Posted the evening of April 29, with today’s “buy” target in mind:

We may soon have bullish alerts triggered on soybeans, corn, platinum and palladium.

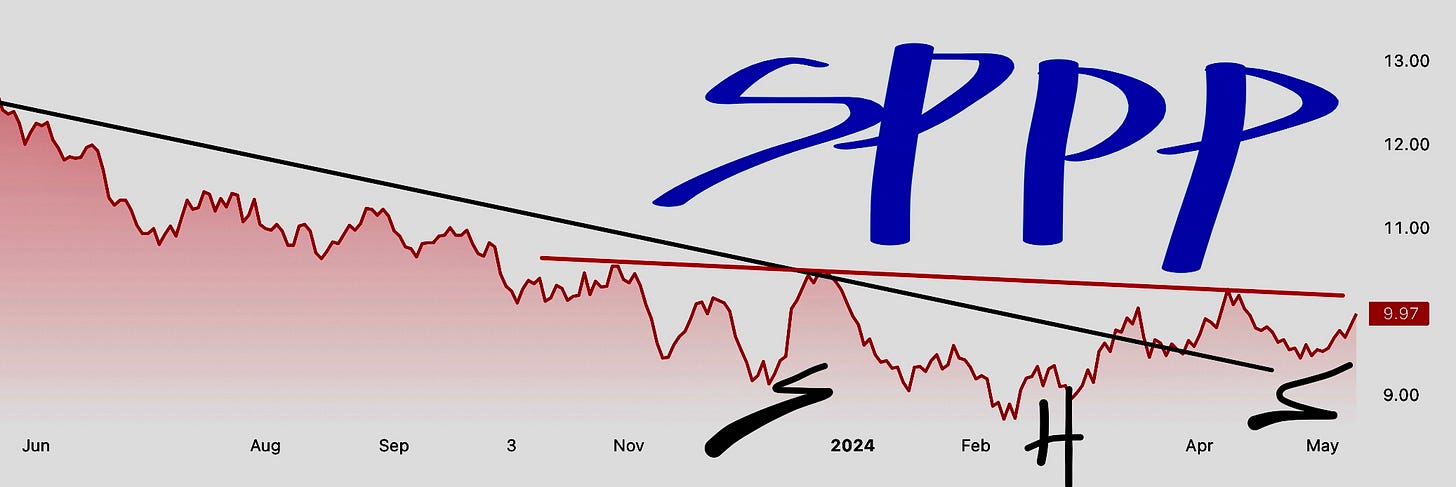

SPPP

SPPP - Sprott Physical Platinum and Palladium Trust hit a low of $9.35 the next day and closed yesterday, Friday May 10 2024, at $9.97

SPPP trades under the same ticker in both the U.S. and Canada, and we’ll track it in U.S. dollars here.

SPPP 1-year and a 5-year chart:

In the top chart an “inverse head and shoulders” pattern is labelled, while a “cup and handle” starting late 2023 is easily seen though not labelled.

Both patterns are very bullish, however neither pattern is completed yet. Both would be activated by a break above $10.45

There hasn’t been a weekly close above $10.05 this year and, other than during an outlying week in April, there hasn’t been any trade above $10.11, so prices above these should be seen as bullish.

The low of $8.55 hit in early February is the lowest level seen in nearly 6 years, including the nadir of the COVID panic crash in 2020.

Considering a long list of indicators and trends I won’t detail here, most importantly my own signals, SPPP and its underlying commodities themselves - platinum and palladium - are about as primed for a major run higher as it gets.

What is SPPP?

Per its website:

Investment Objective

The Sprott Physical Platinum and Palladium Trust (SPPP) is a closed-end trust that invests in unencumbered and fully-allocated Good Delivery physical platinum and palladium bullion.

Goal

Provide a secure, convenient and exchange-traded investment alternative for investors who want to hold physical platinum and palladium.

Why Invest in SPPP?

Fully Allocated Platinum & Palladium Bullion

Redeemable for Metals

Trustworthy Storage

Potential Tax Advantage

Easy to Buy, Sell and Own

A Liquid Investment

What’s all that mean? See here: https://sprott.com/investment-strategies/physical-bullion-trusts/platinum-and-palladium/

Adding SPPP to One And Done idea #4 - Gold

I’m adding SPPP to the gold basket, with a sell stop after any close below $8.55

That’s about 15% risk with far greater upside potential.

A more cautious buyer might wait until it trades above technical trigger levels noted above.

One And Done #4 - Gold ideas have been very profitable, with a perfect hit rate.

In April we booked a 5-week 35% gain in silver via AGQ.

Two GROY positions were sold in December for gains of 10% each after just one month’s holding time.

A third GROY position was recently sold after it ran up 49% in under 6 months, leaving 1 GROY and 2 GLCC positions (both up 12% including dividends since suggested entry just 5 months ago) left in the gold basket.

Read more on idea 4 - Gold, most recently adjusted and updated here:

Selling 1 GROY and 2 Copper (COPX, UYM)

At cycle’s end, stats will show over 80% of investors managed to lose money since 2020’s low despite the huge market run in the interim. Lots of money. 5-10% will break even. If you’ve less than 10 years of success in markets, it’s virtually certain you won’t be in the profitable few percent.

"Most Central Bank Gold Buying Is Unreported": In Stunning New Report, Goldman Sees "Significantly Higher" Gold Prices

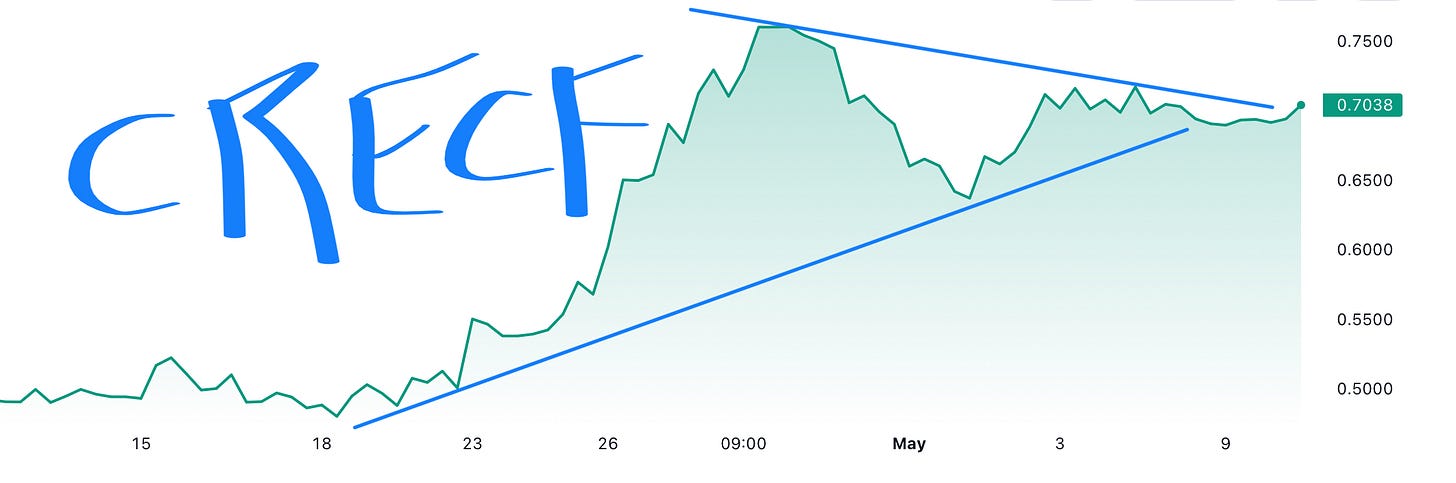

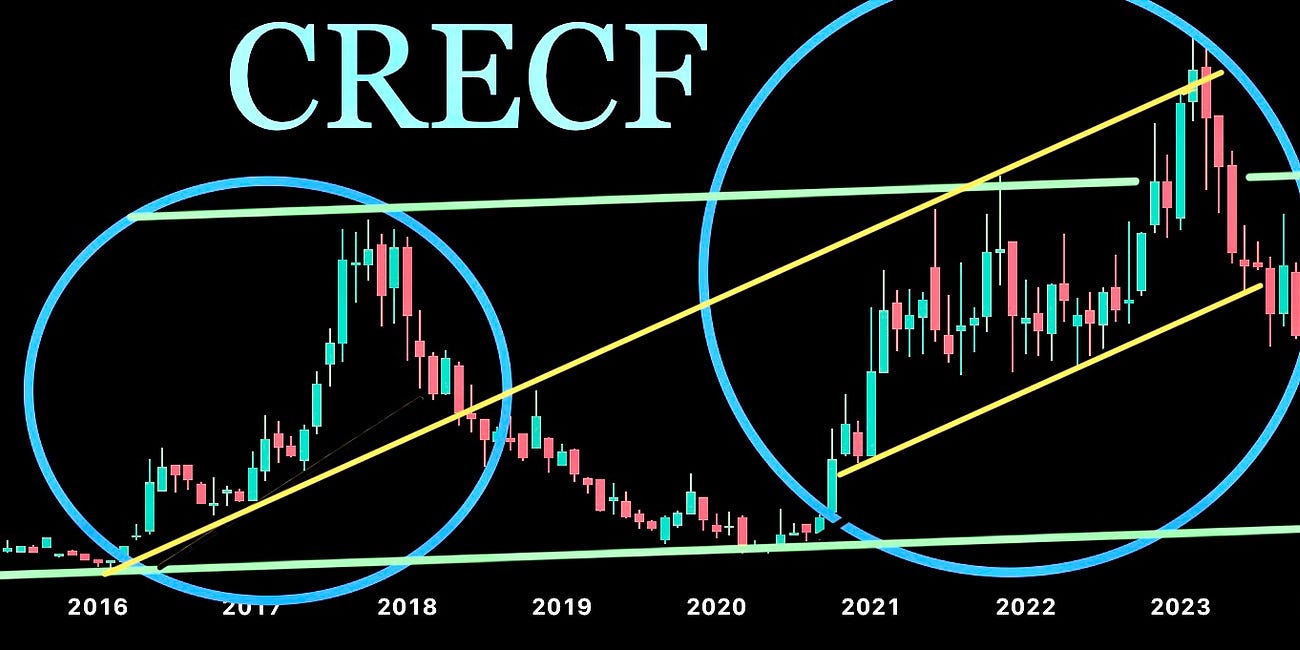

CRECF Revisited

CRECF rallied 57% shortly after the suggested entry in February.

While we booked most of that already, be aware it has since consolidated in a pattern that typically resolves upward and it targets a further 40% run-up.

CRECF is the U.S. ticker for Critical Elements Lithium Corp. (ticker CRE in Canada).

Read the original post here:

Special Situation Twofer: LXU, CRECF

LXU - LSB Industries is new to me. A friend shared the video below. It’s an excellent assessment by a brilliant team on a company I’m eager to buy more of over time as it’s perfectly in-line with my “buy reality” thesis: