All The World's A Circus, With Only Clowns In Charge

Banks failing and Federal Reserve fraud

Today’s post is a selection of items that shed light on what’s really going on, who’s really to blame, and what’s next, none of which mainstream media will credibly offer.

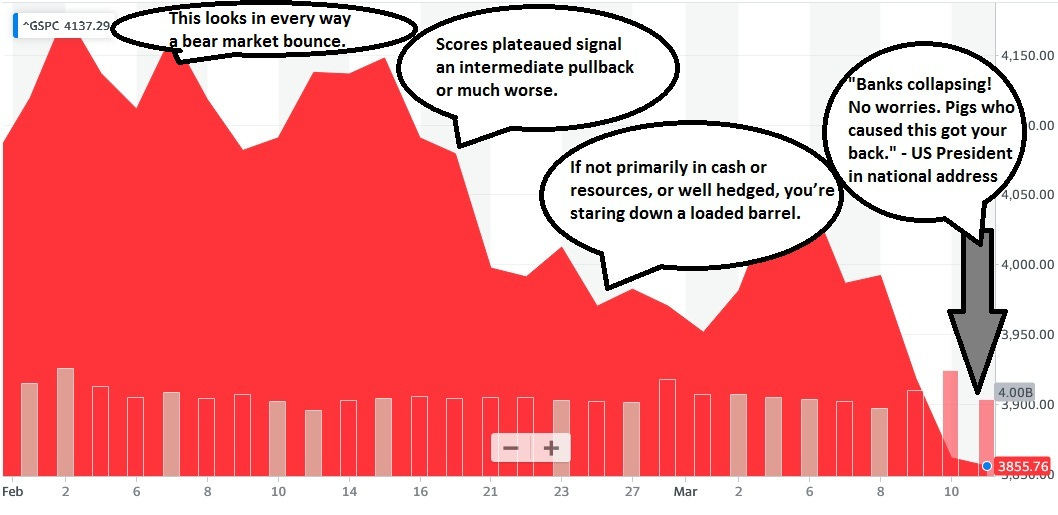

Let’s start with this very substack, quoted on a S&P 500 chart:

Suggested hedge TZA gained about 20% in just 2 days, so far, while gold and related stocks - among my very few open full positions - are doing very well.

How did it come to this… again? Incompetent clowns who caused it are on the case!

Fed Announces Probe Into Its Own Regulatory Failure At SVB

The Federal Reserve Board on Monday announced that Vice Chair for Supervision Michael S. Barr is leading a review of the supervision and regulation of Silicon Valley Bank, in light of its failure.

"The events surrounding Silicon Valley Bank demand a thorough, transparent, and swift review by the Federal Reserve," said Chair Jerome H. Powell.

Jim Rickards’ short take here is worth considering:

Janet Yellen and Joe Biden can sit there and say it isn’t a bailout until they’re blue in the face. But it is a bailout.

Moving beyond the bailout aspect, this story is not a one-day wonder. There will definitely be contagion. […]

Other facets of the SVB collapse are breaking minute-by-minute. It’s reported that top insiders of SVB sold millions of dollars of SVB stock over the course of January and February ahead of the recent disclosures. Did they see this coming?

One of those insiders was on the board of the Federal Reserve Bank of San Francisco. His name abruptly disappeared from the Fed website last Friday. More insider trading by Fed officials?

Simon Black also nails it with some important facts most will not report:

Silicon Valley Bank was no Lehman Brothers. Whereas Lehman bet almost ALL of its balance sheet on those risky mortgage bonds, SVB actually had a surprisingly conservative balance sheet.

[…]

Point is, SVB did not fail because they were making a bunch of high-risk NINJA loans. Far from it.

SVB failed because they parked the majority of their depositors’ money ($119.9 billion) in US GOVERNMENT BONDS.

This is the really extraordinary part of this drama.

US government bonds are supposed to be the safest, most ‘risk free’ asset in the world. But that’s totally untrue, because even government bonds can lose value. And that’s exactly what happened.

Most of SVB’s portfolio was in long-term government bonds, like 10-year Treasury notes. And these have been extremely volatile.

[…]

They didn’t hide this fact.

Their 2022 annual report, published on January 19th of this year, showed about $15 billion in ‘unrealized losses’ on their government bonds. (I’ll come back to this.)

By comparison, SVB only had about $16 billion in total capital… so $15 billion in unrealized losses was enough to essentially wipe them out.

Again– these losses didn’t come from some mountain of crazy NINJA loans. SVB failed because they lost billions from US government bonds… which are the new toxic securities.

If SVB is insolvent, so is everyone else… including the Fed.

This is where the real fun starts. Because if SVB failed due to losses in its portfolio of government bonds, then pretty much every other institution is at risk too.

[…]

Anyone who has purchased long-term government bonds– banks, brokerages, large corporations, state and local governments, foreign institutions– are all sitting on enormous losses right now.

The FDIC (the Federal Deposit Insurance Corporation, i.e. the primary banking regulator in the United States) estimates unrealized losses among US banks at roughly $650 billion.

$650 billion in unrealized losses is similar in size to the total subprime losses in the United States back in 2008; and if interest rates keep rising, the losses will continue to increase.

What’s really ironic (and a bit comical) about this is that the FDIC is supposed to guarantee bank deposits.

[…]

Now there’s one bank in particular I want to highlight that is incredibly exposed to major losses in its bond portfolio.

In fact last year this bank reported ‘unrealized losses’ of more than $330 billion against just $42 billion in capital… making this bank completely and totally insolvent.

I’m talking, of course, about the Federal Reserve… THE most important central bank in the world. It’s hopelessly insolvent, and FAR more broke than Silicon Valley Bank.

[…]

Since the 2008 financial crisis, legislators and bank regulators have rolled out an endless parade of new rules to prevent another banking crisis.

One of the most hilarious was the new rule that banks had to pass “stress tests”, i.e. war game scenarios to see whether or not banks would be able to survive certain fluctuations in macroeconomic conditions.

SVB passed its stress tests with flying colors. It also passed its FDIC examinations, its financial audits, and its state regulatory audits. SVB was also followed by dozens of Wall Street analysts, many of whom had previously issued emphatic BUY ratings on the stock after analyzing its financial statements.

But the greatest testament to this absurdity was the SVB stock price in late January.

SVB published its 2022 annual financial report after the market closed on January 19, 2023. This is the same financial report where they posted $15 billion in unrealized losses which effectively wiped out the bank’s capital.

The day before the earnings announcement, SVB stock closed at $250.04. The day after the earnings call, the stock closed at $291.44.

In other words, despite SVB management disclosing that their entire bank capital was effectively wiped out, ‘expert’ Wall Street investors excitedly bought the stock and bid the price up by 16%. The stock continued to soar, reaching a high of $333.50 a few days later on February 1st.

In short, all the warning signs were there. But the experts failed again. The FDIC saw Silicon Valley Bank’s dismal condition and did nothing. The Federal Reserve did nothing. Investors cheered and bid the stock up.

[…]

This is the financial catastrophe, but it’s just getting started. Like Lehman Brothers in 2008, SVB is just the tip of the iceberg. There will be other casualties– not just in banks, but money market funds, insurance companies, and even businesses.

Foreign banks and institutions are also suffering losses on their US government bonds… and that has negative implications on the US dollar’s reserve status.

Think about it: it’s bad enough that the US national debt is outrageously high, that the federal government appears to be a bunch of fools incapable of solving any problem, and that inflation is terrible.

Now on top of everything else, foreigners who bought US government bonds are suffering tough losses as well.

Why would anyone want to continue with this insanity? Foreigners have already lost so much confidence in the US and the dollar… and financial losses from their bond holdings could accelerate that trend.

This issue is particularly of mind now that China is flexing its international muscle, most recently in the Middle East making peace between Iran and Saudi Arabia. And the Chinese are starting to actively market their currency as an alternative to the dollar.

But no one in charge seems to understand any of this. […]

In fact Fed leadership spent all of last week insisting that they were going to keep raising interest rates.

A few days ago “experts” were virtually certain the Fed would hike rates later this month. Fraud Chair Powell strongly signalled same as recently as a few days ago.

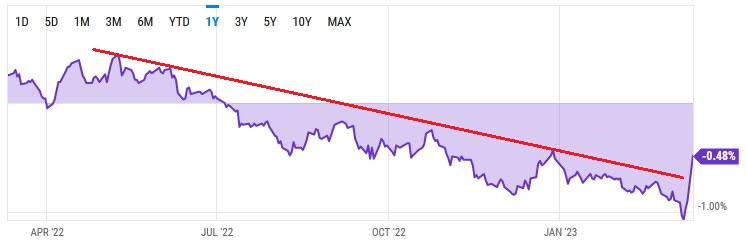

Forget it. A historic yield inversion appears to be over, as I’ve warned would happen. Specifically warning bear markets suffer the worst declines as rates are being cut:

Debt markets decide when rates are raised or lowered, not central bankers, and it appears real rates have changed direction. Here’s a look at the 10-yr vs. 2-yr inversion:

But wait, there’s more blame to go around! Don’t act surprised:

Meet Joseph Gentile, Silicon Valley Bank's Chief Administrative Officer:

Prior to joining the firm in 2007, Mr. Gentile served as the CFO for Lehman Brothers’ Global Investment Bank where he directed the accounting and financial needs within the Fixed Income division.

Mish Note: Lehman went bankrupt on September 15, 2008.

Prior to that, he served as CFO of the Global Corporate and Investment Bank at Bank of America.

Wikipedia Note: Merrill Lynch & Co. agreed to be acquired by Bank of America on September 14, 2008, at the height of the financial crisis of 2007–2008, the same weekend that Lehman Brothers was allowed to fail.

Previously, Mr. Gentile spent more than 10 years with J.P. Morgan in various financial management positions, including Global Head of Financial Risk Management.

He started his career at Arthur Andersen.

Wikipedia Note: Arthur Andersen was an American accounting firm based in Chicago that provided auditing, tax advising, consulting and other professional services to large corporations. By 2001, it had become one of the world's largest multinational corporations and was one of the "Big Five" accounting firms (along with Deloitte & Touche, Ernst & Young, KPMG and PricewaterhouseCoopers).

The firm collapsed by mid-2002, as details of its questionable accounting practices for energy company Enron and telecommunications company Worldcom were revealed amid the two high-profile bankruptcies.

Fatal Distraction? Senior SVB Risk Manager Oversaw Woke LGBT Programs

While Silicon Valley Bank careened toward its spectacular collapse, the bank's head of risk management for Europe, Africa and the Middle East devoted a chunk of her time to various LGBTQ+ programs.

Meanwhile, SVB went without a chief risk officer (CRO) from April 2022 to January 2023, the Daily Mail reports, as the bank apparently had little urgency to replace Laura Izurieta before finally tapping Kim Olson earlier this year.

On the other hand, a few months before that long CRO vacancy began, SVB boasted, "We have a Chief Diversity, Equity and Inclusion Officer, an executive-led DEI Steering Committee and Employee Resource Groups with executive sponsors focused on these objectives."

Sell shit and stay hedged, because clowns run the circus and your well-being and future security are merely props in their malfeasant morally bankrupt play.

But wait, let’s discuss what pronoun you prefer while being forced into non consensual intercourse with the Fed. Bonus points for the correct flag in your Twitter.