Gold, Booz (BAH)

Gold takes the lead, baggies become stuck, yield spreads spread apart, food and a blurb about Booz’s business

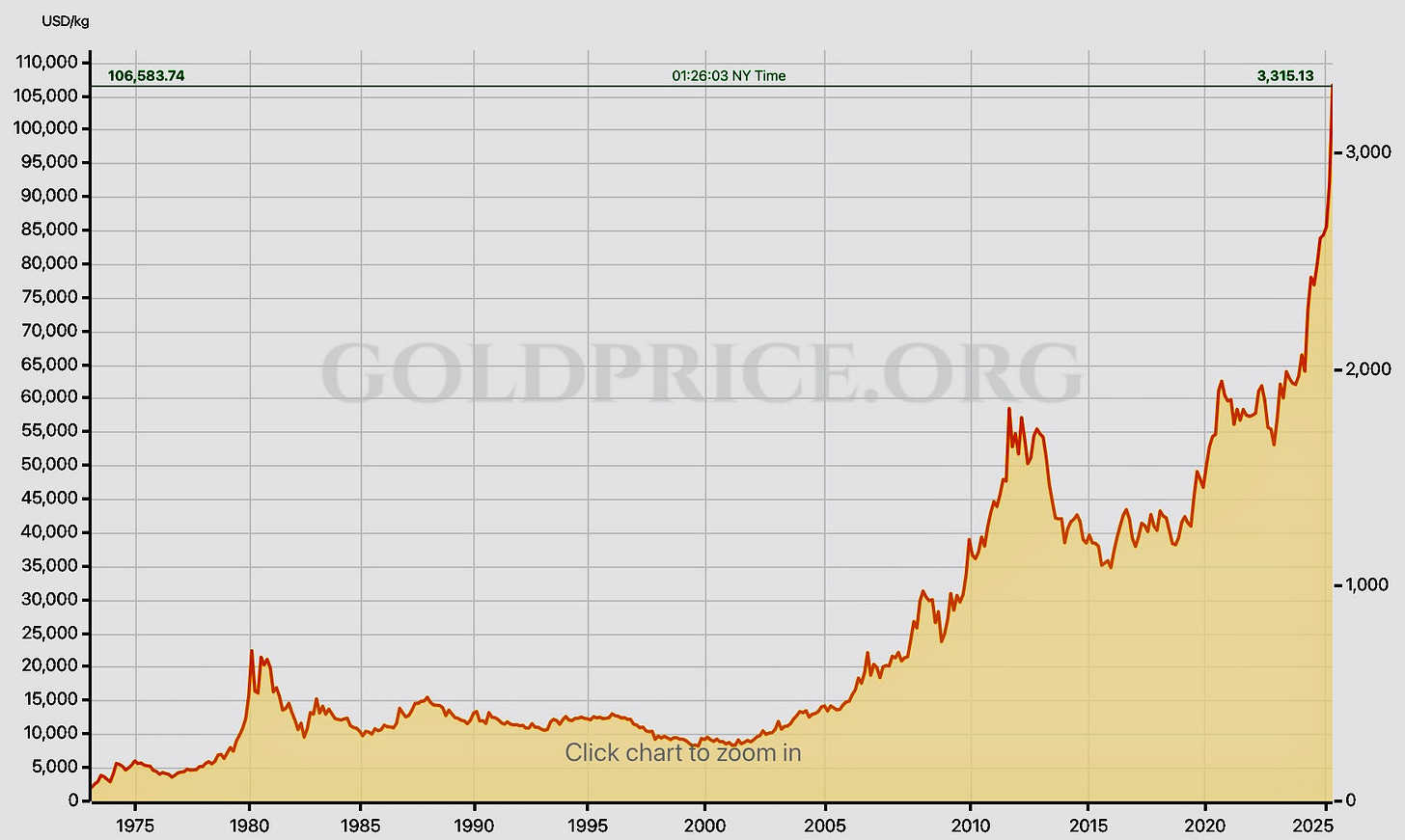

As I type, on Easter Sunday night, it’s impossible not to notice God’s money - gold - ascending to sit in righteous judgement of malfeasant debt binges & gov’t scam currencies.

Hallelujah!

The above chart of gold vs U.S. dollar never gets old, but what about Berkshire?

Since 1998, despite regular market turmoil providing Warren Buffett historic opportunities to do what he does best - “buy when there’s blood in the streets” - Y2K tech crash, 9/11, “Global Financial Crisis”, 2018, Covid, 2022, and another tech crash now - gold has matched the performance of the iconic Berkshire Hathaway while demanding no acumen, advantage, time or effort:

What about good ol’ reliable, conservative banks?

A 5-year bullish “cup and handle” pattern in gold vs. the KBW Bank Index (BKX) suggests we’ll see more of what we’ve been seeing so far this year, for a good while longer:

History strongly suggests the same, as we’re watching it repeat right on schedule.

In late 2023 I wrote:

Complacency is currently widespread, but for now, and probably into 2024, extreme overvaluations can become utterly insane valuations.

One measure of complacency is the spread between corporate junk bonds and treasury yields. When that complacency is at an extreme, a reversal typically precedes serious market turmoil.

That measure recently equalled the 3rd most extreme reading of the past century.

Check! Valuations became utterly insane.

The spread between junk bonds and treasury yields tightened to match the most extreme measures of the past century, as far back as the data goes, before finally blowing apart in March of this year.

Prior to that, historic extremes were everywhere and I offered a slew of charts in early March to underscore the situation.

That post begins with “Bagholding is the new black” and contained this section:

Another data set of mine, running like clockwork. When the yellow down trends are broken, markets suffer major drawdowns shortly thereafter. This chart was made three months ago and has since triggered another bear signal:

You know what happened in the six weeks since, and now baggies - also known as stuckholders - abound.

If only there’d been a sure-fire recessionary predictor stridently sounding the alarm months ago, this wouldn’t be the latest entry under “no surprise whatsoever”:

"Economists now say a dire economic slowdown has already begun.”

- MarketWwatch

The same sheep economists earlier this year, while the many massive red flags I noted were flapping in recessionary winds loud & clear:

Wall Street Journal survey of 75 economists: all 75 expect real U.S. GDP will be higher in a year’s time.

Three weeks ago, I noted:

Gold, another idea that was not popular while I made the case for owning it almost every other update since this substack’s inception, is at an all-time high.

From central banks to professional money managers to retail investors - all cohorts that on average have abysmal track records, coming nowhere near the returns of major indexes much less gold itself - are now excited about and buying precious metals.

Gold is already 10% higher. During those three weeks the Nasdaq dropped as much as 14.5% Perhaps as a result, and as predicted, punters have begun to pile into precious metals with some vigor.

As trend-chasers abandon the fading fad in tech, fantasy, and hyper-valuation for the next fad in commodities, reality and value, it’s reasonable to wonder how long it might last.

Reversals in history’s periods of most extreme complacency, as measured by the yield spread, were: May 1929, January 1966, July 1973, October 1979, February 2007, and March 2025.

Those are historic dates in stock market history, to say the least. Virtually everyone interested in equities has a good idea what happened to stock markets shortly after those dates, but what about gold?

After the inflections of 1929 and 2007, gold doubled within a few years.

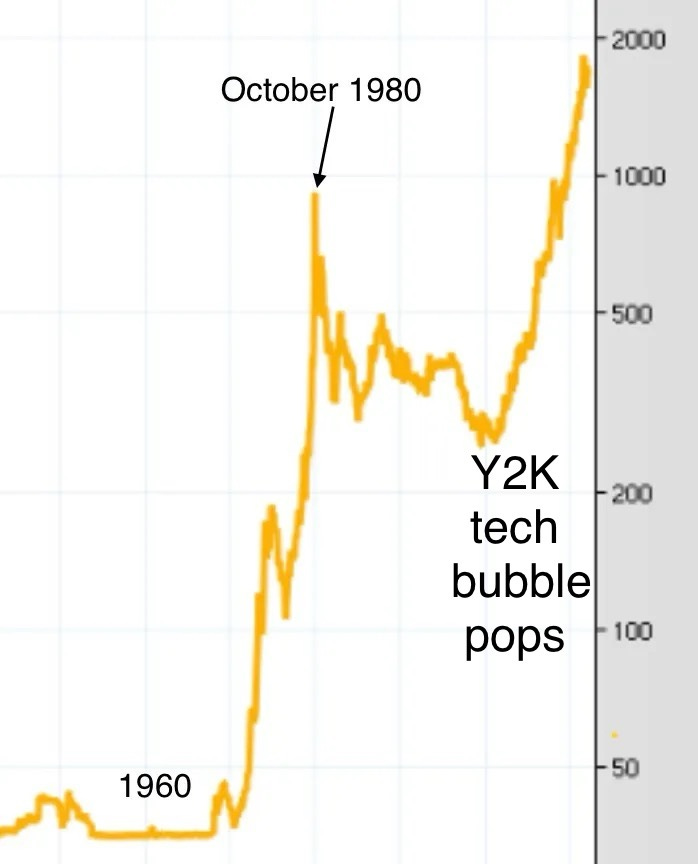

This chart depicts gold’s action through the 1960-1979 period:

Note too what happened to gold in the wake of the Y2K tech crash.

As for 2025, we’re now seeing what happens as this generation’s tech bubble pops.

It likely won’t be much different than in the past, and if that’s the case then we have a few years to go:

Conclusion: Own real companies and real things.

Wheat’s looking great, and I’m still holding food commodities via DBA, WEAT and CORN, as detailed in February.

It’ll be time to add uranium again soon.

Meanwhile, keep an eye on Booz Allen Hamilton (BAH) for continued relative strength. It may very soon meet my “special situations” criteria and, quite unlike most companies, its stock has traded sideways the past two months. Also quite unlike most companies, it’s arguably deep in value territory at the close Friday of $113.68

The Trump administration has been rattling about slashing spending on government contractors, and government contracts are the bulk of Booz’s business. Market activity since February suggests that’s already been priced in.

This is encouraging news. Well done.