Booking Big CRECF Rally, Buying LL Again

Updates: LXU, BNKU, Disney, Tesla, crypto, uranium, TZA

My “special situation” ideas have been very profitable. We’re 8/9 so far, for a lucky hit rate of 88.88% across a wide variety of sectors and market caps, long and short.

The latest Special Situation, in the Japanese yen, isn’t going well though.

Headline today:

JPY Plunges To Fresh 34-Year-Lows After BoJ Does Nothing... Again

In due time I believe the yen position will be profitable too, but I’m not adding to it and I won’t consider adding until ideal timing is again evident.

I’ll post when that happens. Now the yen is 0.00638 USD, after a low today of 0.00625

When I went long, it was 0.00666, and as things sit now I’ll need to see it above 0.0065 before reconsidering it.

Meanwhile I’m down 8% on YCL, which stays open with no stop.

Shorting Disney was my first Special Situation idea. It netted a 13% gain in 3.5 months, closed within pennies of its low and just prior to a 57% rally:

Closing Disney Short

3 1/2 months ago I shorted Disney. With the writers strike over it could be argued Disney can now get back to committing its slow-mo brand suicide, and I expect it will. Also the consumer is very stretched, so streaming services like Disney+ should

2 of my 4 LL special situation positions were sold for a gain of 17% each in just 3 weeks.

The other 2 were closed after 9 weeks, while still up 11%.

That’s a fast average gain of 14% on 4 different positions:

I suggest revisiting the original LL posts here and here, because for those same reasons I’m going long LL again in the face of its steady price decline and extremely overvalued markets overall.

LL closed today at $1.55, on verge of breaking a down trend and triggering bullish technical signals by my methods.

The company is scheduled to report its quarter Wednesday May 08 pre-market.

I’ll repurchase a single LL position only if it hits $1.60 before then.

The Tesla short special situation was closed last week for a 41% gain in 3 months.

More on Tesla below.

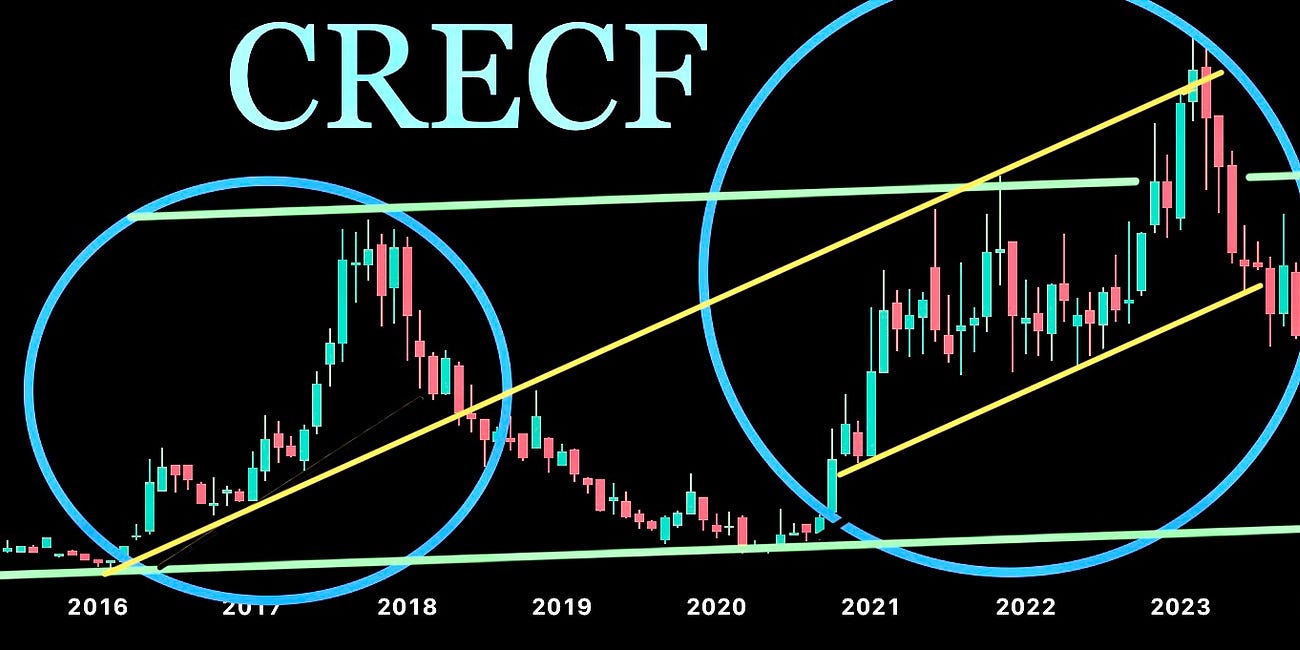

In February I offered a Special Situation Twofer: LXU, CRECF:

Special Situation Twofer: LXU, CRECF

LXU - LSB Industries is new to me. A friend shared the video below. It’s an excellent assessment by a brilliant team on a company I’m eager to buy more of over time as it’s perfectly in-line with my “buy reality” thesis:

CRECF was up 57% at today’s high.

At the close, it’s up nearly 53% in just 2.5 months and, while I stand by my statements about its long-term potential, for now the “special situation” is over and I’m putting this huge score in the books by closing the position.

LXU is up 6% since then, up 16% at its recent high, and I still like it very much for the longer term even at the current higher price.

We may soon have bullish alerts triggered on soybeans, corn, platinum and palladium.

Commercial Real Estate Foreclosures Soar To Levels Not Seen In Nearly A Decade

Middle Class Can't Afford Homes In Nearly Half Of Top 100 US Metros, Study Finds

April Marks Worst Month For SMB Rent Delinquency In 3 Years - 43% of small business owners delinquent in paying rent

Small business rent delinquencies exceeding levels measured at peak global pandemic lockdowns, yet supposedly everything’s fine and the economy is great.

Soft landing? No. A memorable decline with a landing that many will wish they can someday forget.

Same for Tesla bulls, as the stock goes “to the moon!” along the same trajectory as its “meme stonk” EV peers and other infamous (alleged!) frauds:

US probes Ford hands-free driving tech after crashes

Move over Tesla, as Canadians favour hybrid vehicles amid fading EV demand

Supreme Court Rejects Elon Musk's "Free Speech" Appeal In SEC Case

Wall Street Journal: U.S. Regulators Tie Tesla’s Autopilot to More than a Dozen Fatalities, Hundreds of Crashes

Federal auto-safety regulators have opened an investigation into the adequacy of Tesla’s December recall of 2 million vehicles equipped with Autopilot software, tying the technology to at least 14 fatalities, several dozen injuries and hundreds of crashes.

The National Highway Traffic Safety Administration said in a report published Friday that its examination of Tesla’s Autopilot, a driver-assist system that automates some driving tasks, uncovered a trend of “avoidable crashes involving hazards that would have been visible to an attentive driver.”

On Friday, the regulator said it was closing its earlier probe and opening the new one into the adequacy of the recall remedy, which was deployed through a software update. The recall in December was among Tesla’s largest to date and involved nearly all the vehicles it had sold in the U.S.

NHTSA also compared Autopilot to similar systems deployed by auto-industry rivals, saying it found Tesla’s approach was an “industry outlier.” The agency said the Autopilot name “elicits the idea of drivers not being in control,” while other systems use terms like “assist” or “team” to imply that active supervision is required.

In its latest report, NHTSA took issue with Tesla’s statements that a portion of the recall remedy required opt-in from the owner and could be reversed at the driver’s discretion. It also said some Tesla updates appeared to address Autopilot issues that the NHTSA raised without identifying them as remedies.

“This investigation will consider why these updates were not a part of the recall or otherwise determined to remedy a defect that poses an unreasonable safety risk,” the agency said.

January’s “Special Situation - Short Tesla” (via TSLQ) was closed last Thursday at my prior-stated stop price for a 41% gain in exactly 3 months.

Tesla rallied as much as 37% since then. That’s not a typo, and at today’s close it’s up 34% in just 4 market days.

I’m sorely tempted to reset that additional short position, but will stand pat for now with my existing Tesla short via TSLQ.

Factoring the dividend of $3.723 paid in late December, my original TSLQ holding has an average cost of $32.49 so is still slightly profitable at today’s closing price of $32.99

Ref:

Tesla Short and Buying More Natgas

Richard Feynman, in a 1974 commencement address at Caltech: The first principle is that you must not fool yourself – and you are the easiest person to fool. Feynman was a Nobel Prize winning physicist and one of the best-known scientists in the world, credited with pioneering the field of quantum computing and introducing the concept of nanotechnology, an…

Cryptomania drives record $520 million into BlackRock bitcoin ETF in single day

A group of investors have agreed to settle their civil case against Sam Bankman-Fried in exchange for his cooperation in their case against celebrities who promoted FTX.

This includes celebrities like Tom Brady, Gisele Bündchen, Shaquille O’Neal, and more.

Scammer pleads guilty after creating a fake Coinbase website to steal users’ funds.

He created a spoofed Coinbase site which let him steal login credentials from users. In the end, he stole ~$9.5M.

Pentagon fails sixth audit, with number of passing grades stagnant

In its most recent audit, the Pentagon could only account for half of its $3.8T in assets (including equipment, facilities, etc). No one knows where the money went, or what it was spent on.

I haven’t commented on the crypto sector, my inaugural One And Done idea #1 - Ape In, for months. When I was virtually a lone bull, even among Crypto Kool-Aid guzzlers, few wanted to touch it.

Ref:

One - Ape in!

I’ll introduce 10 ideas for a portfolio, balanced among short or intermediate term swings and longer term ideas, over the course of my first several posts. Guns blazing from the start, ‘cuz no one’s gonna read my substack to learn about Berkshire, bullion

Since then things have changed dramatically, and a lot of people are back to believing it’s a no-brainer can’t-lose opportunity of a lifetime. Back in early 2023 those same people thought you had no brains if you were in crypto. See the difference?

Price chasers to the last, they were totally wrong then and are probably totally wrong now. Call them consistent.

Now even mainstream investing advisories tout crypto hard, often clearly displaying little if any clue about the sector in general or bitcoin specifically. I write this having been in crypto over a decade, and deep into NFTs before there was a floor price, involved in DAOs before most could spell it, with a past life in big tech, back when AI was just called “programming”.

It doesn’t take any brains or experience, however, to know the best opportunities are not widely followed and favored, much less universally touted by come-lately or clueless outsiders.

I’ll add that the super-hyped “halving” often appearing at the core of today’s breathlessly bullish bitcoin broadcasts is actually irrelevant or arguably bearish for reasons beyond what I’ll include here.

Just keep in mind the Bitcoin Core group overseeing and maintaining the code can change its supposedly “limited to 21 million” number to any number they wish. The code is easily edited, and has been before. Many times.

That is in part why other bitcoin blockchains, which can be credibly argued to be the true bitcoin, like BitcoinCash exist.

Ref:

Crypto - Quick Update

October 2nd: ApeCoin remains fully hedged since $4.20 with staking rewards going to cash. I’m much less net short crypto now, rather building a pairs trade of increasing size: Bitcoin Cash (BCH) long vs. short a basket of alt-coins. BitcoinCash.org I’ll accumulate BCH above $228

Note: BCH (BitcoinCash) was $228, remained above $200 and recently hit $719.

Solana was around $30 at time of that post and recently hit $209.

Back to bitcoin, if the existence and scope of the Bitcoin Core group governing and changing the code for a “decentralized” and “immutable” cryptocurrency is a surprise to you… well it’s really not important. If professional advisors don’t know fundamental facts, why should you care? You shouldn’t. It’s all about faith, not fact.

Tesla’s accounting? Ratings agencies or auditors that gave giant baskets of scam mortgages, or Lehman, or Enron, top marks just before implosion? Central banks?

Take it all purely on faith, if you can take it at all.

Care about prudence in timing and allocation instead.

All else that matters is that bitcoin ebbs and flows according to whatever the majority of participants want to believe or fear, same as anything else. At best facts or fundamentals only matter at the extremes, and for all its supposed decentralization it may also surprise many to know that bitcoin has tracked the Nasdaq for years:

It’s all just one big bad hopeium bubble of historic proportions.

My prior crypto positions returned quick results probably beyond what this substack will ever realize again, and my Apecoin position remains fully hedged (short and long in equal amounts, to only gain staking rewards) while paying a 17% yield currently. In the past that yield was at times well over 100% (not a typo), on top of the massive gains made in the Apecoin token itself and other crypto positions.

Proven above, I began last year very bullish crypto against a backdrop of extremely bearish sentiment. At the time I suggested staked ApeCoin or MARA (Marathon Digital). A short while after, Cramercoin.

A few weeks later, CramerCoin had gained as much as 355%.

On April 2nd 2023 I pivoted, stating it was “Crypto Turtling Time”:

ApeCoin position is fully hedged, with staking rewards still incoming and being converted to cash. […]

Many, or most, in crypto can’t imagine their favourite token trading 70-90% lower this year, if ever. I’ve seen an estimate from well-known persons in the space placing a “0.1% chance” on a 33% drop. Nonsense. A 70-90% drop has very high odds…

Most alts and tokens dropped at least 70% mere weeks after that.

MARA went on to run up almost 400% from my January suggestion, though I’d already closed the position for an average gain of 103% in just 3 months.

Ref:

Crypto Turtling Time

1. Crypto ApeCoin +49% at high since called 3 months ago, much more if staked MARA +134% at high, +114% at Friday’s close As noted previously MARA profits and the core position had been trimmed when it was up ~ 100%, to 1/4 its original dollar value and is effectively cost-free.

A further 34% gain in a single week was booked when I turned bullish again and briefly removed my hedge:

ApeCoin Update - Back to Hedged

Having capitalized on this month’s upswing in crypto, I’ve restored a full hedge on ApeCoin. ApeCoin was my inaugural theme in One And Done, which along with other crypto suggestions went far higher not long after. By early April in “Crypto Turtling Time

Apecoin staking rewards continue to be converted to gold (which has also appreciated significantly, compounding these already amazing short-term gains), or cash, so while most have seen massive losses in this token I’m far ahead and literally can’t lose.

If Apecoin goes higher, despite being hedged the staking rewards are still worth progressively more, so I accumulate more real assets (gold) with those proceeds.

If the token price goes lower I’ve got a huge profit locked-in while still accumulating real wealth (gold) with the staking proceeds, without any worries about what the SEC or the market might do with crypto since I’m already up far more than the amount of my original speculation which has already been converted into gold or cash.

Epic win.

As for the “everything bubble”, I’ve already got 2 levered shorts against the Russell 2000 Small-Caps index, via TZA, for One And Done idea #7 - Hedge or No Hedge?.

Though again I’m tempted to add shorts I’ll stick with process and prudence while standing pat with TZA and existing tech shorts.

I’ve cycled two prior TZA positions, both profitable despite a raging stock mania the past year.

The 1st was sold for a gain of 13% in 7 months.

The 2nd netted a 16% profit in 5 weeks.

Ref:

Adding 2nd TZA

In “A Fine Day To Exit”, 7 weeks ago, I announced restoring my TZA hedge position. TZA opened the next day at $20.62 and a month later it was already 19% higher. I’m still holding it, as markets are too extreme to rush to dump a levered hedge. Meanwhile it’s come full-circle, closing today at $20.10

Money-Market Fund Assets See Largest Outflows Since 'Lehman'

… largest weekly drop in money-market fund assets since Lehman (Sept 2008) and the biggest two-week drop (-$143BN) on record/

Huge Bond Wagers Make Some Hedge Funds Too-Big-To-Fail, IMF Warns

Bank Failures Begin Again: Philly's Republic First Seized By FDIC

Banks, along with virtually everything else, are overbought and very vulnerable.

I’m entirely out of the financial sector, after a very profitable year in bank stocks for One And Done idea #5 - Financials, and through this summer I’d rather be short banks than long. However, for now neutral suits me fine.

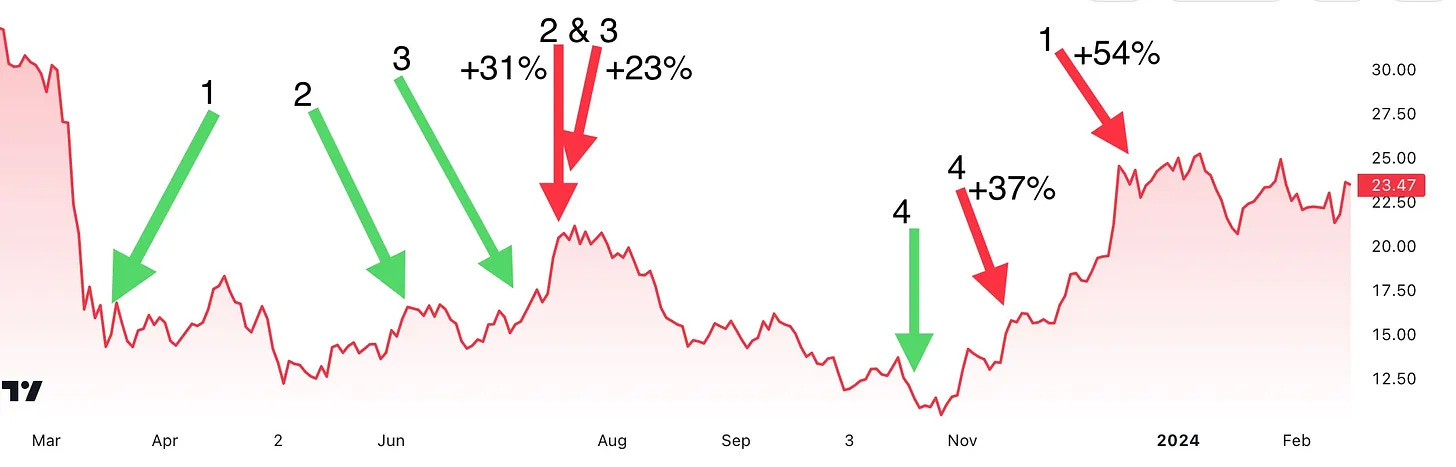

Here’s a chart of BNKU, an ETF for U.S. big banks, with green arrows at dates I bought, red where I sold as per posts in real time or in advance for all entries and exits:

Ref:

Bailing Out Of Banks

What happened last week? The U.S. Federal Reserve signalled rate cuts coming soon. Rates have already peaked and reversed, but the pretence of central bank control over rates must be maintained. “Experts” were somehow surprised and speculators celebrated by rushing to buy at prices far higher than just days prior. Most of them are likely to be facing ma…

Global Metals Markets Face Uncertainty As Russian Ban Takes Effect

Copper hits $10,000 a ton as BHP bid show tight supply pipeline

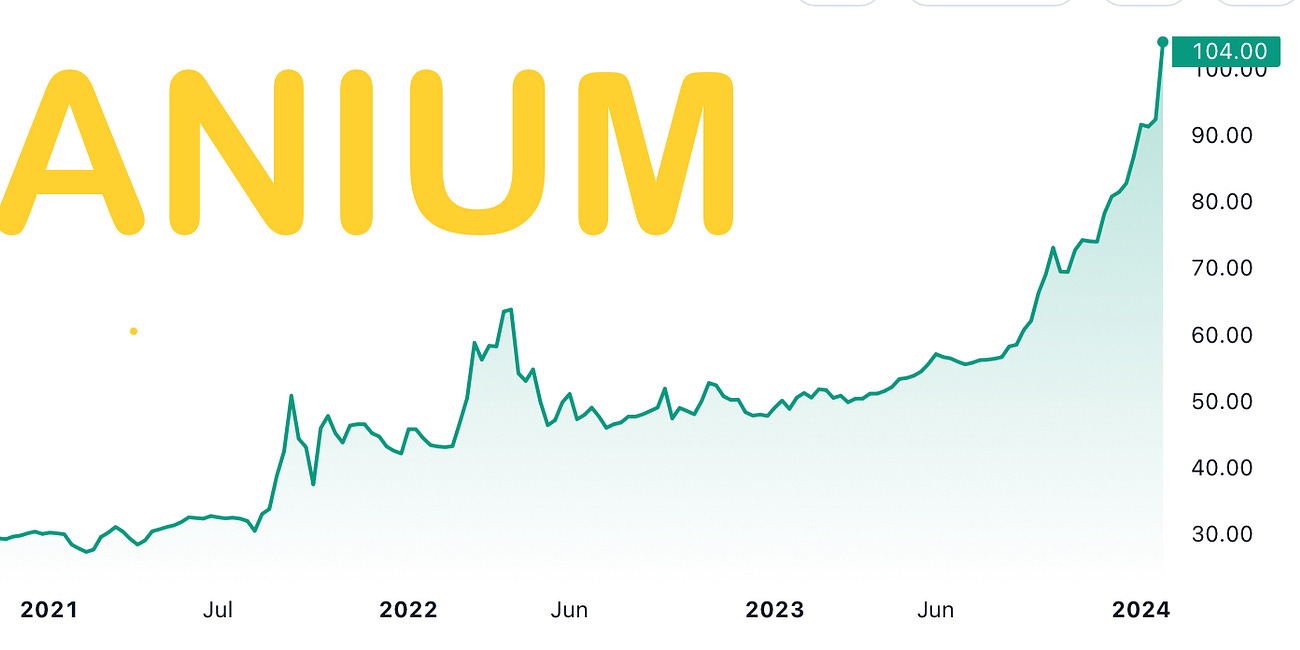

Uranium Stocks Rise After White House Mulls Russian Import Ban

Key uranium producers are falling short of targets, while politics plays an increasing role in constraining the supply chain.

That’s all bullish for the price of uranium, and the consolidation I’d predicted for the sector is likely over or nearly so.

Global Uranium ETF (ARCA: URA) remains my “one and done” for the sector, and it’s now up 38% since my call in January 2023. At its high since then, it was up 49%.

Two additional URA positions were closed in late September. One was booked for an 18% gain in under 5 weeks, while the other netted 21% in 2 months.

Considering the latter was purchased with proceeds from a BNKU position that had just gained 31% in a few weeks, that’s a massive compounded gain for such a short holding time.

Several of the other uranium suggestions made last January, and since, are up far, far more. I’m still occasionally adding LTBR (Lightbridge Corp.) below $5.00

Ref:

Uranium Now!

Nearly 1/4 of my posts the past 6 months had uranium in the title, including “Uranium Set To Explode” 5 months ago. No more than a few posts went by the whole year this substack has existed without my stridently bullish commentary on uranium. Are you making a killing?

The triumph of vinyl: LP sales continue to skyrocket

'Winning with bullets' Mexico enduring deadliest election ever as 30 politicians murdered

Keep two key things in mind, at least one of which is true:

It’s impossible to time the market.

Everything cycles while human nature never changes.

That’s all we need to know.

Congratulations on the timing of your Tesla shorts. His mercurial style is hard on short sellers.

And thanks for introducing Gold Royalty here - my neighbourhood and I appreciated the run.

*that last* run.