Adding Uranium

Sprott Physical Uranium Trust (SRUUF), Japanese yen, rates reverting, consumers collapsing, bullish: oil, platinum & palladium

Even now, at the peak of a generational speculative mania, more than half the roughly 25,000 stocks listed in America the past 90 years proved to be worse investments than Treasury bills.

We carry on, with prudent capital preservation foremost in mind.

Big, quick bounce-rallies are hallmarks of bear markets. Do not chase prices.

Here’s a look at the Japanese yen vs. the S&P 500 index in purple:

Those lines should meet again in due time, which suggests lower equities and higher yen.

Below is an updated yen chart, with my initial target in blue. By the time the lines in the chart above intersect again, it should prove that my target is very conservative.

My “Special Situations” series boasts a 100% hit rate of quick significant profits.

The idea of going long the yen, while the world was selling it hard, was published late February of this year as a Special Situation and was most recently updated here:

Rates & Consumers

Headline: Fed chair Powell says 'time has come' to cut interest rates

The Fed is trailing real rates, as always. Central banks only follow real rates, and it’s never been different because that’s all they can do. The rest is pure Kabuki, all pretense, smoke and mirrors and noise signifying nothing. Soap opera drama for finance bros.

Recession - the inevitable economic downturn - is already underway, and if it mirrors the mania on the way up it’ll be a brutal comedown. We’ll soon see.

Simply, rates are said to be inverted when longer term rates are lower than short term rates. The latest period of inversion lasted a record 3.5 years, and that record length of inversion prompted many supposed experts to assert that yield inversion is no longer a working indicator.

That’s ridiculous. We’ve been keeping a close watch on yields for many months, fully aware that the trouble starts after yield “reversion”.

Reversion essentially means “back to normal”; longer term rates higher than short term.

In July I noted:

Yield inversion is proceeding rapidly to reversion as expected.

Rates reversion is now in evidence:

Lowe's Cuts Full-Year Outlook On "Challenging Macroeconomic Backdrop" Hitting Homeowners

RV Downturn Turns Apocalyptic With Largest Dealership Offering 55% Discounts

Macy's Plunges On "Sharp Cut" To Full-Year Forecast; Goldman Expects Consumer Weakness To Persist

Ally Financial (ALLY), a major issuer of consumer credit cards, reported a sharp rise in consumer loan delinquencies sending its shares down 15%

Goldman Finds "Thrift Trends Outperform" Amid Consumer Slowdown

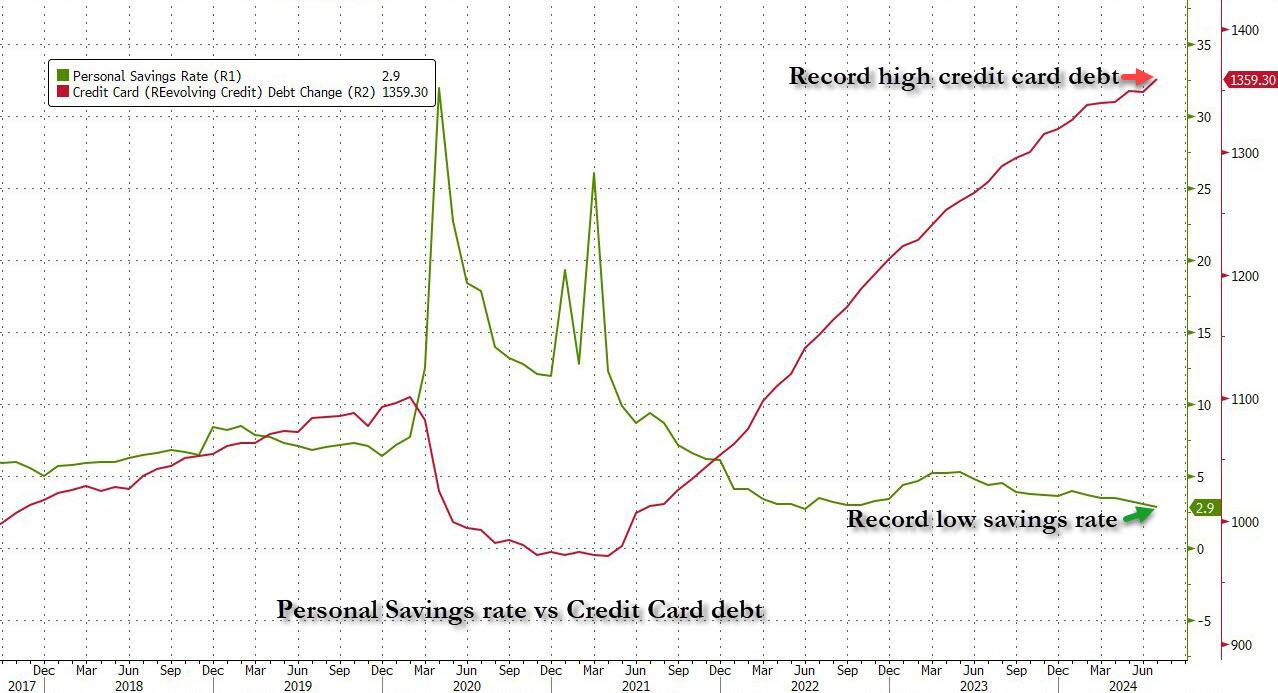

Total credit card debt is at an all-time high while the personal savings rate is at a record low:

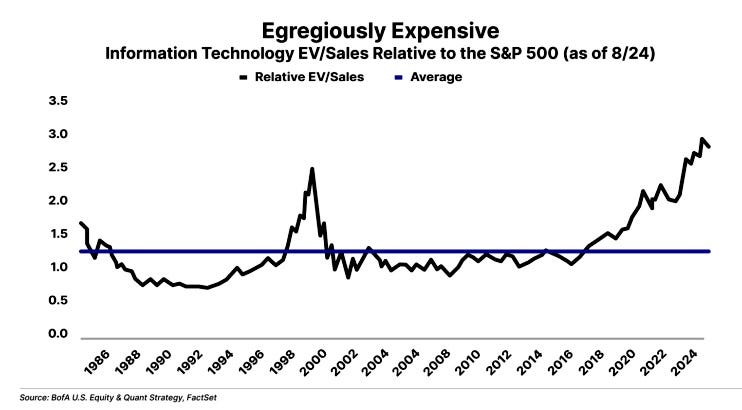

My “buy reality” theme is playing out, while the surreality of tech stock valuations based on mostly empty promises remains egregiously expensive:

That’s not going to unwind elegantly. For now equities markets overall still perch precariously on a teetering tech top, but not for long.

Oil & Gas

Goldman Cuts Oil Price Target By $5 To $70-$85 Just As Sentiment Hits All-Time Low

Oil Facing Physical Shortage Crisis: API Crude Draws 9 Of Past 10 Weeks As Cushing Hits Tank Bottoms

It’d be tough to come up with more bullish headlines for oil, and I expect to offer new ideas for “One And Done #8 - Oil & Gas” soon.

That oil and gas basket currently contains two open dividend-paying positions: DVN - Devon Energy and OXY - Occidental Petroleum for the longer term. Brompton Oil Split (ESP), which is not yet paying a dividend, is also in this group of holdings.

Two other positions were closed 6 months ago, with lucky timing just prior to the high in oil this year: NRGU after a gain of 36% over 5 weeks holding time, and a 2nd DVN position that gained 14% in 5 weeks for us.

Read more here:

NRGU, DVN: Booking Big Short-Term Gains

I’m trying a new format in this entry to keep myself and hopefully regular readers amused while new subscribers - welcome! - can quickly catch up on my themes and positioning.

Uranium

Dormant For Decades, US Uranium Producers Are Regaining Traction

World's top uranium producer cuts next year's production target

India's second 700 MW nuclear power KAPS-4 plant starts operation at full capacity

Russian President Putin said Wednesday Moscow should consider limiting exports of uranium, titanium, and nickel in retaliation for sanctions. He also said restrictions could be introduced for other commodities, noting Russia is major producer of natural gas and gold.

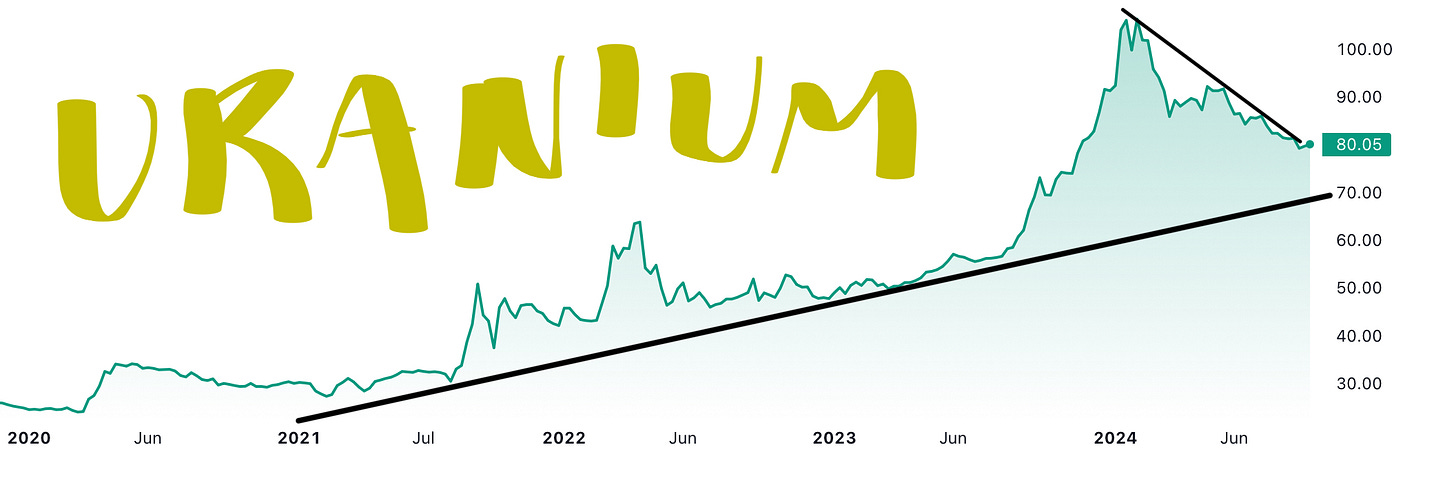

Below is uranium’s chart, exhibiting a very bullish pattern.

My outlook remains that once this year’s consolidation is complete it’ll rally to at least $125, this time with retail investors participating by sending shares of companies in this sector far above present levels.

Global Uranium ETF (ARCA: URA) remains my “one and done” for the sector. At its high since my call in January 2023, it was up 49%. Currently it’s up about 15%

Two additional URA positions were closed in late September of last year. One was booked for an 18% gain in under 5 weeks, while the other netted 21% in 2 months.

Considering the latter was purchased with proceeds from a BNKU position that had just gained 31% in a few weeks, that’s a massive compounded gain for such a short holding time.

Several of the other uranium suggestions made originally are up far, far more. I’m still occasionally adding LTBR (Lightbridge Corp.) below $5.00

Read more here.

Buying Sprott Physical Uranium Trust

To One And Done #6 - Uraniumania, I’m adding a new position in the Sprott Physical Uranium Trust.

Investment Objective

The Sprott Physical Uranium Trust invests and holds substantially all of its assets in uranium in the form of U3O8.

Goal

Provide a secure, convenient and exchange-traded investment alternative for investors interested in holding uranium.

Why invest?

World's Largest Physical Uranium Fund*

Experienced Commodity Fund Manager & Uranium Technical Advisor

Liquid and Convenient Way to Own Physical Uranium

Transparent Daily Reporting of Net Asset and Holdings

Low Fees

Read more about the Sprott Physical Uranium Trust here: https://sprott.com/investment-strategies/physical-commodity-funds/uranium/

Its ticker is U.UN in Canada, SRUUF in the States.

It closed today, September 11 2024, at $24.40 CAD and $18.02 USD.

For disclosure, I already own a lot of it and have been accumulating since early 2021. For purposes of tracking results in this substack, I’m entering SRUUF at the open tomorrow and planning to hold it long term without a sell stop.

Looking for more ideas?

I’ll follow-up with a new One And Done for food commodities shortly.

Meanwhile, platinum and palladium still look very bullish to me:

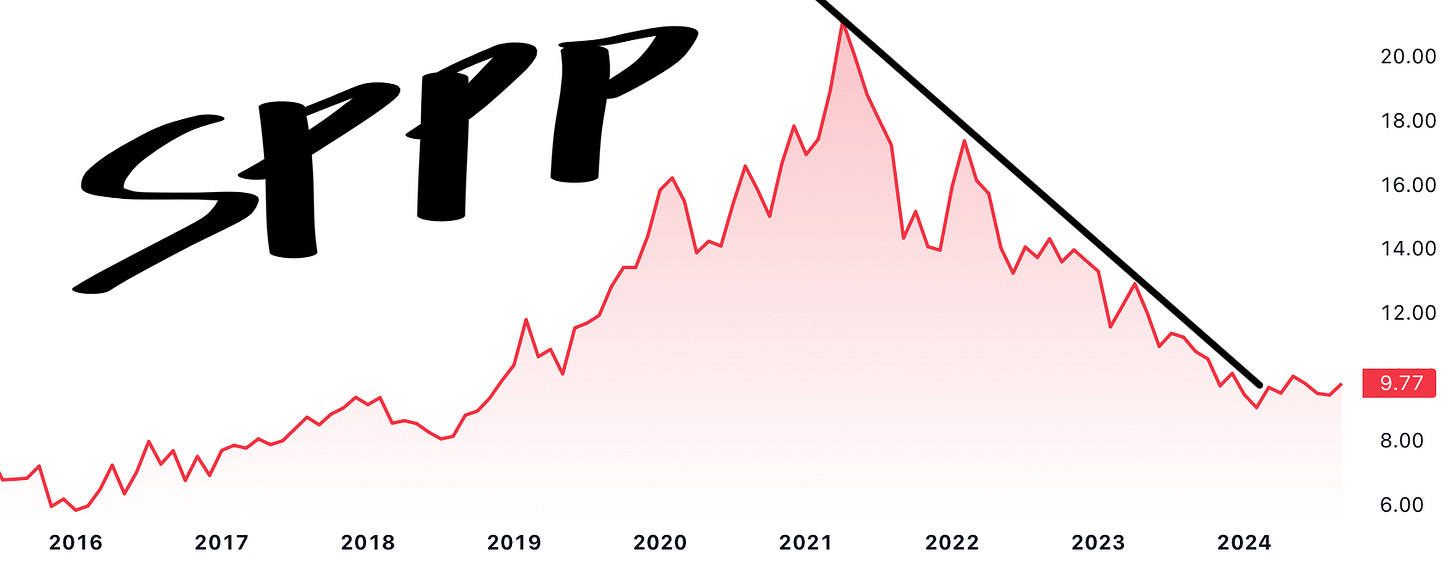

Updated SPPP chart:

Headlines:

D.C. Court Cancels Three Approved LNG Projects Over “Environmental Justice”

China On The Verge: Welfare State Crumbles, Explosion In Social Unrest As Youth Unemployment Soars, Strikes Surge

Year-Over-Year EV Sales Crash, Consumers Opt for Plug-In Hybrids

Ford Cancels Plans for Electric SUV, Expects a $1.9 Billion Loss

Tesla

We’ve enjoyed profitable Tesla shorts within this publication, and I’ll remain long-term short the stock with a very reasonable price target far below $50.

I’m not much interested in commenting on the company going forward, as the problems it faces and the fudge it shovels are no longer relatively unknown while there are better targets for my focus and capital.

If you want to keep up to date on Tesla shenanigans, I again recommend the reporting done by “Motorhead”: