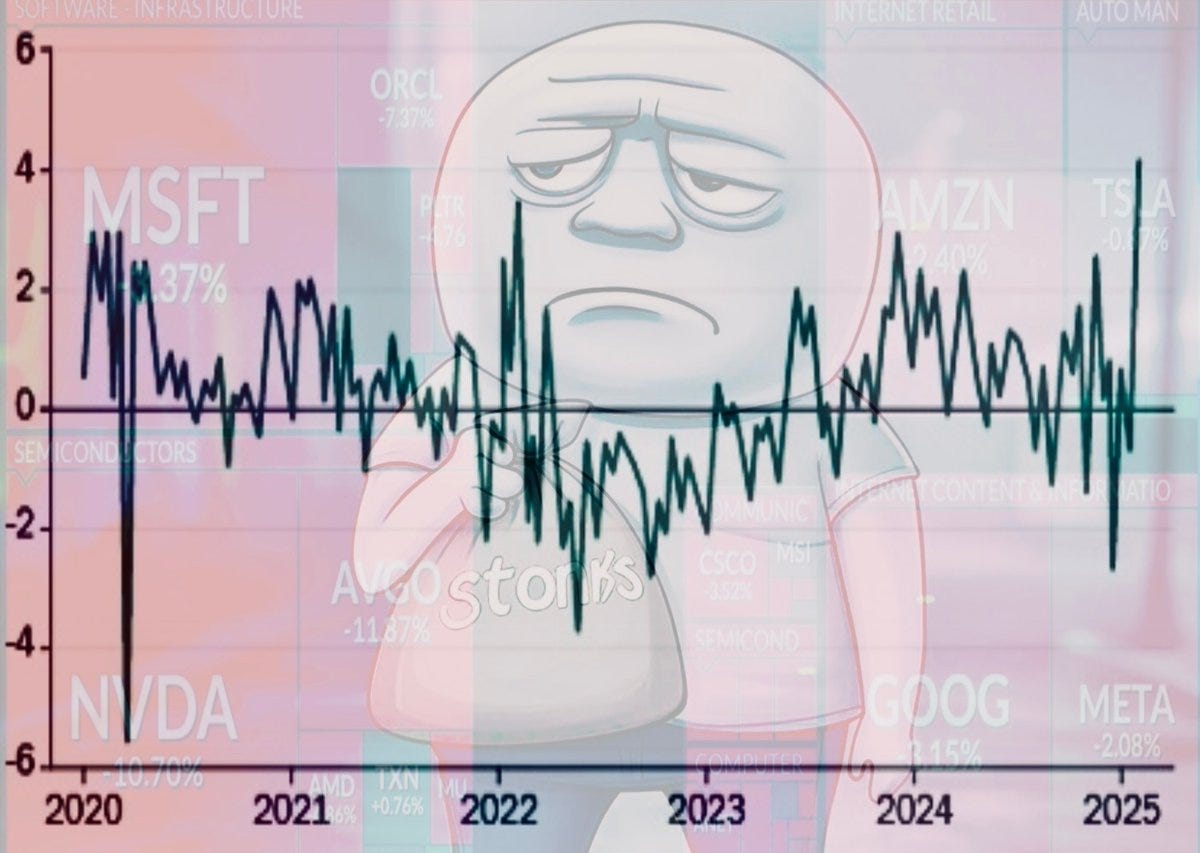

Bagholding is the new black.

JP Morgan retail sentiment gauge reveals an appetite for destruction higher than January 2020 or January 2022. Both dates marked the start of market crashes.

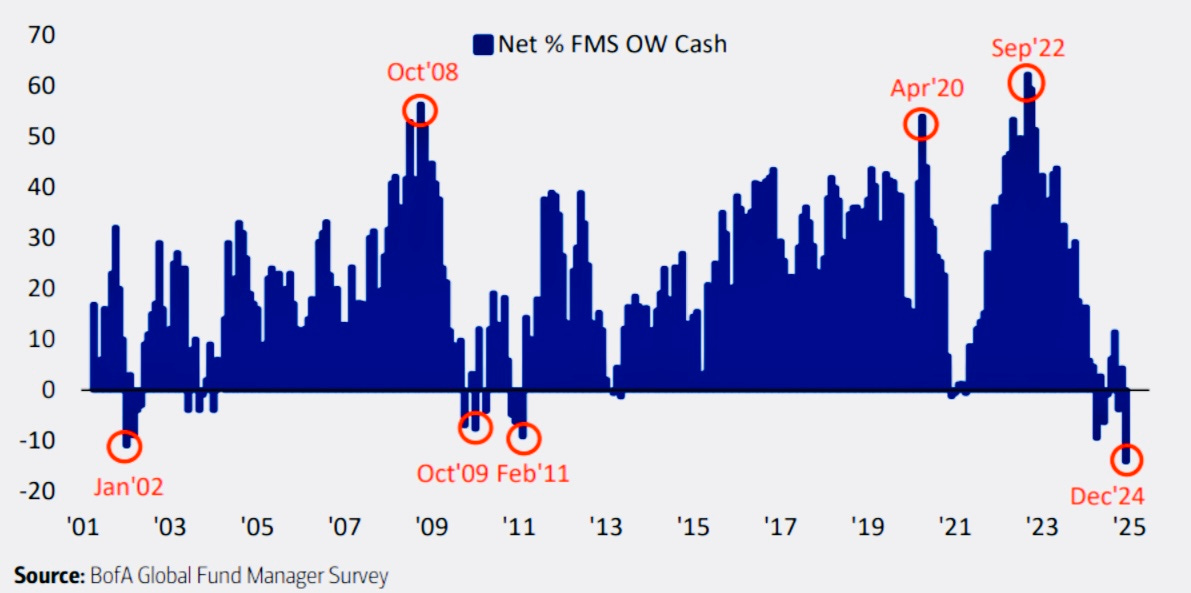

Professional fund managers (read: professional fee-churners) had the most cash on record when buying opportunities were the best seen in generations.

You guessed it, they were all-in plus utilizing margin debt at major tops:

Here’s one of my own. Since the hyperbolically-named “Great Financial Crisis” 15 years ago, current level was only hit 3 prior times: early Feb 2020, early Nov 2021, late May 2022.

Another data set of mine, running like clockwork. When the yellow down trends are broken, markets suffer major drawdowns shortly thereafter. This chart was made three months ago and has since triggered another bear signal:

The art market is in a correction as big spenders fade

Bloomberg reports that "the major May New York [art] auction season fell about 23% by value from the prior year."

Deloitte estimates outstanding loans against art could surpass $36 billion in 2024, up from $29 billion to $34 billion last year.

That also compares with $20.3 billion to $23.6 billion of such loans outstanding five years ago, according to Deloitte.

20 Percent of Households Making Over $150,000 Live Paycheck to Paycheck

American consumers are increasingly underwater on their car loans

US current account deficit hits record high

Number of US bankruptcies currently under Chapter 11 jumps to 2,462, highest count in 13 years

"Consumers Running Out Of Money": Former Target Exec Offers Dire Warning

Americans haven't been this worried about making their credit card payments since the pandemic

Majority of millennials are afraid they won't have enough money in retirement

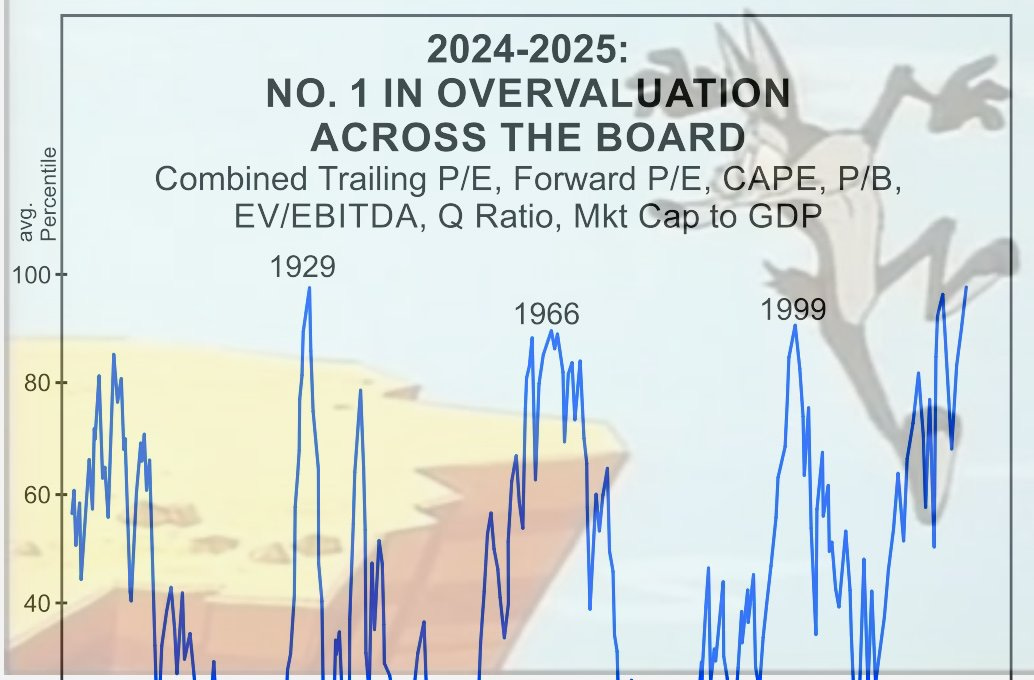

Yet consider these headlines and charts:

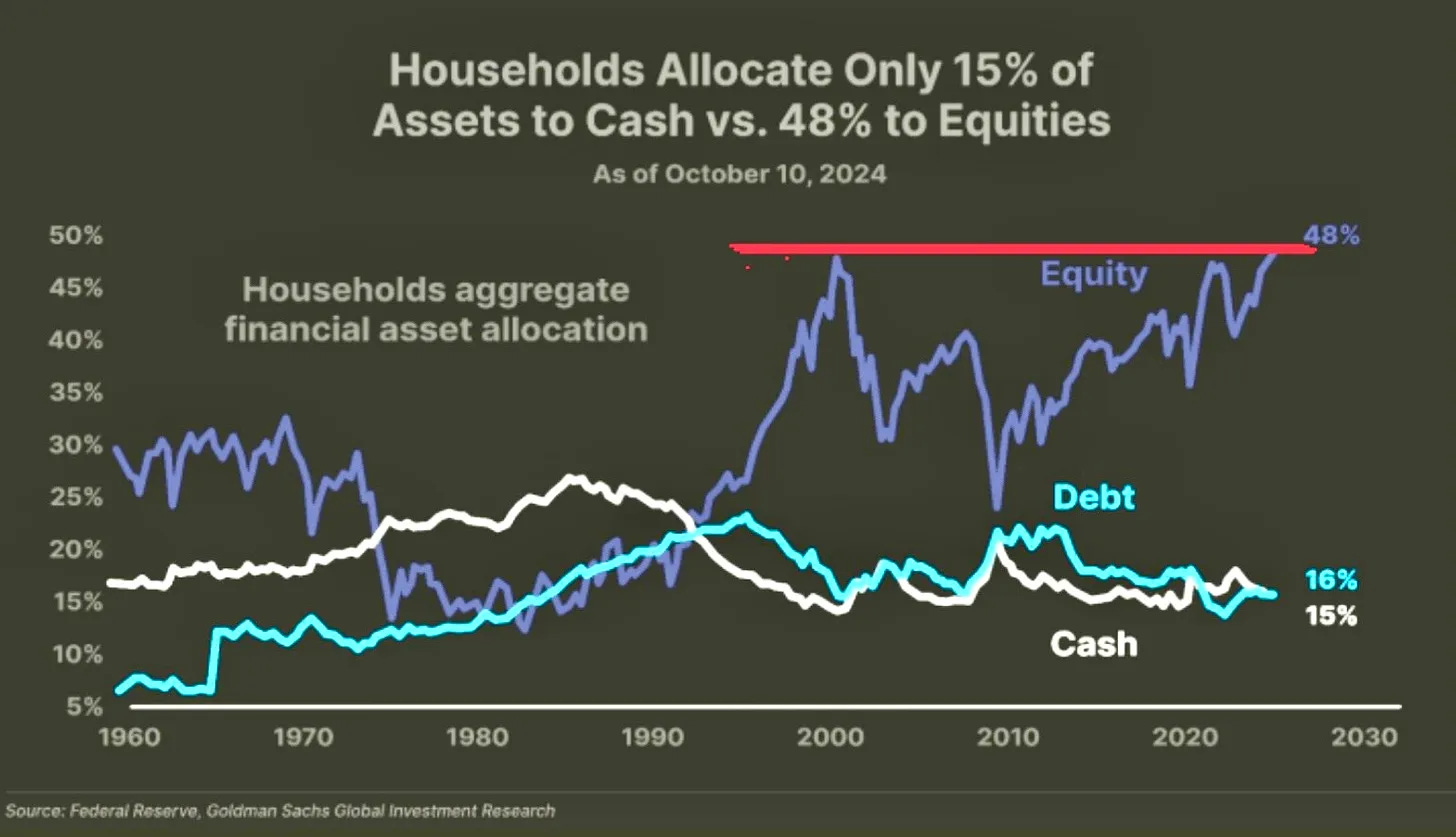

U.S. households are all-in on the stock market, with the highest allocation – at 48% – to stocks as a percentage of total financial assets, since the dot-com bubble

Investors all-in on stocks: Mutual fund cash levels lowest on record

Can it get crazier? It already has! All the charts and data points above are 2-5 months old. The stats today are worse.

A reckoning is underway. However that doesn’t leave us without opportunity.

Quite the opposite. A historic speculative mania in tech resulted in a crash which led to a 10-year commodities boom (plus a real estate bubble and crash) from 2000 - 2011. It’s not different this generation.

Today I’m finally offering an ideal setup in rare earths.

“Finally” because since February 2023 - the 2nd month of this substack’s existence - I’ve periodically promised a coming focus would be on the rare earths sector.

That was long before most people had heard the term, long before it was frequently found in geopolitical headlines because the “Leader of the Free World” has been chanting it.

Critical minerals, strategic elements, REE (rare earth elements), or rare earths; it’s all the same.

What are rare earth elements, and why are they important? Learn more here: https://profession.americangeosciences.org/society/intersections/faq/what-are-rare-earth-elements-and-why-are-they-important

At this point I’m only suggesting an ETF product - the VanEck Rare Earth and Strategic Metals ETF (REMX) - and will offer other ideas within this theme at some later date.

Its chart reveals what happens when its down trends break, and a roughly 4-year cadence of lows preceding major rallies: January 2016, March 2020, and September 2024.

Most important, it meets my “Special Situations” criteria, which so far boasts a perfect hit rate (10/10) across a wide variety of sectors and market backdrops. See here for a recap, keeping in mind the Japanese yen idea turned profitable subsequently:

CHPT +24% in 4 Days! Booking It.

As I type, markets are still open and Chargepoint (CHPT) is $2.38, which is up 24% since my suggested “Special Situation” entry not even a full 4 market days ago.

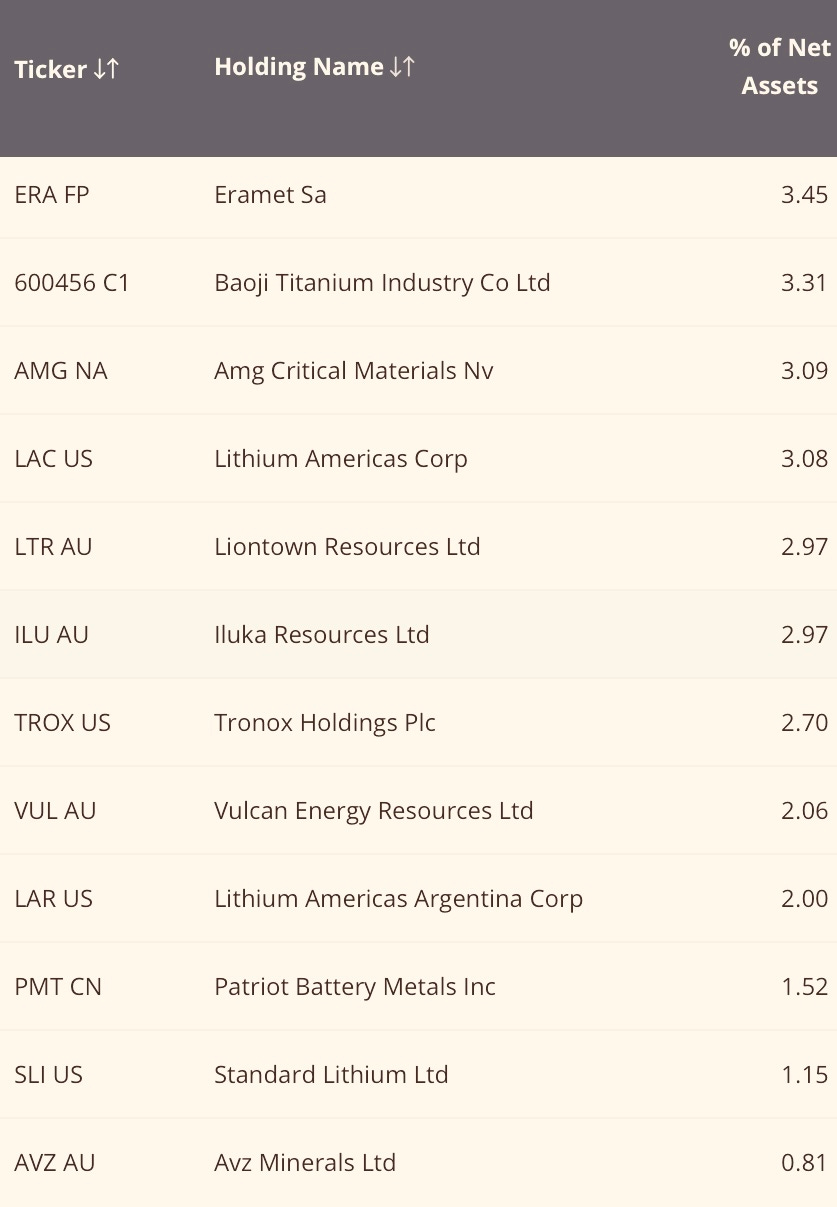

It you’d like other ideas to add to REMX, there are plenty to choose from among its holdings.

I own several and particularly favor its 2nd-largest position, SQM - Sociedad Quimica Y Minera De Chile, along with MP - MP Materials, and SGML - Sigma Lithium.

REMX - VanEck Rare Earth and Strategic Metals ETF

Link: https://www.vaneck.com/us/en/investments/rare-earth-strategic-metals-etf-remx/overview/

Fund Description

VanEck Rare Earth and Strategic Metals ETF (REMX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS®Global Rare Earth/Strategic Metals Index (MVREMXTR), which is intended to track the overall performance of companies involved in producing, refining, and recycling of rare earth and strategic metals and minerals.

Fund Highlights

One-Trade Access to the Rare Earth/Strategic Metals Industry

Many of the world’s most advanced technologies rely on rare earth & strategic metals

Pure Play, Comprehensive, Global Exposure

Companies must derive at least 50% of total revenues from the rare earth/strategic metals industry to be added to the Index and may include A-shares issued by Shanghai-listed companies trading via Shanghai-Hong Kong Stock Connect

Industry Known for Volatility

Rapidly changing supply and demand dynamics, government defense implications, and heavy China involvement have driven significant volatility in the industry historicallyIndex Key Points

Underlying Index: MVIS Global Rare Earth/Strategic Metals Index (MVREMXTR)

The MVIS Global Rare Earth/Strategic Metals Index (MVREMXTR) tracks the performance of the largest and most liquid companies in the global rare earth and strategic metals industry. This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from rare earth and strategic metals or that have ongoing mining projects that have the potential to generate at least 50% of the company's revenue from rare earth and strategic metals. The index includes refiners, recyclers, and producers of rare earth and strategic metals and minerals.

Companies initially eligible for inclusion in Index:

Market cap exceeding $150 million.

Three-month average daily trading volume of at least $1 million.

Minimum trading volume of 250,000 shares each month over last 6 months.

Weighting Scheme: Maximum weight capped at 8%

Review Frequency: Quarterly

Holdings:

REMX closed today, March 05 2025, at $41.52

I’m holding it with no stop.

China Puts Export Curbs on Minerals US Needs for Weapons and Technology

Rattled by China, West scrambles to rejig critical minerals supply chains

Europe Aims To Reduce Reliance On China For Critical Minerals

Europe is looking to boost its domestic production of rare earth metals to reduce reliance on China and enhance energy security.

Norway has discovered Europe's largest deposit of rare earth metals, which could be crucial for the development of renewable energy technologies.

Sweden has also made significant discoveries of rare earths, indicating potential for increased European production.

Gold is God’s Money

It should be yours too.

GLCC - GLOBAL X GOLD PRODUCER EQUITY COVERED CALL ETF raised its dividend by $0.12 /yr, or 4.5%

It’s now paying $2.76 /yr which is 9% of its current share price of $30.84 but 11.5% of the entry cost per this blog of $23.90 on two GLCC positions 15 months ago.

Since then GLCC is up 29% plus has paid $3.32 in dividends for a total gain on the table of 43% on both positions.

President Trump’s appointment as Secretary of the Treasury - Scott Bessent - previously ran a large investment fund. His fund’s largest holding, by far, when he was appointed to head the U.S. Treasury? Gold.

Of course President Trump is a renown lover of gold too. He and Bessent will not forsake it. They are both very well aware that national currencies are the original scam-coins, and that there is no possible way for the empire to remain even slightly solvent without devaluing its currency ever more.

The President is also a stridently vocal proponent of lower interest rates, which go hand-in-hand with a lower dollar and higher gold price.

Gold, gold, gold. Gold. Gold and gold. Own as much as you can.

Signed Into Law: New Jersey Eliminates Sales Taxes On Gold And Silver

Costco gold bars fly off the shelves as bullion prices smash records

Tanzania orders gold dealers to reserve 20% for purchase by central bank

Sitka Gold (SIG, SITKF)

To the gold basket - One And Done idea #4 - I’m adding Sitka Gold.

Sitka (ticker SIG in Canada, SITKF in the U.S.) closed today at $0.375

I’ll be tracking it here in its domestic, Canadian, currency.

You’re highly encouraged to read its website, news, and 2025 technical report:

The highlights in my view are:

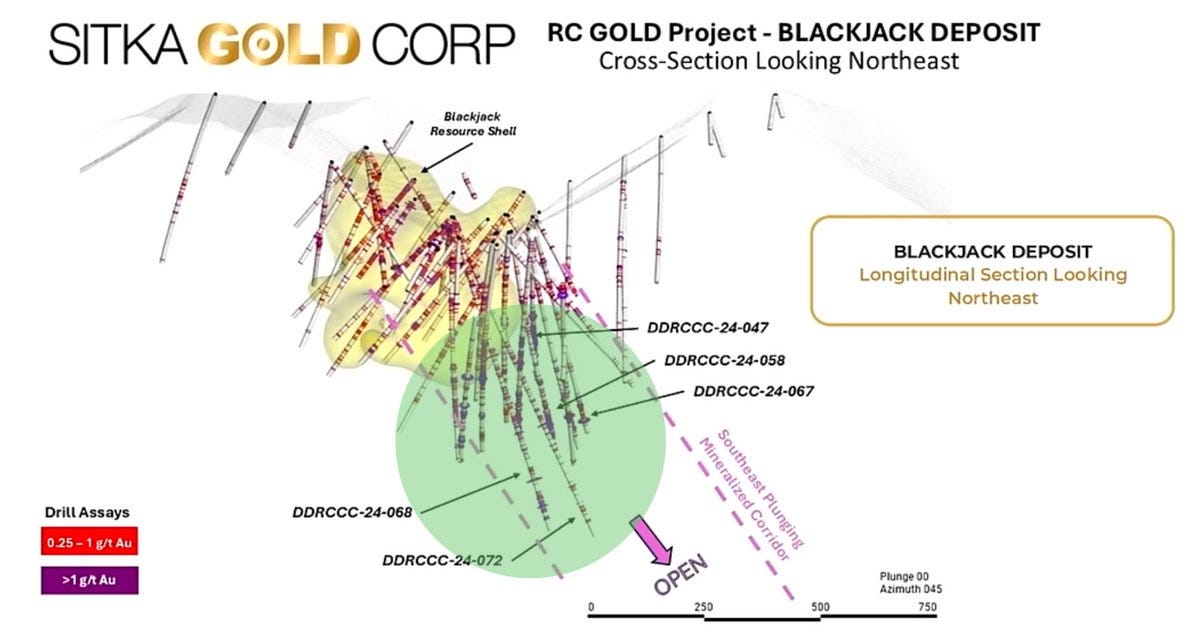

Remarkable assay results, in a very mineral-rich and mining-friendly jurisdiction, with a steady stream of potentially excellent results incoming from last year’s drilling, along with a very large (for a company of this size) fully-funded 30000 meter drill campaign just begun in 2025.

Also remarkable is that many of the most exciting drill holes end in exceptional mineralization. This is rare, as normally if drilling intersects a vein of ore then it’s up to future, costly drilling to possibly determine in which direction and how deep that vein goes. Often that’s where exploration campaigns fail.

With so many of Sitka’s holes ending in mineralization, the simple and relatively very inexpensive thing to do is to simply drill deeper down holes into established mineralization.

I’ve placed green ovals on Sitka’s images of drilling cross-sections to illustrate the point:

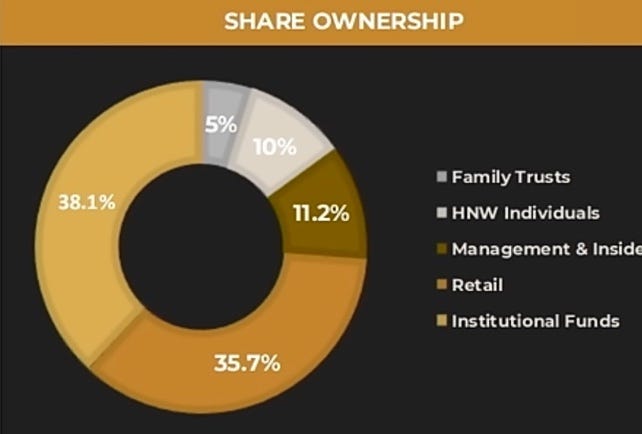

A majority of Sitka’s share ownership is in the hands of insiders or institutional / sophisticated resource investors. That’s super rare for a company at any price in any sector.

Sitka’s land is on trend and adjacent to, with similar geological tells as, Snowline Gold. Indicative of nothing at all, here’s Snowline’s chart:

I know the region and its potential well, once having had a lot of shares in Snowline at an average cost around $0.25

Another of Sitka’s neighbors is Goliath Resources, a company I’ve followed since the day of its market debut and still have some shares. Here’s its chart:

And finally Sitka:

I’ve been buying Sitka since $0.17 and added as recently as today, holding it with no stop.

I believe it’s reasonable to remain bullish at least above $0.25

Food Commodities

Coffee price highest since 1977 on Brazil crop fears

Arabica Futures Surge Into Blue-Sky Breakout As Traders Panic: "We Might Not Have Enough Coffee"

Global Cocoa Deficit Deeper Than Expected, US Stockpiles Hit 2009 Lows

Electric Vehicles

Ford to halt production of F-150 Lightning EV pickup truck

"We're Just Giving Them Away": EV Leases Plunged To As Low As $20 Per Month

Volkswagen plans major layoffs, to shut at least three German plants

Aston Martin Crashes, Stellantis Slides As Auto Slowdown Worsens For European Carmakers

Lightbridge (LTBR)

Independent Modeling Studies from MIT and SIA and Results from Previous Testing Presented at TopFuel 2024 Conference Further Validate that Lightbridge Fuel™ has Safety Advantages Over Current Nuclear Fuel