To start, here’s a comprehensive list of things different this time:

Nothing

Position accordingly:

Buying Natural Gas Again

Sticking with my “buy reality” theme, I’m adding natural gas via BOIL.

BOIL closed today, August 19 2024, at $10.20

BOIL is a 2x levered play on natural gas. Read about it here: https://www.proshares.com/our-etfs/leveraged-and-inverse/boil

Obvious caveats: don’t speculate in things you do not understand, especially not with leverage, and always practice prudent risk management.

UNG is a natural gas ETF without leverage: https://www.uscfinvestments.com/ung

With this BOIL reentry I’m restoring my 4th position, without a stop level, which was sold 3 months ago:

Selling 4th BOIL, +57% in 1 Month

A month ago I added a 4th BOIL position, a levered long on natural gas, at $14.10, noting:

Yen

With my Japanese yen idea now profitable, suggested “Special Situation” plays have a 100% hit rate, most having returned sizable gains in short order.

See here for a recap:

CHPT +24% in 4 Days! Booking It.

As I type, markets are still open and Chargepoint (CHPT) is $2.38, which is up 24% since my suggested “Special Situation” entry not even a full 4 market days ago.

Here’s an updated yen chart:

The red represents big banks’ positioning. I expect big banks will return to a net short position in Japan’s currency.

My target is the blue line, and of course I’ll post an update when I close the position.

Headlines relevant to One And Done ideas:

China is rapidly building nuclear plants while the rest of the world stalls

Maersk adds nuclear power to its growing list of new fuel potentials

Bezos-backed nuclear fusion company raises $15 million from two Canadian government agencies for demo

Builders now offering half-price mortgages, but still no takers

Total Outstanding Mortgage Debt Up 19% The Past 3 Years

Credit Card and Auto Loan Delinquencies Surge in the Second Quarter

The average American has $6,329 in credit card debt

Earnings Call Mentions Of "Consumer Downturn" Soar To Highest Level Since Financial Crisis

Disney Admits Lower-Income Consumers Are "Stressed & Shaving Time At Parks"

Airbnb Shares Plunge On Slowing US Demand As Consumer Downturn Worsens

Canadian consumer insolvencies hit 4-year high in Q2

Homeowners Increasingly Tap Home Equity Lines As Savings Rate Plummets

The Share of Young Adults Living with Parents is the Highest Since 1940

Executives and HR Admit RTO (Return To Office) Is Meant to Make People Quit

$150,000 House in 1988 Now Costs $707,500 Thank You Fed

US Records 2nd Biggest July Deficit In History As 25% Of Tax Revenue Go To Pay Interest

5,800 IRS Employees And Contractors Owe Nearly $50 Million In Unpaid Taxes

Gold Soars To Record High, Dollar Dumps As Harris Unveils Economic Plan

Gold prices keep breaking records in 2024. Central banks are driving the rally

Aug. 15, 2024, marks the 53rd anniversary of the “Nixon Shock,” the day that United States President Richard Nixon eliminated the gold standard for the US dollar.

At the time, Nixon claimed that taking the dollar off the gold standard was “temporary” and would “stabilize” the dollar, which has lost 98.5% of its value since that day.

Gold vs U.S. dollar:

Zelensky Suspends Ukraine's Foreign Debt Payments Starting Aug 1st

Gold vs Ukrainian hyrvnia:

Nearly 1-In-20 Of All Syrians Now Lives In Germany, Over Half Receive Welfare

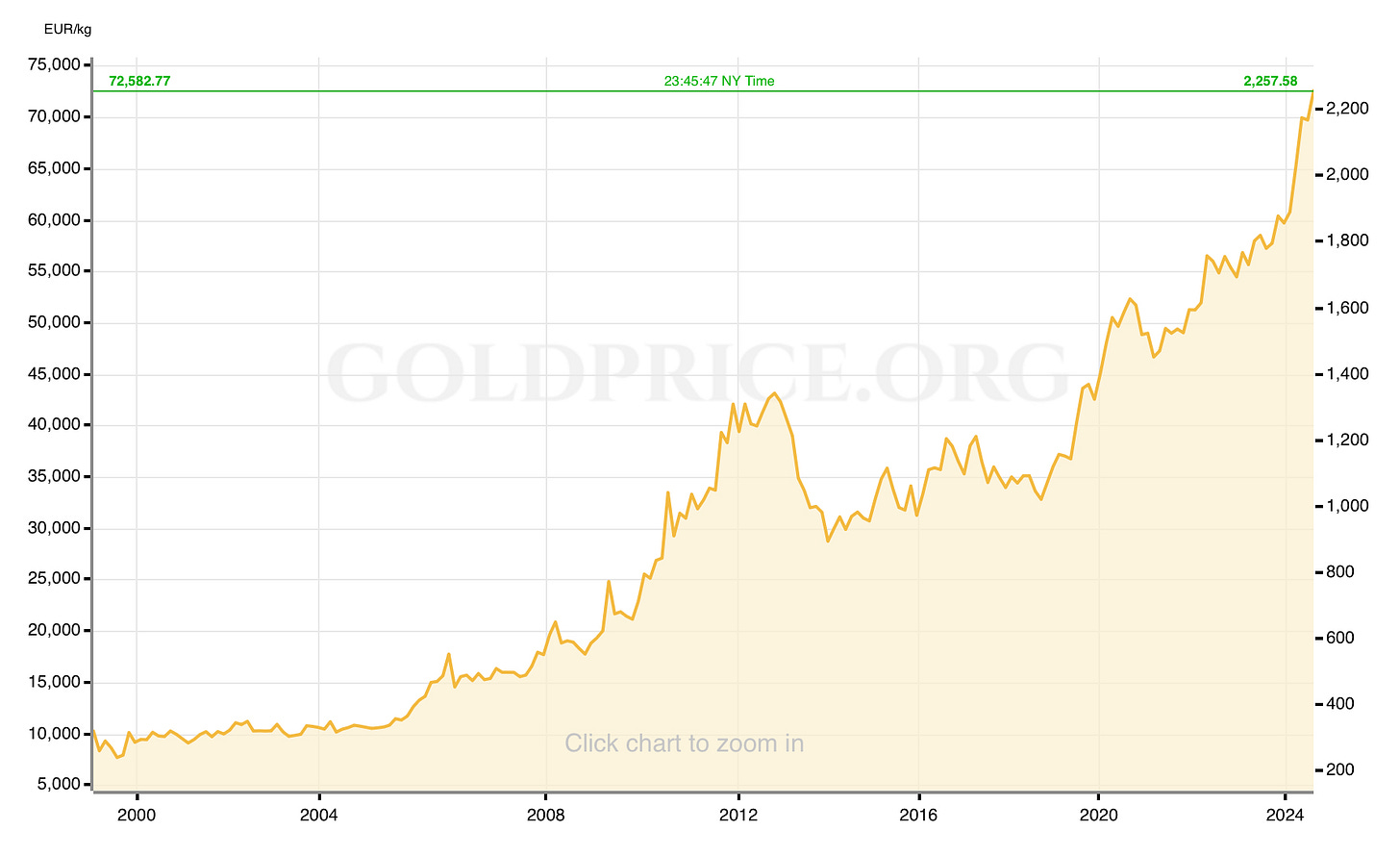

Gold vs euro:

Swiss voters back higher pensions, reject working longer

Gold vs Swiss franc:

Canada Revenue Agency admits to $10 billion in pandemic relief sent to ineligible applicants Only a fraction has been recovered, with billions in losses expected

Gold vs Canadian dollar:

Nigeria steps up efforts to curb speculation against the battered naira, including banning street trading in foreign currency

Gold vs Nigerian naira:

I commented on Nigeria’s economic woes and currency collapse last October:

Headline: Nigeria's inflation rate at its highest level in two decades, 26.72%

Don’t worry. It can’t happen here because our politicians are incorruptible, experienced, fiscally responsible persons, with a functional knowledge of historical precedents and successes in the real world beyond a career of vote buying and lying.

It’s not like they’re just making it up as they go, in order to placate whichever greedy or vindictive special-interest group is lobbying them hardest or enabling the easiest cash and power grabs.

Oh, in case you’re wondering the apparent reason for Nigeria’s inflation:

Economic observers say recent government policies are to blame for the inflationary surge and predict the trend might continue.

"The policies were not handled properly,” said the chief executive officer of ThinkBusiness Africa. “What is happening is that they're learning on the job.”

If that doesn’t seem extremely relevant and ring some alarm bells, it soon will. At that point your dollars, euros, yen, etcetera will be worth a lot less.

Meanwhile, consider this short article by Mish Shedlock: Kamala Harris and Her Free Money, More Inflation Now Proposals (MIN)

Despite the title Mish takes both “sides” to task, and he’s always balanced in that respect. As he correctly concludes, “MIN [max inflation now] is truly a bipartisan effort.”

I’ll only add that he neglects to mention the exponential amount that’ll be lost to waste, grift and fraud within those proposed programs, as reflected in several headlines above. It’s never, ever different.

Don’t despair! Gold loves you.

New readers can catch-up on my gold ideas here:

Adding Seabridge Gold to Basket #4

The typical starter home - defined as those valued in the lowest third within a region - is now “worth” at least $1 million in 237 US cities. In 2019 there were 84 such cities.

More News:

"Margin Calls, Death, Divorce & Bankruptcy": Art Lending Market Booms As Rich Americans Scour For Liquidity

"If you're an owner and need liquidity now, you pause on selling and instead borrow against your art, waiting for better market conditions," Adriano Picinati di Torcello, global art and finance coordinator for Deloitte, told Bloomberg, adding that's sparked growth across the art-lending market.

A rising number of affluent Americans with fine art collections have called their wealth advisors, asking about creative ways to unlock liquidity while keeping the multi-million-dollar Andy Warhol painting on the living room wall - for family and friends to appreciate over a glass of wine.

Waymo Robotaxi's Late-Night Honking Nightmare Sparks Outrage Among San Fran Residents

Germany's EV Sales Sink 37% As Subsidies End

EU To Impose Tariffs As High As 48% On Chinese Electric Vehicles

South Korea to hold emergency meeting after EV fires raise safety concerns

Toyota bets big on hybrid-only models as EV demand slows

Cisco to cut 7% of its global workforce

Cisco Prepares Second Round Of Layoffs Amid Increasing AI Skepticism

Iron ore hits lowest level since 2022 as steel crisis rattles market

Investors Pull $2.2 Billion From ARKK In 2024 As Cathie Wood Underperforms Nasdaq By -30% YTD

Great Barrier Reef Sees Third Record Year Of Coral Growth

Massive increases in coral across the Australian Great Barrier Reef (GBR) have been reported for 2023-24 making it the third record year in a row of heavy growth.

Across almost all parts of the 1,500 mile long reef, from the warmer northern waters to the cooler conditions in the south, coral is now at its highest level since detailed observations began.

Meta Agrees To Pay Texas $1.4 Billion Settlement In Biometric Data Lawsuit

Meta Platforms has agreed to pay $1.4 billion to settle a lawsuit brought by the state of Texas over its unauthorized capture and use of the personal biometric data of Facebook users, Texas Attorney General Ken Paxton’s office announced.

We don’t have inflation because the people are living too well.

We have inflation because the government is living too well.

- Ronald Reagan

It’s not partisan if it’s true. Get gold no matter which “side” you misplace your faith in.

Incredible work! Thank you for this substack