Apex Critical Minerals

A special speculation, a valuable lesson, and a lesson in “How NOT to”

This is written and posted evening of Tuesday August 12, 2025

“expect bounces to last so long and go so high it seems inconceivable that the worst is not over.”

- April 09, 2025, at the bottom

Markets are melting-up and, for as long as that lasts, speculating is arguably prudent.

If we can limit speculations to sectors that are not yet the focus of very popular and totally tired narratives chased by day-flailers, then the better our odds.

When reliable signs of the peak appear, I’ll again lean heavily short.

In the meantime, a real-time lesson of sorts via special speculation.

I’m often asked about my methods and am happy to share some.

In the past I’ve written about round-number psychological price levels ($1, $10, $100, etc.) serving as resistance, support, and buy or sell signals.

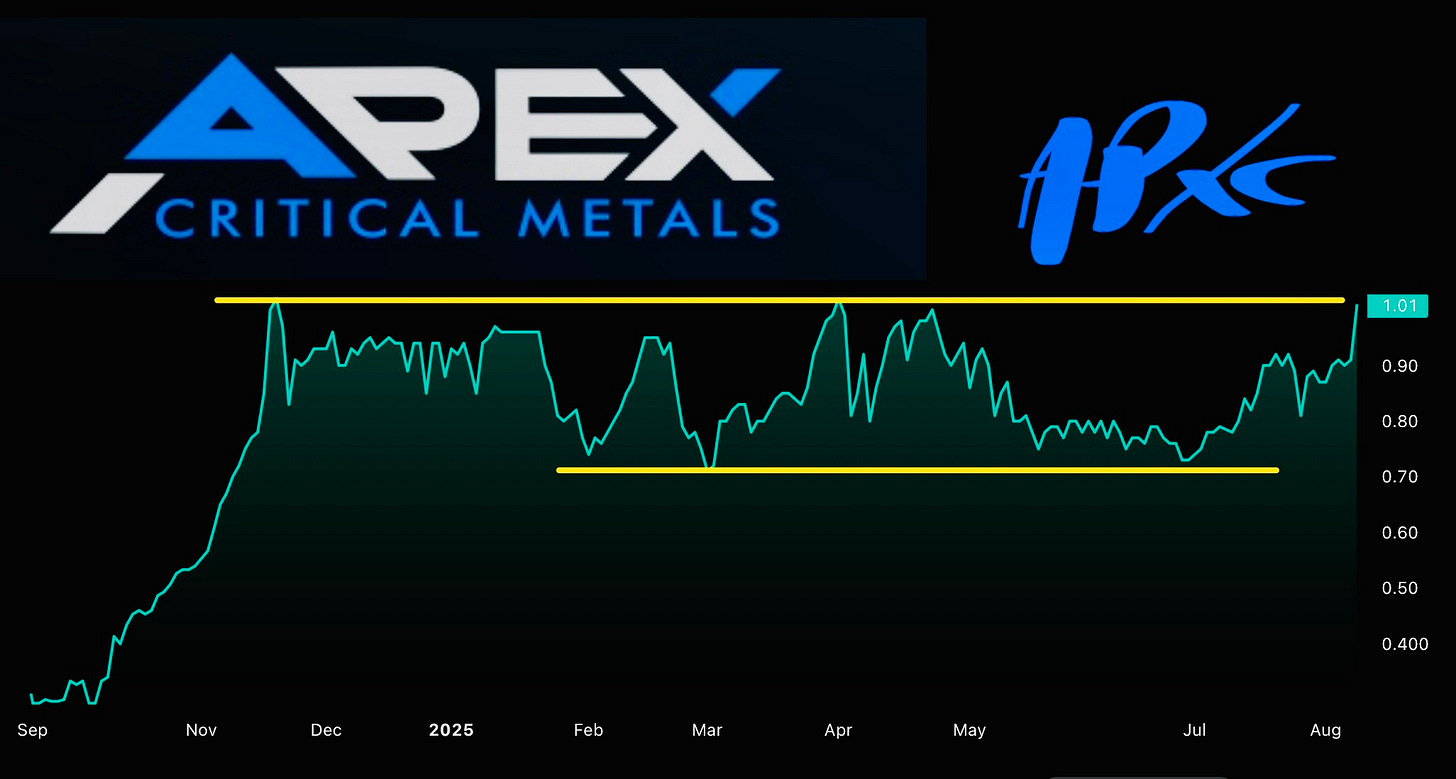

Apex Critical Minerals (ticker APXC in Canada, APXCF in the U.S.) hit its apex today (August 12), reaching an intraday all-time high while missing posting its highest daily close by a mere Canadian penny.

Most important, it traded as high as $1.07 today and closed at $1.01, above that key $1.00 level which is a Holy Grail threshold for penny stocks.

Note: unless specified otherwise I’m always citing prices and showing charts of a company’s domestic listing. In this case, Canadian.

Before we focus on Apex, here’s an example to illustrate what I mean with respect to psychological price levels, using a stock I’ve enjoyed great gains from the past year.

On its chart, below, I’ve put yellow lines at the dollar and 50c increments:

A friend told me about this company nearly a year ago, and my average price after accumulating awhile was around $0.30

That friend is the type of guy to phone rarely, out of the blue, with a 15 or 30-second pitch closing with “Take a look, you’ll love it!” and that’s it.

Indeed I loved the chart, and he’s extremely astute so I bought a bunch. It looks exciting in hindsight, but took some weeks to do much. Maybe it was months. For awhile it looked like dead money and that it’d roll over and plunge. Then it took off.

Most was sold before the key $1.00 level and by around $1.70 I’d closed all but a tiny portion of my position.

Along the way, and to this day, I could tell you the ticker but not the name or what the company even does. I’ve only a vague idea, which may be stale info from last year.

For this type of play, it’s better that way. No emotion or ego-opinion, just purely operating on the chart, statistics and any call that might come from that same source. Keeping it simple.

A key part of my process is to hold some shares for the longer term after I’ve effectively sold out, which forces me to see it in my portfolio from time to time and track it. Maybe spark a conversation with whomever brought it to my attention. Possibly get another great stock tip. Usually this kind of wild parabolic action resolves back below $0.10 over time.

Do not forget that last sentence.

90-95% drops in popular parabolas aren’t exceptions, they’re so common as to be reasonably expected. This included Amazon, Apple, bitcoin, Gamestop, AMC, tulip bulbs, Bored Ape NFT’s (read my related post) - and many dozens more household names in market history. Meme stocks, debacles, Enron, World.Com, or tech icons, it doesn’t matter. Boom often precludes bust. I am quite sure that list will include Tesla too in the fullness of time.

If you put ego, wishful thinking, or opinion ahead of hard cold process and inviolate sell stop levels, you will suffer mightily at some point. Repeatedly, if you persist in such folly.

Some stocks recover - witness uranium stocks in what I call “Round 2” or today in “Round 3” - and Apple, Amazon, etc.

Some will never recover.

Do not forget that last sentence.

See this as a feature not a fault. To be blunt: it gives those seeking rock-bottom portfolio destruction what they need, while it gives us excellent re-entry opportunities before the next cycle (uranium, gold, tech stocks, rare earths, etc. etc.)

Read this short post below from January 2023, making note of the charts because a great many of today’s most popular stocks - especially if the names contain “AI” or “quantum” - will end up with charts like these eventually, and are already at least halfway there livin’ on pure hopium:

For now however these are the good ol’ days, so we party-on until the music stops.

You got to know when to hold 'em

Know when to fold 'em

Know when to walk away

And know when to run

Every gambler knows

That the secret to surviving

Is knowing what to throw away

Knowing what to keep

'Cause every hand's a winner

And every hand's a loser- “The Gambler”, made famous by Kenny Rogers, written by Don Schlitz

I don’t like gambling / market analogies, but those lyrics are as good a fit as it gets because most people in markets are merely gambling at best; randomly switching half-baked strategies with numbers for allocations or entries pulled out of thin air. I’d include stops here, but it’s rare those types have any stop. They might cite one, but won’t act on it.

Probably most blackjack players actually understand the game, and harbor no delusions of special prowess or getting rich playing. Far fewer active in stocks understand, while the hubris is way off the charts.

The irony on top is that it’s not unusual for me to encounter people who are super bitter about some names in which I’ve made repeated killings - like Lightbridge (LTBR), a stock that long-time readers have hopefully joined me in booking fantastic cyclical profits from (“buy and re-buy below $5.00”) - and refuse to see the cycles and recurring epic opportunities that I’ve proven are virtually obvious.

Their negative attitude and lack of taking responsibility - their total lack of proper process or willing to understand they earned their losses - clouds their vision so badly that they then fail again by refusing to see tremendous opportunities ahead. Typically while they watch history repeat without them, they’re stuck holding some late-stage dying trend which they invariably also bought near the top. Again. On margin.

This is the same toxic self-sabotage psychology that causes people to cling to preposterous conspiracy theories while their obsession-stock slowly trickles to zero along with their net worth, while random tickers and sh!tcoins are skyrocketing daily.

Here I’ll extend a warm welcome to Gamestop and AMC fans!

We’ve all been there. A small percentage of people choose to learn and move on up. This substack site is for you.

Now here’s that chart again:

I can almost hear the cynics cracking snide digs, but the fact remains that - especially in periods of market mania totally unhinged from fundamentals - markets move mostly, and often solely, on the basis of mass psychology.

You can see for yourself that those round dollar numbers and 50c increments factored significantly. Those lines are the only reason why I bought back in a couple months ago around $1.75, then added when it broke back above $2.00

$1.50 was my obvious sell-stop level, but it didn’t get there. Yet. Instead it broke back above $2.00 so I added more. Now in no time at all it’s above $3.00 and today I sold my way down to the original capital I put at risk.

Whether it goes to $30 or 30c or first to $30 then to 30c, I don’t care. I’ve already compounded the exponential gain made earlier this year with another roughly 50% profit in very short order, and I have easier targets to focus on…

Here’s the chart again for Apex Critical Metals:

I’m out to compound the nearly 800% profit I made on it in 2024.

My approach: I’m holding above $0.90 and possibly adding more between $1.00 - $1.10

I won’t chase it above that price.

If it closes back below $0.90 then I accept this might not be working in my favor and will trim the position by 1/3 to 1/2. My average price on this latest swing is around $0.95 and I consider anything below that a loss regardless of prior profits in the name.

On any close below $0.80 I’ll sell another 1/3 or 1/2 of what remains, and below $0.70 I’m all out. That makes my risk around 15% with far greater upside.

Positives:

Good share structure, with a long consolidation prior to today’s break above $1.00 which gives this speculation higher odds of success

A great name in the hot “critical minerals” sector

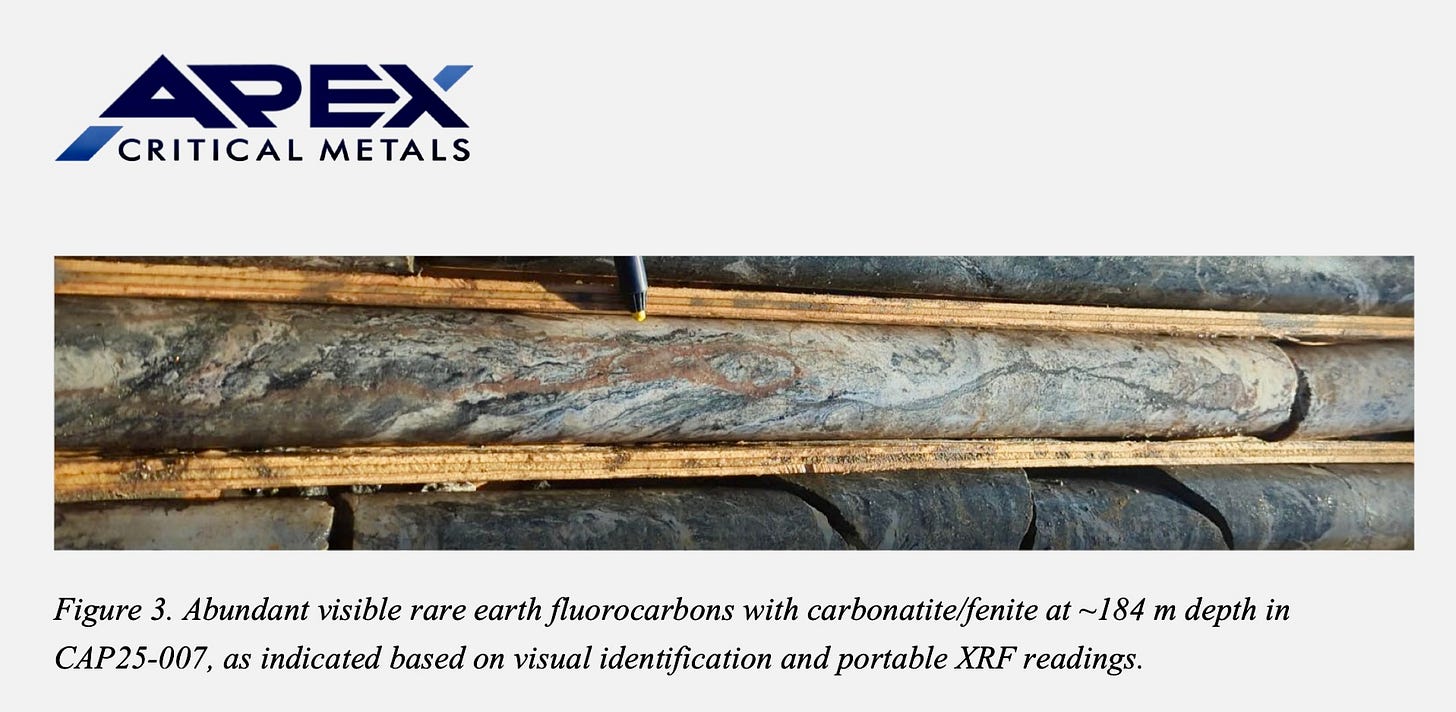

News released after today’s close (see website)

That news includes the phrase “Abundant, nuggety pyrochlore mineralization”

https://apexcriticalmetals.com

I owe it to my future self to buy “abundant, nuggety pyrochlore mineralization” with a chart like this every time, and buy it hard.

You’ve gotta love it:

It may turn out to be the find of the cycle. And if so it may even turn out over time to become fully permitted and an economically viable mine. Even if so, there’ll be wild fluctuations before then, probably including terrifying drops.

That’s not casting any bearish energy on the company or its projects. It’s just true, and those experienced in markets know it. You know it too, so invest or speculate (if at all) only to the degree that any significant drops are of no real concern.

And note I titled this a “Special Speculation”, not “situation”.

Don’t overcommit to any speculation, or investment for that matter, and remember to have fun!

Enjoyed this one immensely. Great points and visual rep.