In investing or speculating, complacency kills.

Laughing or crying? Opportunity or crisis?

As a famous Canadian rock band sang:

Are markets complacently yawning at myriad serious risks, or is the bear wide-awake and snarling?

When the dark and crowded theater smells of smoke, it’s best to be at or near the exits. Whatever happens next, it’s the prudent thing to do.

Complacency measures are extreme.

The code is red.

Position accordingly.

Updates:

Crypto

I began the year very bullish crypto against a backdrop of extremely bearish sentiment.

Specifically, I suggested staked ApeCoin or MARA (Marathon Digital).

On January 28 I changed tack:

… a consolidation, or worse, is due across crypto. I’ll start withdrawing staking rewards to cash, a “stablecoin” or Paxos Gold (PAXG) tokens.

CramerCoin is up 93% since I mentioned it nearly 3 weeks ago, up 147% at the high.

By early March, CramerCoin had gained as much as 355% since my mention.

Obviously it was a heady time in crypto, with punters piling in as I was cashing out in caution.

We now know ApeCoin topped just hours prior, at $6.42, up 57% since my suggestion.

It’s down 83% from there though, now at $1.11

PAXG is dead flat since that warning.

March 29, in Surfing Big Waves of Bank Bailouts, a post worth review if only for the memes, I further cautioned:

It’s utterly appalling, though sadly no surprise, to see so many in crypto who claimed the moral high ground and core values of decentralization and “be your own bank” coming out of the closet for Big Bro when it comes to bailouts. And all while Uncle Scam is aggressively de-banking the crypto sphere.

Who knew tech nerds were so morally flexible and athletic? Extreme genuflecting and logical somersaults worthy of Olympic gymnastic gold medals in evidence.

Don’t be fooled by an apparent “flight to safety” the past week into crypto. It’s a nice narrative but looks like a bull trap, so consider hedging more the higher it goes.

Correlate the posts above with a chart of your preferred alt-coins.

Here’s a few of the most popular - Polygon Matic, Avalanche, and Dash:

On April 2nd I stated it was “Crypto Turtling Time”:

ApeCoin position is fully hedged, with staking rewards still incoming and being converted to cash. […]

Many, or most, in crypto can’t imagine their favourite token trading 70-90% lower this year, if ever. I’ve seen an estimate from well-known persons in the space placing a “0.1% chance” on a 33% drop. Nonsense. A 70-90% drop has very high odds: 50/50.

Many alts and tokens have already dropped 70% or nearly so since then. An additional 70% lower from today’s levels should come as no surprise when it happens.

MARA went on to run up almost 400% from my January suggestion, though I’d already closed the position for an average gain of 103% in just 3 months before it truly took off. It has since traded all the way back down to the level at which I’d sold.

I remain net short crypto, while ApeCoin is still fully hedged since $4.20 with staking rewards still converted to cash regularly.

By doing so this position, which would otherwise be a significant loser, is a big winner, up about 80%, however the risk / reward is tilting negatively and I could close it entirely soon. If so, I’ll post it.

COIN is the ticker for Coinbase, also a reasonable short target in my estimation. It closed today at $67.72

COIN closed the week at $70.96

I expect to see it below $10 eventually.

Financials

PayPal (PYPL) was originally my “one and done” for the financial sector.

That position was closed at break-even, then I focused instead on banks.

Recall the bank crisis earlier this year, when the president of the United States had to stage a national broadcast to assure the citizenry all was safe and sound.

When such a thing happens, it’s a guarantee not all’s safe and sound. It’s also an opportunity. As the world panic-sold banks, I bought banks with leverage:

Forget all the bank drama. Nothing in recent market moves has been anything out of the ordinary or unexpected at this stage of the cycle.

When trees fall due to a high wind it's usually because the tree was already weak, perhaps rotted internally. Markets are the same way. My signals were already on pause at the top and bearish before the bank sector tumbled, with hedging in place.

Thus far however, there hasn't been a plunge across the board. There's been nothing disorderly occurring. Quite the opposite. A single-day drop in the Dow of 1000-1500 points will happen at some point, and that too will be statistically normal.

Ignore the short term. There will be wild swings and eventually there will be disorderly markets and capitulation, but we've seen nothing of the kind in years.

Of course the banking sector has seen unusual action lately, and opportunity knocks.

The reckless and lazy speculator’s pain is the prudent bear’s future payday.

Still so very true today, so I’ll repeat:

Thus far however, there hasn't been a plunge across the board. There's been nothing disorderly occurring. Quite the opposite. A single-day drop in the Dow of 1000-1500 points will happen at some point, and that too will be statistically normal.

Ignore the short term. There will be wild swings and eventually there will be disorderly markets and capitulation, but we've seen nothing of the kind in years.

May 30, added more BNKU.

July 11, added a 3rd BNKU position.

July 25: “Much Less BNKU…”

My 3rd BNKU position entered 2 weeks ago has already gained as much as 31% and at today’s close of $20.13 sits 23% higher.

The 2nd BNKU position is up 31% in just 7 weeks, and I’m booking both of those while leaving the original position open.

The highest close of the past 6 months for BNKU was the day prior to that post, and the 2nd-highest close was the day after.

BNKU is down 33% since those sales.

My most recent commentary on BNKU was August 21.

Uraniumania

I introduced my ideas for the uranium sector in January.

At the time virtually no one was talking about the sector, much less in a bullish way.

My prediction was for “a 15-month consolidation around $50 before an explosive move higher.”

That was January 13. Uranium had been consolidating around $50 for about 9 months at that time. By May a parabolic run higher had begun.

“Uraniumania” is under way.

A feature article last week:

Meanwhile, as I stated April 1st, “a great many ‘meme stonks’ and popular ‘green’ delusions [are] still flying far too high on speculative hopium.”

Here’s charts for 2023 showing a collapse in wind and solar respectively:

I expect both those sectors to continue far lower while uranium screams higher.

From March 04 I regularly reiterated:

The chart for uranium could not look better. It’s arguably crazy not to be invested in it, and totally irresponsible not to crank up the exposure when the timing’s right.

By June 04, I was emphatic and restated this in several subsequent updates:

Today uranium looks fantastic.

Uranium still looks fantastic.

Revised stats and entry levels:

URA i2 m1, broken 15-month down trend, super bullish now at $21.14

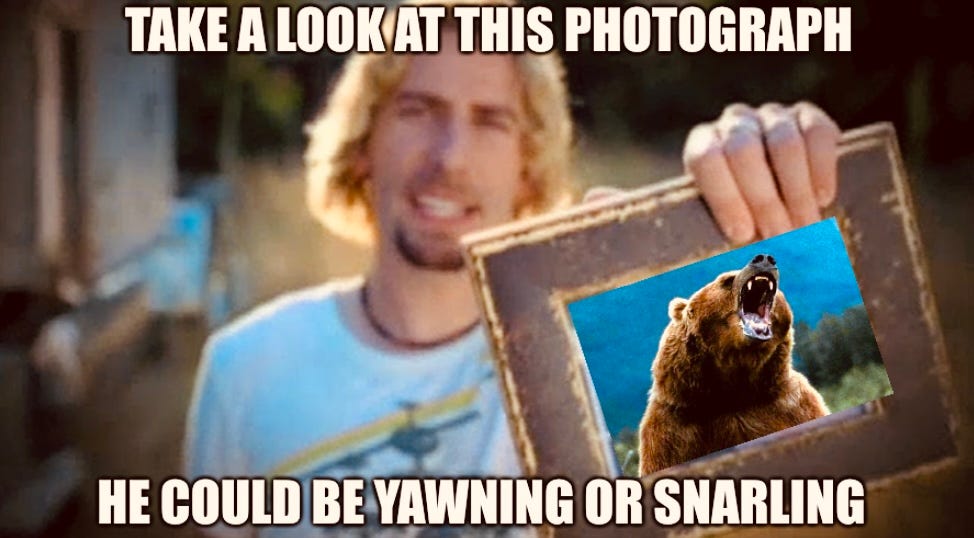

ANLDF long term bullish entry signal in effect, best buy > 5.5c

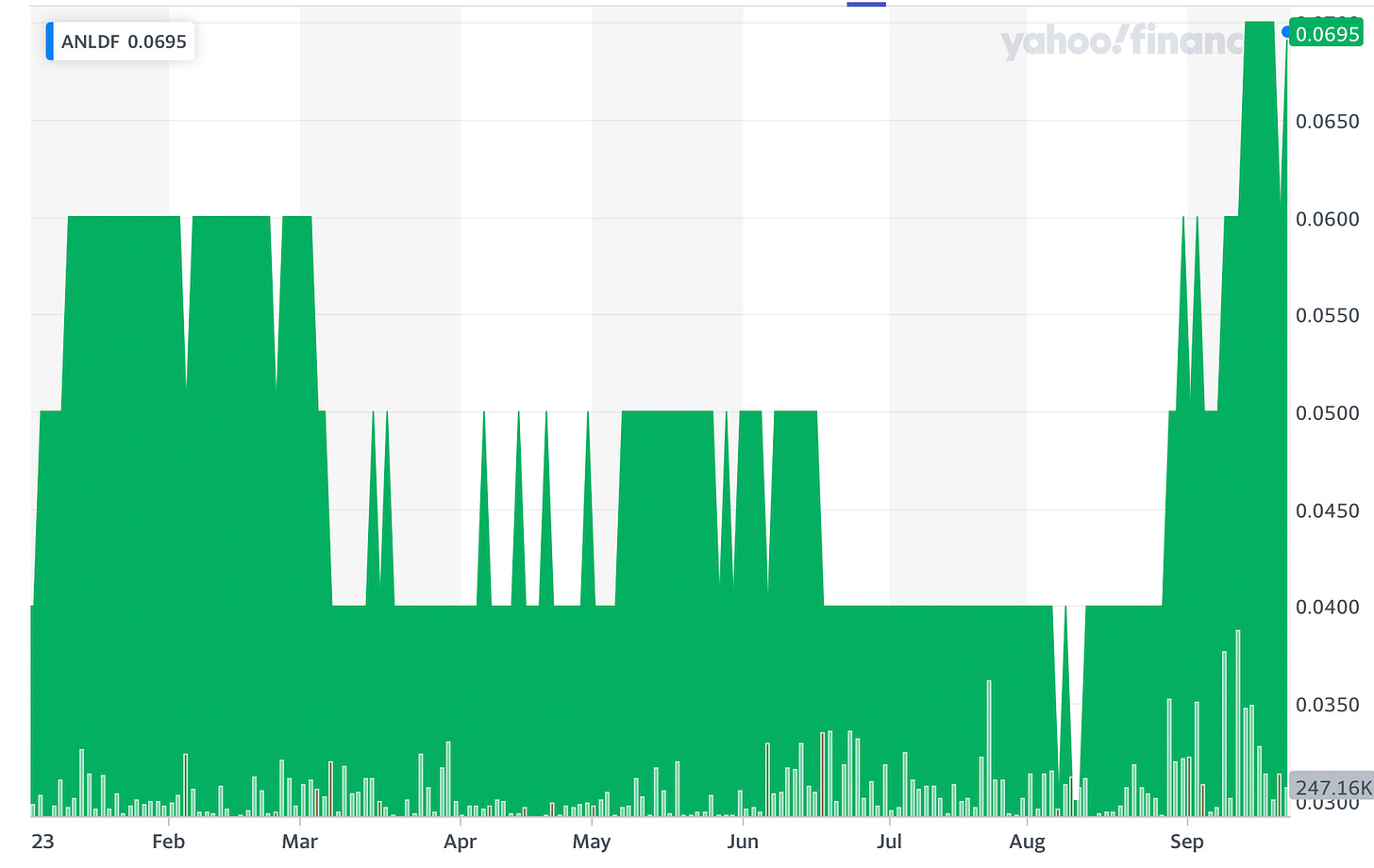

DNN technical “strong buy” above $1.25

UROY technical “strong buy” above $2.05

U.U i3 m1 = long term bullish, at an ideal entry/add point

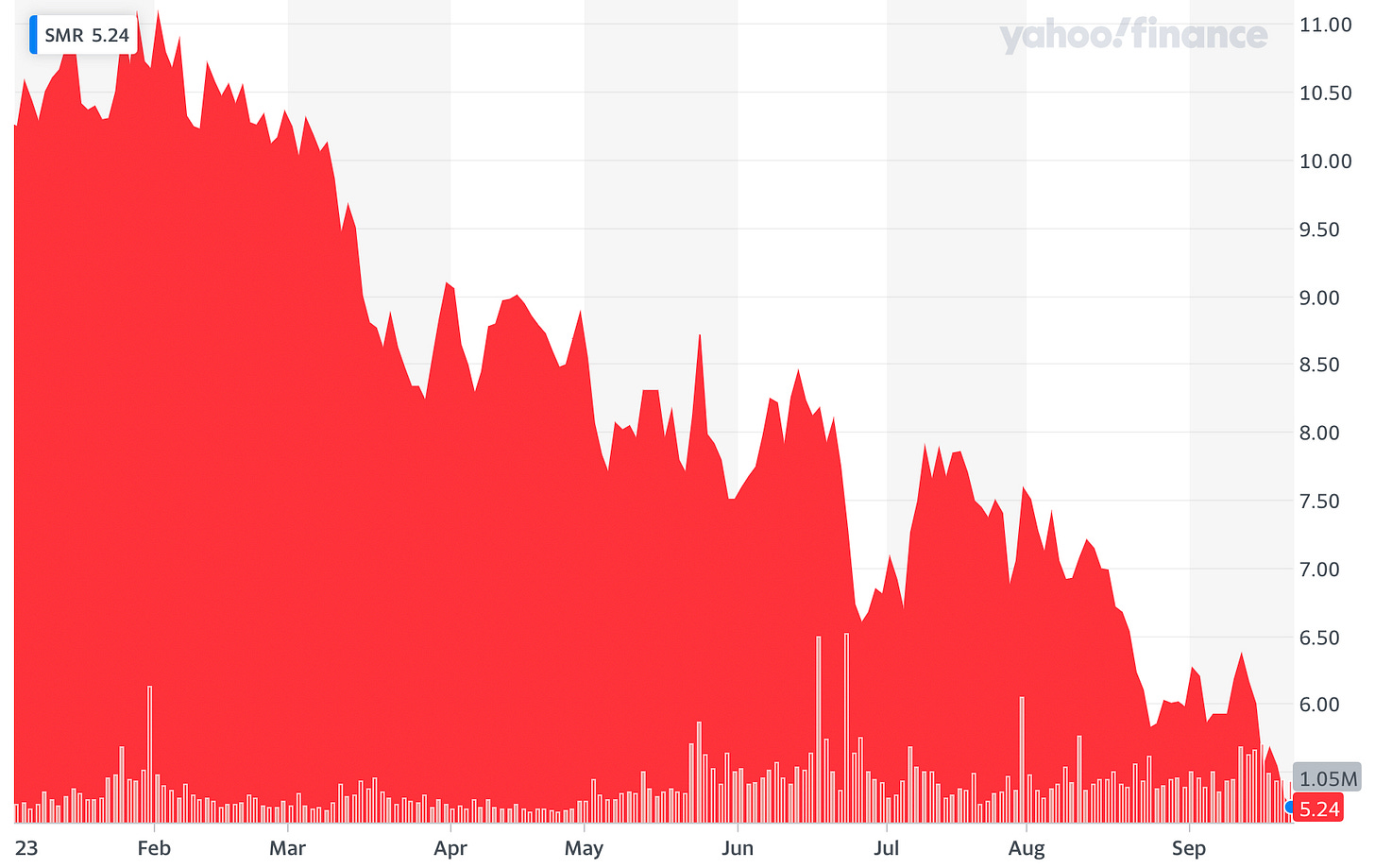

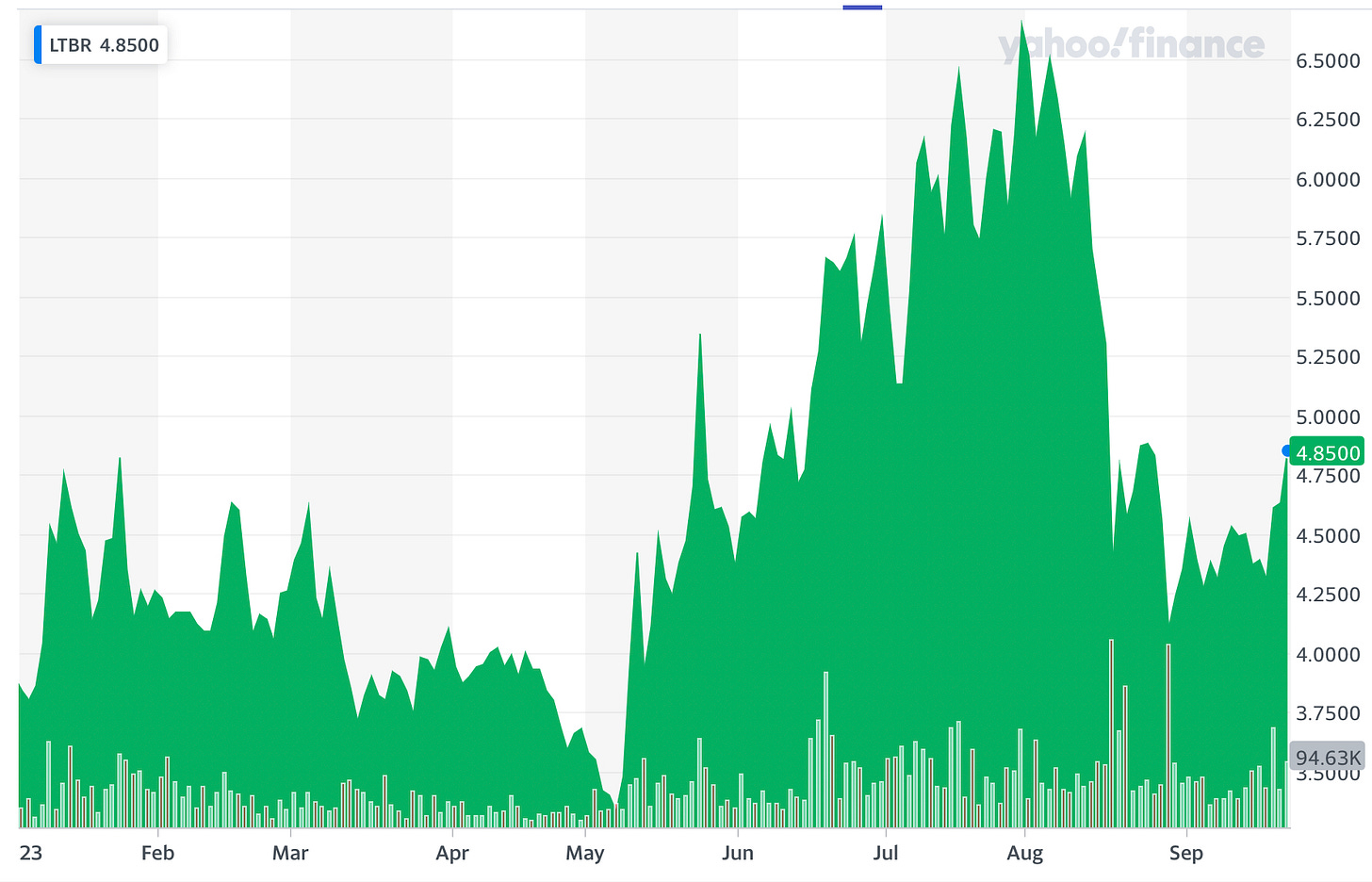

I’m still adding LTBR periodically below $5, though today it closed at $6.06 still with tremendous upside.

I’m doubling-up on URA, the Global X Uranium ETF.

August 13’s post was titled “+3rd URA… Uranium Set To Explode”

I’m adding a 3rd position in URA tomorrow morning

This is its hyper-bullish 10-year chart…

Uranium 45% to 75% higher should be no problem, probably later this year.

During September uranium and related stocks shot higher.

Here’s its 1-year chart:

Here’s charts for 2023 for the sector stocks I’ve discussed on Substack so far:

September 22, with risk exposure in mind:

I’m closing the two additional URA (Global X Uranium ETF) positions.

One is up 18% in under 5 weeks, while the other’s up 21% in 2 months.

Considering the latter was purchased with proceeds from a BNKU position that had just gained 31% in a few weeks, that’s a massive compounded gain for such a short holding time.

I remain hyper-bullish on nuclear energy and the uranium sector going forward, while at the same time I’m passionate about setting a good example and proving a success record for free and in real time that few could ever hope to match.

Soon I’ll update other sectors I track.