When To Run, and The Wisdom of Warren

Highland, Secret speculation update, Proper process for entries and exits, Banks

October 26, 2025.

My prior post, titled “All Joyrides End In A Crash”, was last Sunday.

Excerpt:

When price action is relentlessly and exponentially higher, and the crowd is nearly unanimous in bullish fervor, is when it feels comfortable to jump in or stay fully invested. That’s when it’s best to instead do the uncomfortable thing. When the herd dives in to “drink” with reckless abandon, it’s smart to step aside in cold, calculated caution and head upstream. […]

A main rule-of-thumb I go by is to sell when I can, not when I have to or when I wish I’d sold earlier. However late we are in this cycle, few if any good opportunities remain in gone-parabolic joyrides.

The purpose of my efforts here is to 1. help lead you to setups that have a high likelihood of working, and 2. to signal when odds are no longer in our favor.

The odds are no longer in our favor.

It’s reasonable to expect a consolidation in metals, probably a dramatic pullback that will punish latecomers now lining-up to buy on credit. History suggests a lull will last months to a couple of years. When, not if, it happens, related stocks will drop 30-70%. […]

Danger is significant in aligning with mass sentiment, at any time and in any theme or narrative.

Headline a few days later:

“Gold Suffers Worst Day in 12 Years. With all the people lining up for physical gold, maybe traders could’ve foreseen it.”

Formerly “can’t stop, won’t stop” stocks in momentum sectors - AI, drones, metals - lost as much as 70% in a few days.

This type of fracture, as I call it, often occurs at cyclical tops.

Highland is up 2.3x in 2.3 months since the idea was introduced.

Last week I posted:

It still looks strong. […]

I trimmed a bit at just over $2.00 but still have much more in dollar terms at risk in the name than I began with, so I’ll sell more soon.

I’ve not yet sold more since it still looks strong, so much so that it’s a remarkable outlier among critical minerals names; most stocks in the sector are down dramatically the past week or two.

Those who entered prudently and sold on the way up, as exemplified in One And Done, are comfortable and profitable, while the majority who bought at the top are feeling pain if not panic.

Sell on the way up, little by little.

Average out, not in.

Absolve yourself of nailing the top, seeking only to have a reduced position at the peak.

“I made my money by selling too soon and never buying at the bottom.”

– JP Morgan“Be fearful when others are greedy, and greedy when others are fearful.”

– Warren Buffett“Fortunes are made by buying low and selling too soon.”

– Nathan Rothschild“We as a firm are always going to buy too soon and sell too soon.”

–Seth Klarman“Always sell too soon.”

– Jesse Lauriston Livermore

This “secret speculation” idea will undergo a name and ticker change tomorrow.

Link: https://finance.yahoo.com/news/buscando-announces-effective-date-name-193200419.html

I remain bullish, patiently waiting to see what the new CEO can accomplish by deploying considerable funds, recently raised, into a fresh focus for the company.

If you’re going to give an idea some amount of time to work out, for whatever reason, as long as that reasoning is valid then price is generally immaterial unless you’re basing your decisions purely on price.

An entry may’ve been optimally timed via technical metrics, but exit can be based on completely different conditions. For value positions, or high-conviction themes, I prefer to swing a portion based purely on technical entries and exits while holding a core position for the idea to play out over the long term.

However I will only enter upon technical conditions, no matter the “value” or what management is accomplishing. I will never mechanically increase a holding, usually referred to as dollar-cost averaging.

Ideal entries mitigate risk, while maximizing the hit rate and gains.

I won’t hold forever, and certainly won’t hold full positions that have gone parabolic while random newbies or mainstream financial outlets recite lines or tickers that appeared here months or a year before.

That’s the distinction of my approach, and the whole point of this publication.

To succeed over the long term we must remain agnostic with respect to both price and hype. Drink upstream from the herd. Make moves in a steady and measured way.

Once I have my planned allocation I don’t buy more if the price goes down, or at least not solely because the price goes down. If not enough time has passed and nothing material has changed in the sector or with respect to the specific enterprise, then I don’t want more just because it’s perhaps at $2 and I bought at $10.

Stick to a proven plan, and be kind: if people are in a desperate panic to buy something you’ve got, sell it to them.

That’s absolute conviction, not a lack of it.

If I do add, I’ll only add when my metrics are back onside. Often it’ll be at a higher price, or not until the next sector cycle, and that’s perfectly fine.

Process is always crucial and patience will again become key.

People are now accustomed to near-instant, dramatic price appreciations. That will end. People mistake price increases for value, or validation of a thesis, and fail to grasp a vision can come true, or a company can be successful, yet be reasonably valued for years or decades at a level far below today’s market cap.

Wait and see.

I’ve inserted edits in the block quote below to have mercy on your email or browsing filters, and be warned there’s spicy language at the link.

A short, perhaps shocking, AI Slop update by the inimitable James Howard Kunstler includes:

Last April, conservative activist Robby Starbuck sued Facebook when its chatbot reported falsely that he had been on-the-scene for the Jan 6, 2021 US Capitol protest (he was in Tennessee that day). Facebook’s parent company, Meta, settled the case with Starbuck in August, 2025, for undisclosed terms and the company apologized publicly.

Two days ago, Mr. Starbuck sued Google for defamation (with malice and negligence) when its Bard A-I output alleged that he was a “child r*pist,” a “serial s*xual abuser,” that he abus*d and st*lked his ex-wife (Starbuck states in his lawsuit that he has no ex-wife).

It accused him further of fraud, embezzlement, drug charges, st*lking business partners, and being a “sho*ter” or “person of interest” in a 1991 murd*r case (Starbuck was two years old at the time), of appearing in Jeffrey Epstein’s flight logs (untrue), working as a p*rn actor, and voicing support for the Klan.

The A-I cited non-existent news articles from outlets such as Newsweek, The New York Post, Rolling Stone, Mediaite, The Daily Beast, and Salon, along with fake URLs and headlines (e.g., “Robby Starbuck Responds to M*rder Accusations”). Starbuck demonstrated this in a podcast episode on October 22–23, 2025, where he queried the A-I live. [YouTube link]

Google spokesman José Castañeda attributed the issues to its A-I “hallucinating” — which tells you that the recursive feedback of garbage content in A-I is already well-advanced. Prepare for ever more interesting mischief, while you watch your portfolio of index stocks go up in a vapor.

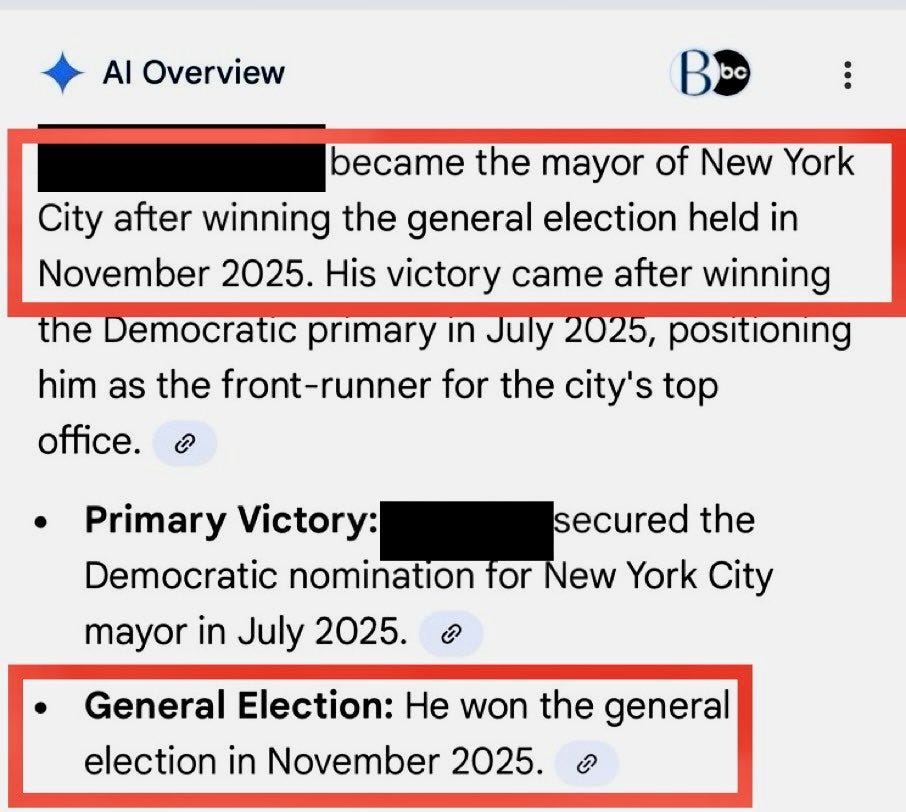

AI is so amazing and powerful that it flatly states - in the past tense - who won the NYC mayoral election next month:

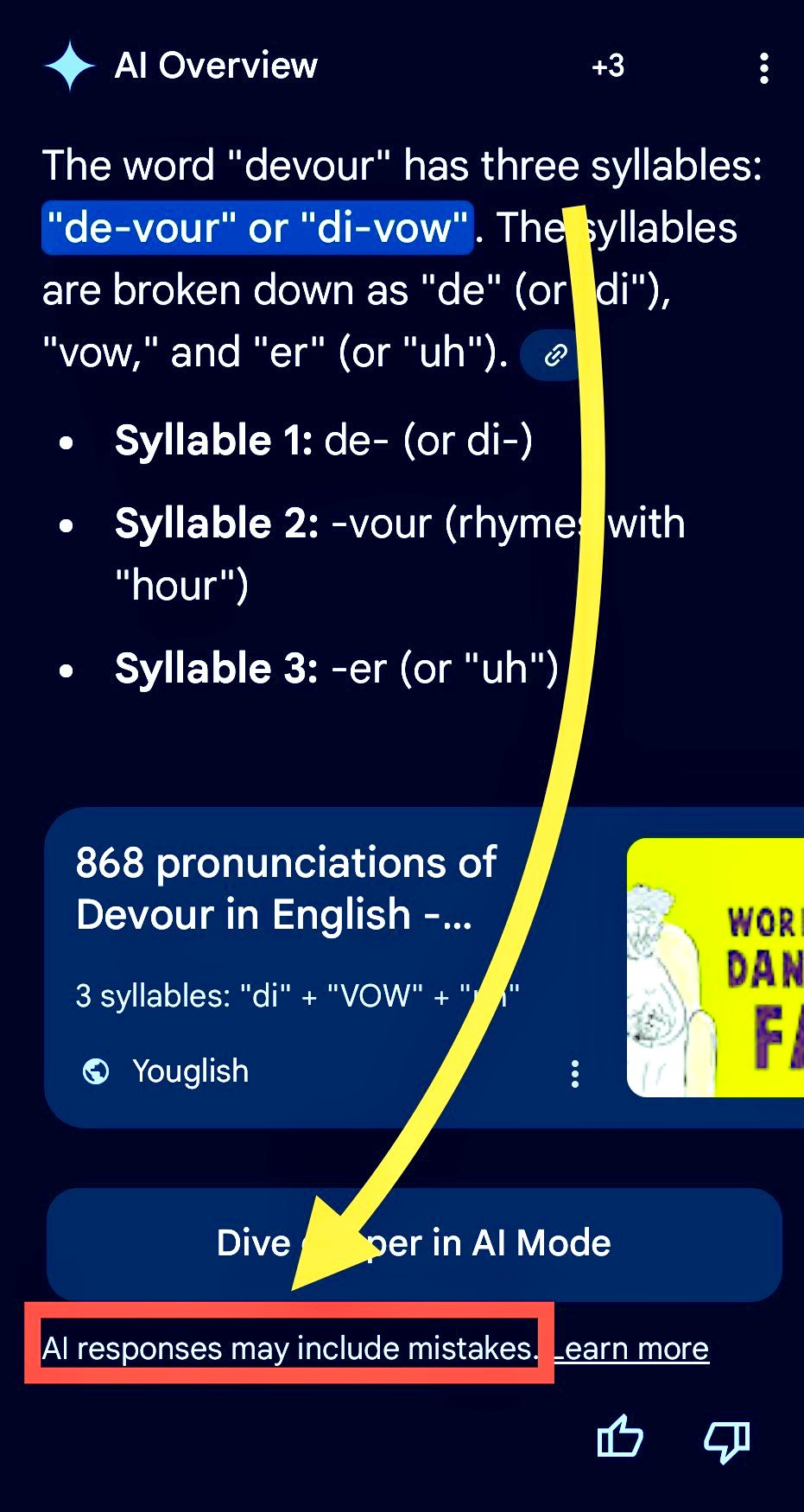

When not busy time-traveling, AI can help with mundane tasks like counting to 2… though it may count to 3 to remind us it’s much more artificial than intelligent:

Still on the topic of failure, last post I noted:

Markets have shown signs of serious stress recently, including concerns of solvency among regional banks as popular momentum stocks appeared to top.

Long-time readers will recall gains we made in banks 2 years ago, and the plan to do it again next cycle.

BNKU was bid up another 14% in the 2 market days since my last update, putting the original BNKU holding up 54% in 9 months.

Though I still like big banks in the long term and will hold-on to dividend paying financials in my personal holdings, my commentary here offers nothing unique or of value if it boils down to “buy and hold banks”.

Banks could go far higher before a top, however the exceptional opportunity identified back in March, while the world was panic-selling financials, has clearly passed and BNKU doesn’t pay a dividend to hold it.

I’m closing out of BNKU entirely at this morning’s open.

The 2nd BNKU position was closed when it was up 31% in 7 weeks.

3rd BNKU position was closed the same day. It was up 23% in just 2 weeks.

The last position closed was up 37% in a mere month.

That’s exceptional, especially in a widely-followed conservative sector, and I expect to do the same or much better in banks when people are again selling in panic.

Until then, or at least until I’m willing to sell financials short, one and done #5 - Financials - will sit empty.

We’ll get there.

Banks had ages to mitigate existential risk, but few did anything other than amplify it.

Nearly 40% of the 158 largest banks have commercial real estate (CRE) exposure of greater than 300% of equity. In some cases it’s pushing 500%.

This won’t end well, and that’s great news we’ll take full advantage of, at the ideal time, by deploying considerable profits set aside after selling “too early”.

Patience and discipline.. thank you for the reminder.