We’re 8/9 so far on Special Situations, for a lucky hit rate of 88.88% across a wide variety of sectors and market caps, long and short.

The 9th is recent, still open, and I’ve every confidence will be profitable too.

Today, another twofer: JOBY and EVNX.

JOBY - Joby Aviation

Joby is a California-based company building quiet, all-electric aircraft to connect people like never before. With up to 150 miles of range and the ability to take off and land vertically, the Joby aircraft will change the way we move while reducing the acoustic and climate footprint of flight.

Our long-term vision is to build a global passenger service that helps the world connect with the people and places that matter most, while helping to protect our precious planet. As well as strategic partnerships with Toyota, Delta, Uber, and many more, we have a team of more than 1400 engineers and experts working to bring aerial ridesharing to our skies.

JOBY came to market late 2020, peaking during the SPAC bubble of 2021 at $17.00

It subsequently plunged 82% during the SPAC & tech bust of 2022 to a low of $3.15

It closed today, Tuesday May 14 2024, at $5.39

The green lines on the chart are parallel:

Most important is that based on the timing signals I use it’s buying time for JOBY.

With JOBY being a relatively recent market listing, there isn’t much data to go by so it’s only had one prior instance of a positive timing signal. That was early 2023, when I was virtually a lone hyper-bull in tech while experts running hedge funds had a record net short position.

After that signal JOBY went 12% lower before tripling within just a few months. That was during a raging bull market in tech last year though, while markets are topping now.

As for shorts, I don’t know whether any “experts” are short JOBY however it does have a very significant short interest which could add an upside catalyst:

I’m buying JOBY up to a limit of $5.75 with no stop.

Start your research here: https://ir.jobyaviation.com

ENVX - Enovix Corporation

Enovix is on a mission to power the technologies of the future. Everything from IoT, mobile and computing devices, to the vehicle you drive, needs a better battery. Our disruptive architecture enables a battery with high energy density and capacity without compromising safety. We are scaling our silicon-anode, lithium-ion battery manufacturing capabilities to meet customer demand.

ENVX made its market debut in January 2021, also via a SPAC deal, peaking in November of that year at $39.48

It subsequently plunged 86% to a low of $5.70 last month.

ENVX closed today at $9.78

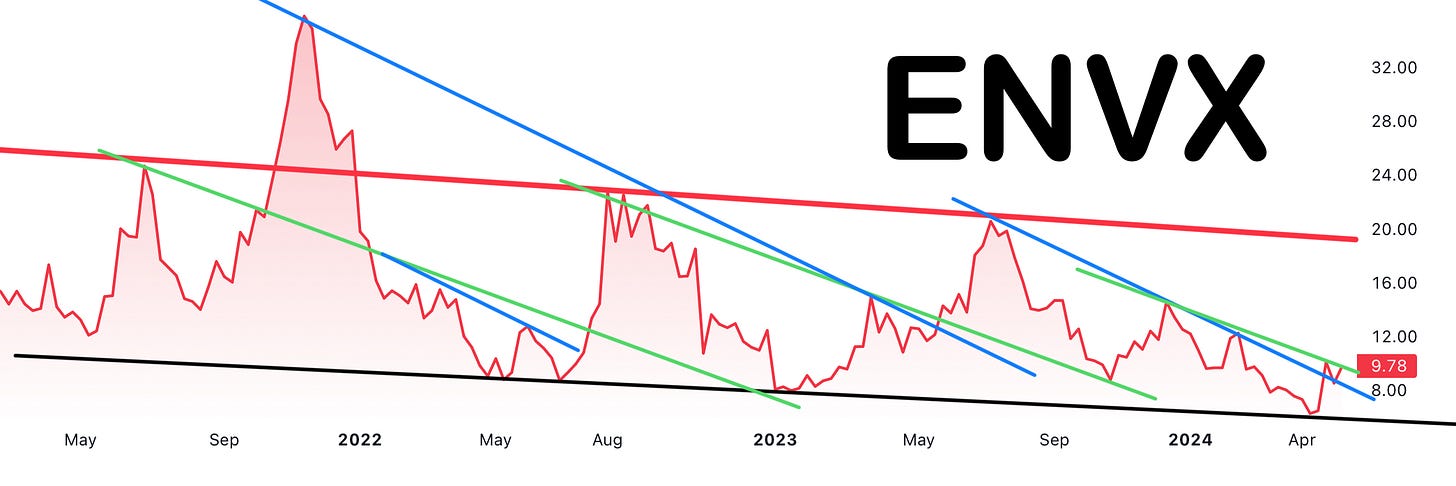

Here’s its chart. The blue lines are parallel, as are the green:

In the past ENVX enjoyed a good run above those lines, plus based on my timing signals it’s buying time for ENVX too.

ENVX had one prior instance of a positive timing signal, after which it went 1% lower before running 2.6x higher within just a few months. That was during a raging bull market in tech last year however, while markets are topping now.

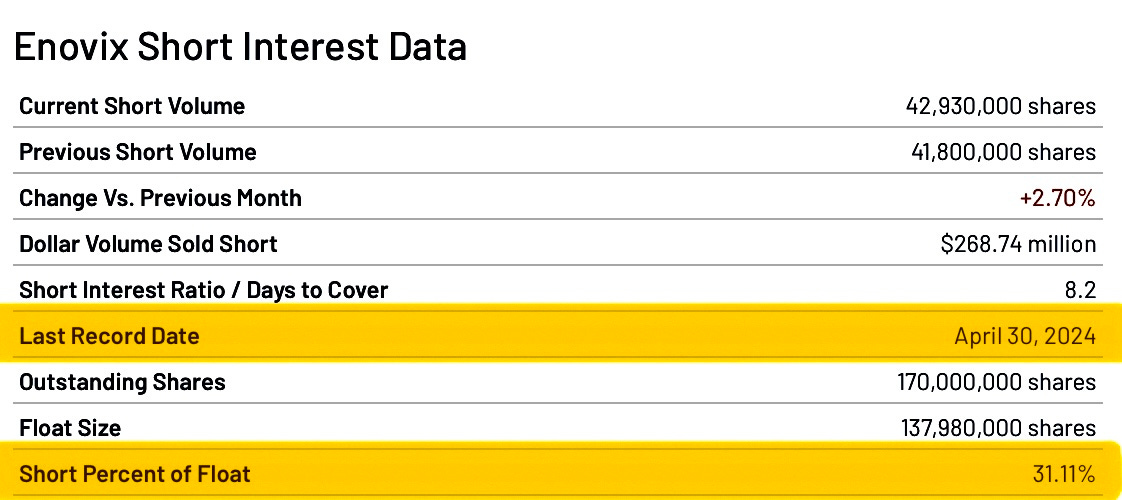

I don’t know whether any “experts” are short ENVX either, but it has a massive short interest which could add a material upside catalyst:

I’m buying ENVX up to a limit of $11.00 with no stop.

Start your research here: https://ir.enovix.com

Biden hikes tariffs on Chinese EVs, solar cells, steel, aluminum

That should be bullish for Tesla yet, despite this news plus the return of momentum-chasing panic buyers of 2021’s “meme stonk” darlings, it barely budged higher.

In time that news will prove to be bearish for Tesla and bullish for commodities.

We remain comfortably and profitably short Tesla, while very profitably long copper and other commodities.

Heard about the return of “meme stonk squeezes”, via parabolic run-ups in zombie companies like AMC and GME?

It’s a gift to legit short sellers, none of whom were still short full positions in these names unless ready and very eagerly willing to multiply their shorts at exponentially higher prices.

When a stock is down 90-95% from its high, that’s the sweet spot for this type of action. Both GME and AMC were down over 90% from their respective 2021 mania peak, and ripe for a brief burst higher. Professional shorts knew this.

It’s nothing new, so don’t buy into the narratives and manipulation conspiracies. Gullible market newbies were used as stooges to orchestrate short squeezes via online message boards over 25 years ago too, as I detailed here:

There was even a meme stock frenzy attributed to youth conspiring on message boards to pump and dump stocks and “wage war on short sellers”.

In 2000 the U.S. had its closest and most contested Presidential election (at that time), marked by widespread accusations of cheating and vote-counting irregularities with some recount results having to be settled in court yet still doubts over that election persist.

By 2001 these were the big news items: terrorism, ideology, proxy wars, the tech bubble popping as a global recession began, and yet another war in the Middle East.

So many similarities. It’ll end the same way, and the latest round of idiocy is an echo of past peaks; a sure-fire sign of a major top in progress, right on cue and as expected so stay hedged and as history repeats remember:

Correlation is not causation

Past performance is no guarantee of future results

Nebraska Ends Income Taxes On Gold And Silver, Declares CBDC’s Are Not Lawful Money

Viva Nebraska!