Yield inversion is proceeding rapidly to reversion as expected.

Here’s a look, with prior peaks over the past year at -0.13% and -0.14%, while the print today (July 23, 2024) was -0.15% :

In addition to One And Done themes and “Special Situations”, I make the rare suggestion which doesn’t fall into a particular category of mine.

One is MO - Altria. I first mentioned it the same month I began this blog, in January 2023, noting:

Any time mainstream news - not financial news, but regular news - leads with a story about markets crashing then buy Altria and Berkshire and hold very long term.

In other words do differently than da masses, or do differently than dumbasses. You’ll by far outperform the vast majority of “experts” and indexes by doing so.

This remains excellent advice.

I didn’t suggest buying MO until February of this year:

Altria (MO) currently pays a 9.7% dividend, sitting at a decent long-term entry point.

It has nothing to do with precious metals but is in-line with my “reality” theme.

Next market crash it’ll be at an even better entry point, but in seeking progress not perfection I added some Friday at $41.14

No stop.

It opened the next day at $41.13, closing today at $49.12 for a gain of 29% (including dividends) in 5 months.

That’s fantastic performance for this type of stock, and though I still like it long term I’m selling it.

Why? The dividend yield at this price is too low to interest me, and I plan to take my own advice by buying it back at a much lower price when markets crashing make headlines. We won’t have long to wait.

Another company I’ve been very bullish on, outside of my usual categories, is TFIN - Triumph Financial.

TFIN hit my “above $90” target last week, when I sold some:

TFIN is now $93.60, up 33% in the 8 months since I suggested it. I’m trimming enough of the position to pocket the profit, by scaling back to my original amount of exposure for the longer term in TFIN.

It peaked the next day at $95.46 then, after its earnings report, plunged 17% overnight to a low of $79.21 before bouncing to close today at $89. I’ll keep holding it long term.

We’re in quarterly earnings season now. Expect many unpleasant surprises resulting in plunging prices, and many will not bounce back so quickly… if ever.

Tesla reported after-hours today.

Tesla Slammed 8 Percent After Hours, Musk Postpones Robotaxi Announcement

Mish’s commentary, via the link above, is a quick, informative and amusing read.

Of my 2 Tesla shorts, via TSLQ (2x inverse Tesla), one was a Special Situation play closed for a 41% gain in just 3 months.

The other was entered in segments over the course of months last year, and remains open. Factoring the dividend of $3.723 paid in late December, my original TSLQ holding has an average cost of $32.49 and was down 22% at today’s close of $25.33

Tesla fell nearly 8% after hours so TSLQ, given its 2x leverage, should open about 15% higher tomorrow. I’m keeping this short open, as my long-term target for Tesla remains well below $50.

Of 11 “Special Situation” suggestions so far, all but one offered significant short-term gains.

The Japanese yen is the outlier, however due to its current rally - retracing 3 months of losses in just 10 days - it’s only down 3% since our entry 5 months ago:

Special Situation - Japanese Yen

I opened a long position in the yen today vs. the dollar, via YCL. YCL is the ProShares Ultra Yen ETF, which “seeks daily investment results that correspond, before fees and expenses, to 2x the daily performance of its underlying benchmark.” I’ve got a timing trigger telling me to buy the over-sold yen, which also looks like it’s at or near a typical poin…

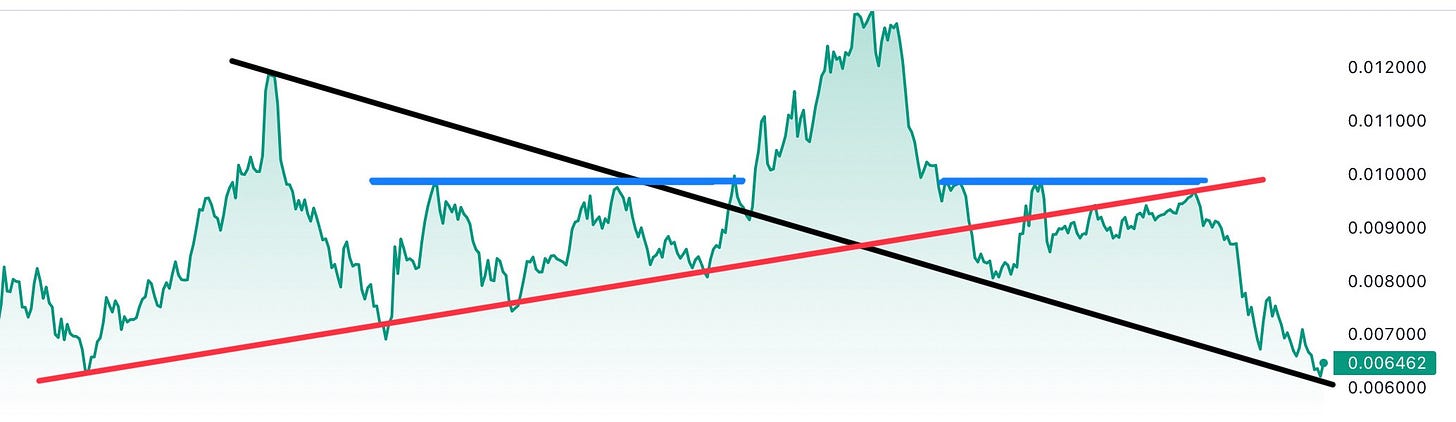

Here’s a fresh look at the yen, starting with a 1-year chart:

The pattern above promises significant upside if prices cross over the black down trend. Until then, I will not consider adding to this position.

YCL - ProShares Ultra Yen ETF has been our instrument of choice to play the yen, which due to its 2x levered nature at today’s close was down nearly 9% since suggested.

Here’s a 40-year yen chart, with lines of major support and resistance observed:

There’s a pair of solid Special Situation ideas on deck, suitable for long-term holds, just waiting for signals to trigger. We won’t have long to wait.

‘Til then, keep yer powder dry.