Adding Seabridge Gold to Basket #4

Lies, Bastiat, Gold, Kingfisher Metals, Energy, Bitcoin

The typical starter home - defined as those valued in the lowest third within a region - is now “worth” at least $1 million in 237 US cities. In 2019 there were 84 such cities.

In gold houses today are priced less than in 2019, the same as in 2009, less than half vs. 1999, the same as in 1989 or 1979, and 75% less than in 1970:

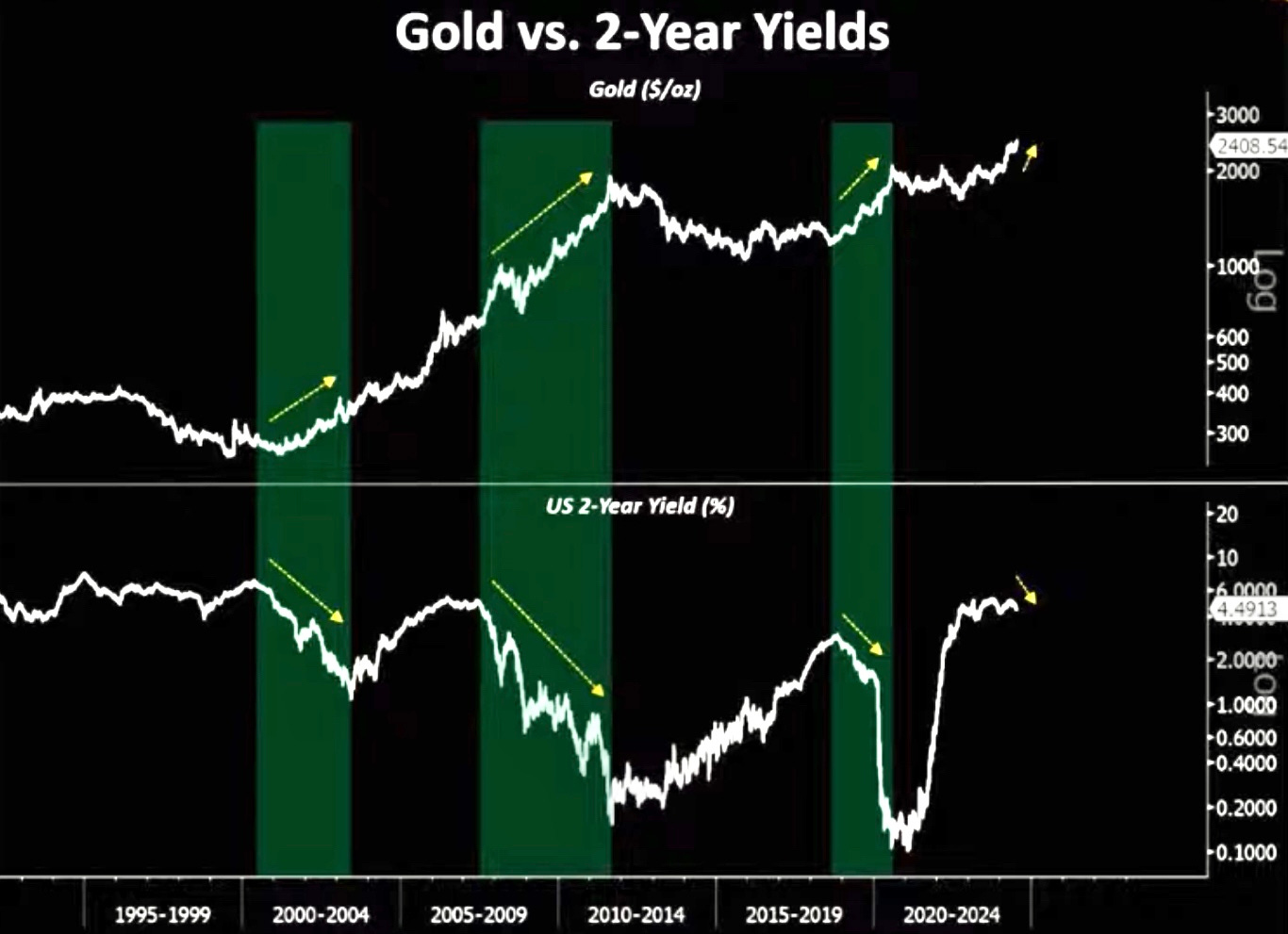

Now consider real rates topped late last year and are about to accelerate lower due to recession, and note the price of gold during past periods of falling rates:

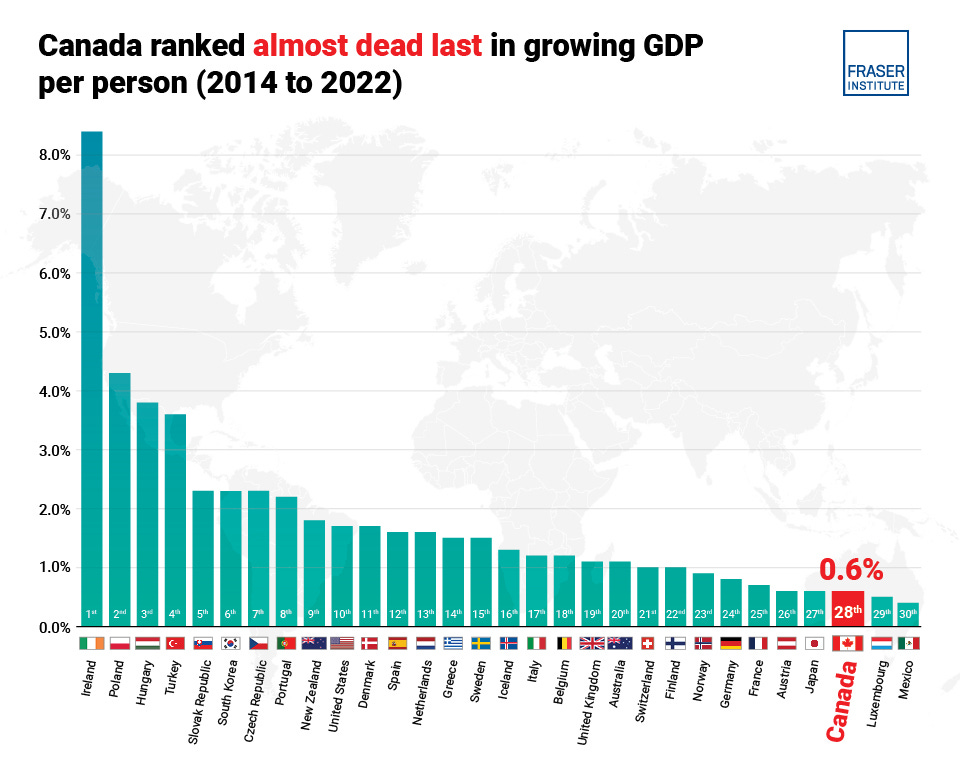

Canada’s standard of living is on track for its worst decline in 40 years per new study by Fraser Institute

To be fair, GDP (Gross Domestic Product) and “growth”, is not all good.

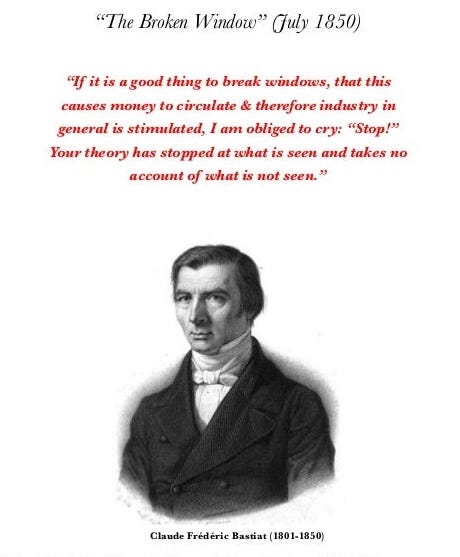

Negative events precipitating a spike in spending, including disasters, government boondoggles, and war, spur GDP “growth”. Consider Bastiat’s parable of the broken window.

Of course nothing about this is taught in school, nor does mass media make mention of it when parroting official economic fallacies, half-truths, and outright propaganda.

We’re similarly not taught or told the whole truth when it comes to prices either, or about the Law Of Unintended (But Totally Predictable) Consequences, because it doesn’t suit politically profitable narratives.

As a result people typically learn the hard way, and too late. Just this week, many who’ve come to this realization include victims of crime in Paris, France, or victims of government forest mismanagement in Jasper, Canada.

CBC: Jasper in ashes as 'monster' wildfire spans 36,000 hectares

Calgary Herald: Bad management has turned forests into firebombs

Here’s a 20-year chart of gold vs. the official Canadian scamcoin:

In the charts above, is it possible to find a reliable correlation or long-term trend emerging?

If so, we can potentially use this to our advantage!

Those following along with this substack have done well in precious metals.

In April we booked a 5-week 35% gain in silver via AGQ.

Two GROY positions were sold in December for gains of 10% each after just one month’s holding time.

A third GROY position was sold after it ran up 49% in under 6 months, leaving 1 GROY and 2 GLCC positions.

Entries and exists are always posted in real time, and the vast majority of updates are outside market hours so there’s no need to act in a frenzy on these ideas. All results are based on using common shares, not options or riskier strategies.

The remaining GROY position was $2.60 when I suggested it, now down 47%.

The two GLCC positions are each up 16% (including dividends) in 7 months, paying a 10.8% yield based on the suggested entry price (9.6% yield based on Friday’s close of $27.25).

Also in April we sold 2 of 3 copper positions when, after just 2.5 months of holding, COPX was up 34% and UYM up 21% including dividends.

CPER remains open, slightly up from entry price, in One And Done #11 - Basic Materials.

Despite gold being mentioned, if not featured, in 1/3 of the posts I’ve published here, I’m surprised to find I only suggested Seabridge Gold once, around the time I launched this substack in January of 2023:

Bonus Basket

All in safe, stable North American jurisdictions, from penny stock to producer and including one of the world’s largest resources of gold, copper and silver :

Revival Gold (TSXV: RVG, OTC: RVLGF). It closed the week at $0.50 USD. Double-dare you to do your DD and not come away impressed in context of its peers at that price. https://revival-gold.com

GoGold (TSX: GGD, OTC: GLGDF). Last at $1.78 USD. https://gogoldresources.com

Seabridge Gold (TSX:SEA, NYSE: SA). Last $13.87 USD. https://www.seabridgegold.com

While the more speculative names in the list (Revival and GoGold) are down since then, I still like all three over the long-term cycle.

Recent related headlines:

Revival Gold Advances Programs at Mercur and Completes Geophysics at Beartrack-Arnett

Gold Royalty reports Q2 revenues nearly quadrupled from year ago

Seabridge Gold Receives its KSM Substantially Started Designation from the BC Government

That news is huge for Seabridge. In my estimation it’s an excellent long-term investment for those thinking in years and of generational wealth.

Of course you can read that press release and learn why it’s significant via the Seabridge website. Also take time to marvel at its enormous land holdings, discoveries, and “blue sky” potential.

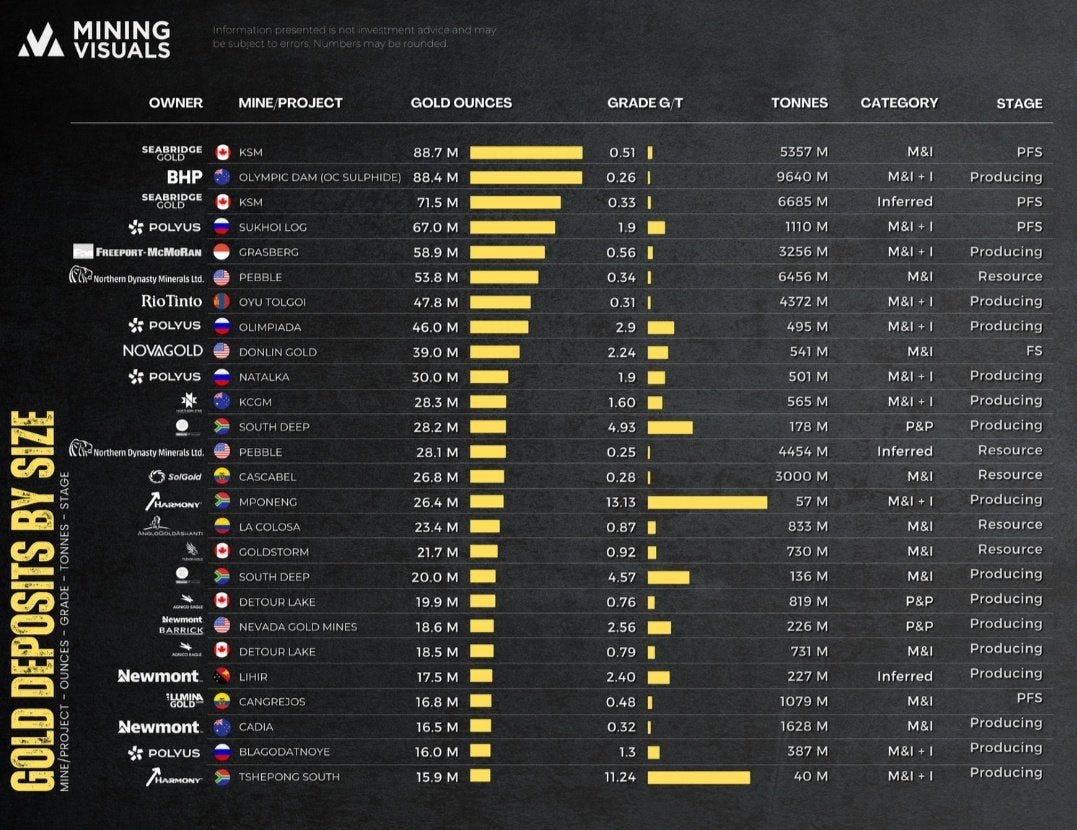

The KSM project alone hosts 2 of the top-3 gold resources in the world:

Adding Seabridge To One And Done #4 - Gold

Seabridge trades under ticker SA in the U.S. and ticker SEA in Canada, closing Friday at $16.22 USD.

I’m adding Seabridge to my basket of gold ideas at tomorrow’s open.

Disclosure: I’ve followed and owned Seabridge for many years, most recently adding last week, and I will buy more at tomorrow’s open however bear in mind I’ve got a reasonably hedged portfolio overall and a much lower cost base in Seabridge.

Buying anything at this stage of the overall market cycle carries far beyond average risk. To wit, here’s the latest expo of analytic excellence from John Hussman:

https://www.hussmanfunds.com/comment/mc240721/

If after that you’re still feeling speculative, an extra gold play to consider:

Kingfisher Metals Corp. closed at 23.5 Canadian cents Friday (ticker KFR), and 0.16 of a US dollar (ticker KGFMF).

Note this is a different company than Kingfisher Mining in Australia.

Kingfisher Metals’ website is https://kingfishermetals.com, where we learn:

Kingfisher Metals is a forward-thinking exploration company focused on efficiently and systematically exploring district-scale Gold and Copper properties in British Columbia.

Recent Kingfisher Metals news:

Kingfisher Provides 2024 Phase 1 Exploration Update

Kingfisher Closes Acquisition of the LGM Project in the Golden Triangle, British Columbia

I’ve had my eye on Kingfisher Metals for years, as I like its projects. After the recent 1/5 share consolidation to a reasonable sized float, it’s been trading sideways on low volume in a way that’s compelled me to start nibbling at it.

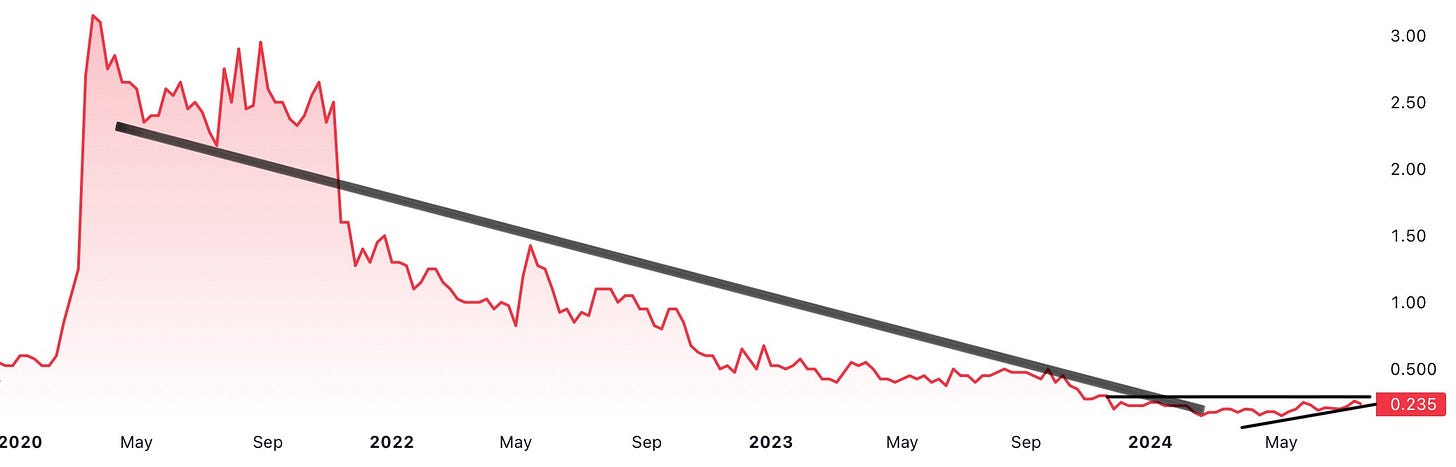

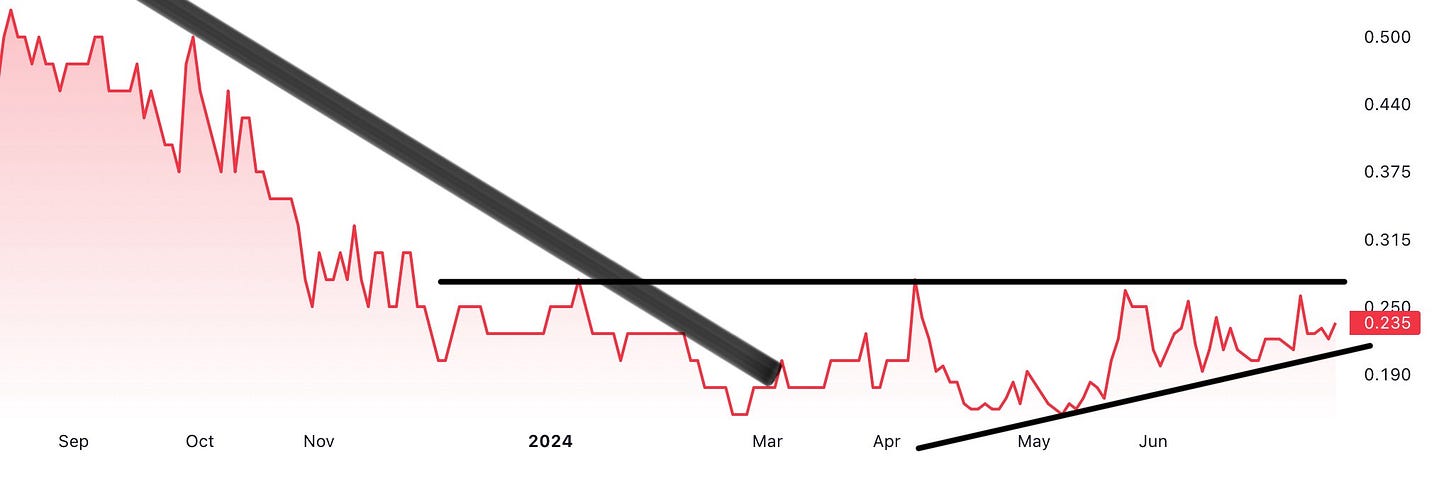

Here’s two views of KFR, 5-year and 1-year:

Above the line at 27.5c CAD (~ 21c USD) I’ll probably chase it to buy the last of my budgeted amount. Until then, I’ll add occasionally if it continues to hold up as markets sell down.

If it falls below its upward trend, I’ll keep what I have in this speculation and resist adding until markets and its chart firm back up.

ENERGY

We’ve done extremely well in energy too.

Here’s my latest entry on oil, and uranium:

Global Uranium ETF (URA) remains my “one and done” for the sector, and it’s now up 33% (including dividends) since my call in January 2023.

Just 2 months ago it was up 60% including dividends. I view the recent drop as a normal pullback during the expected and ongoing consolidation in this sector.

Two additional URA positions were closed in late September. One was booked for an 18% gain in under 5 weeks, while the other netted 21% in 2 months.

Considering the latter was purchased with proceeds from a BNKU position that had just gained 31% in a few weeks, that’s a massive compounded gain for such a short holding time.

Other uranium “bonus” suggestions made last January, and since, have risen far, far more. I’m still occasionally adding LTBR (Lightbridge Corp.) below $5.00

The New Gold Rush: Uranium's Soaring Demand

Be patient, for we’ll have stellar opportunities again soon in copper, oil and uranium, since to succeed in life one must do the opposite of the chronically wrong.

Hedge fund positioning in energy commodities (bottom scale is calendar year):

CRYPTO

Speaking of the chronically wrong, there’s been a lot of hard pumping from supposedly credible news outlets and crypto advisories lately.

They’ll tell you 1 in 4 Americans hold bitcoin. Factoring for those who can afford the devices and costs associated, and navigate the technical barriers of entry, that’d mean about 1/2 of American adults which is absolutely preposterous. Even more so when you consider that probably not even 1/2 (or 1/4?) of people who own crypto hold bitcoin, instead preferring to speculate in alts or meme coins.

The “1 in 4” assertion is even more ludicrous given bitcoin wallets are mostly anonymous. Probably the statistic comes from taking the number of known wallets originated or accessed via US-based IP addresses, plus accounts at leading US exchanges, then presuming each of those is owned by an individual person.

Problem is that even crypto neophytes will typically have many wallets, while crypto natives will have dozens if not hundreds. Some crypto transactions require the creation of a new wallet, so going through hundreds or even thousands of wallets wouldn’t be uncommon.

Another oft-repeated myth along with that “1 in 4” non-stat is that bitcoin is “hard capped” at 21 million tokens. False. It’s capped for now, and that number can easily be - arguably will absolutely need to be if anything approaching mass adoption ensues - raised in the future by the Bitcoin Core governance group.

Yes, governance, by non-elected overseers, of the foremost digital currency. So much like a physical currency it hurts, and how’s that for “decentralized”?

Also not mentioned are other issues:

Bitcoin Core devs set up new policy aimed at handling ‘critical bugs’

https://cointelegraph.com/news/bitcoin-core-devs-launch-critical-bug-disclosure-policy

Still it’s full steam ahead:

Ferrari Expands Crypto Payments To Europe After Successful US Launch

Don’t take any of this to mean I’m bearish bitcoin. It has its many merits, but “digital gold” it is not. That’s OK, perhaps even a feature.

However I do believe that given an imminent broad-based market plunge focused in tech, and failure so far of bitcoin or ethereum to make new highs despite top political candidates pandering hard to the crypto crowd this week, along with the launch of ethereum ETF’s, is bearish in the intermediate term.

Right or wrong, I’ll stick with my timing indicators so for now I remain fully hedged and way ahead in crypto per prior posts (relevant section is about halfway down):

HEADLINES

Recent headlines debunk many more myths and popular delusions, or reveal obvious consequences and cycles repeating:

Pandemic 2.0: FDA To Grant Emergency Use Authorization For mRNA Bird-Flu Shots (Just Like With COVID)

Ford to spend $3 billion to to expand large Super Duty truck production to a Canadian plant previously set for EVs

134-Year-Old American Furniture Chain Files For Bankruptcy, Closes All 553 Stores

39% of Americans worry they can't pay their bills

Southwest profit falls 46% as airline takes 'urgent' steps to increase revenue

Canadian grandparents risking their own financial future to support family

FedEx To Cut Daytime Domestic Flight Activity By 60%

New Car Incentives Soar 53% Amid Rising Inventories & Lackluster Demand Hint At Downturn

1000s Of Marylanders Furious About Eminent Domain Risk For New Transmission Line Powering AI Data Centers

More Americans Falling Behind On Car Payments As Repos Soar 23%

EV output is 45% below what carmakers expected, supplier says

Blackstone Mortgage REIT Slashes Dividend By 24% As Distress Piles Up In Commercial Real Estate

Feds shut down Vineyard Wind project following turbine blade failure

A wind turbine failure is littering Nantucket beaches with debris, angering locals

Debris from a broken offshore wind turbine has for days been washing up on the Nantucket shore, prompting beach closures and frustrating locals at the peak of the summer season.

The massive turbine blade – as long as a football field – was part of the Vineyard Wind farm off the coast of Massachusetts and its islands, Martha’s Vineyard and Nantucket.

Since then, foam debris and fiberglass – including some large and dangerously sharp pieces – have washed onto beaches. A “significant part” of the remaining damaged blade detached from the turbine early Thursday morning, Vineyard Wind said in a news release. The US Coast Guard confirmed to CNN it has located a 300-foot piece of the blade.

There are few answers to what caused the turbine to fail, and the incident has prompted questions and anger from city officials and Nantucket residents.

Public Service Announcement

Be aware of this sophisticated new atypical type of scam.

A Silicon Valley executive had $400,000 stolen by cybercriminals while buying a home. Here’s her warning.

Key Points:

Rana Robillard was tricked into sending her life savings to a criminal.

What happened to Robillard, a 25-year veteran of tech companies, speaks to the increasingly sophisticated nature of cybercrime.

Note, if you visit that link while using an ad blocker, it’s easy to bypass the pop-up by clicking the “continue…” fine print at bottom of it.