For future reference, because there’s no time stamp on Substack and at times the date itself has been off by a day, this note is published pre-market Monday March 31, 2025.

Chevron (CVX)

Chevron is not only an oil, natural gas, fuels, lubricants, carbon capture and storage, chemicals and additives company, and Warren Buffett’s 5th-largest holding at nearly 6.5% of Berkshire Hathaway’s portfolio, but also partnering to develop nuclear fusion energy.

Here’s its site: https://www.chevron.com

Chevron meets my “special situations” criteria, which as of this writing boasts a perfect hit rate over a wide variety of sectors and market caps, both long and short.

Read about that here:

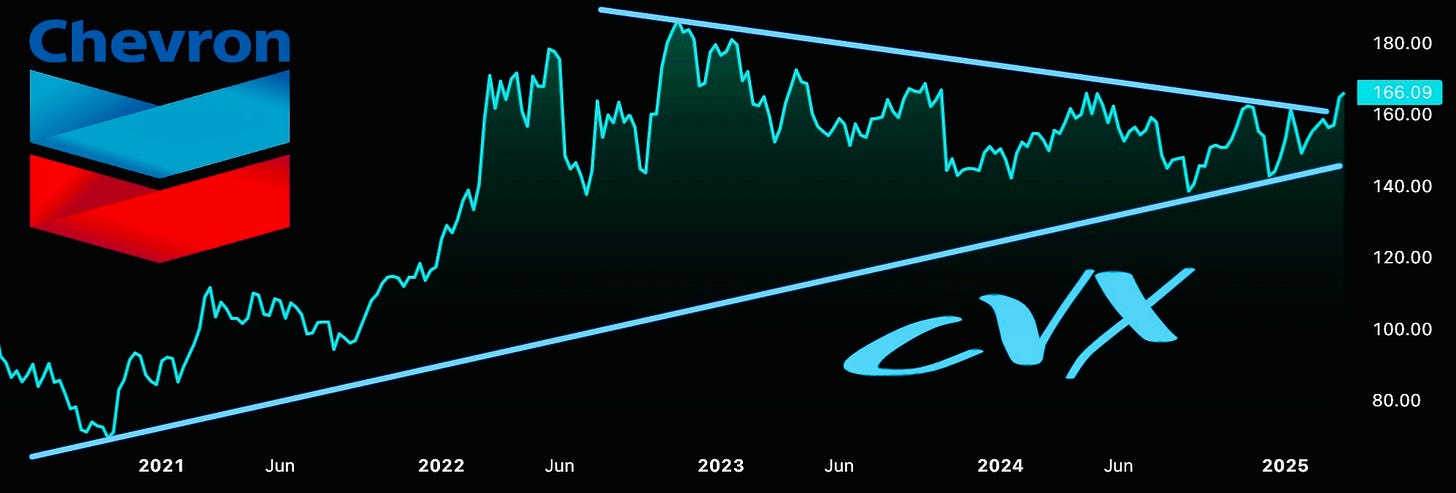

Here’s Chevron’s chart, showing a very bullish breakout of a multi-year pattern that is highly reliable and targets a much higher price:

Chevron currently pays a yield of 4.12% based on its closing price Friday of $166.09

Perhaps best of all, the oil sector is currently far out of favor with near-record under-allocation, price pessimism and short positions among what I call the “Chronically Wrong Cohort” of media pundits, fund managers and retail investors who are almost always caught dead-wrong in positioning at major sector turns, as I’ve made many profitable examples of in this substack from tech to precious metals… and in oil.

Chevron (CVX) goes into the basket for One And Done Idea #8 - Oil And Dividends at the opening price later this morning, March 31 2025, holding it with no stop.