Booking BOIL. Adding DeFi & DeSci. Updating Uranium, Food, Copper and Gold

LTBR, BOIL, DBA, CORN, WEAT, CPER, IXS, BIO, Gold, KFR

Maintaining momentum is one thing. Regaining it is quite another.

I’ve made much momentum since September, just not here. Time to catch up.

Nothing’s materially changed with respect to open One And Done positions, other than generally for the better. When I did have a good actionable idea, by the time I was ready to write it up it’d already taken off. No problem, as there’s always opportunity around the corner.

Meanwhile a core tenet of proper process is doing nothing when there’s nothing to be done. Doing nothing is super difficult in market operations, which is why the apex skill of doing nothing is a key common hallmark of all market legends.

There’s been so much to potentially react to in national and international news since my last update in September - some would say radical changes have occurred, with potentially catastrophic or stupendously wonderful consequences depending which “pill” you take - yet the positions that were forecasted to work back then continued to work. Nice and smooth, as per the plan.

Semiconductors and related companies, the so called “Magnificent 7” (read: malignant 7), were the hyper-valued legs on which markets tottered 8 months ago. Despite some gyrations, that sector has gone net sideways.

The semiconductor index (SOX) topped back in July. It then dropped nearly 28% in only a month, landing within a few ticks of the level it held just 4 months prior before a massive 38% 3-month rally to that July peak.

Now 7 months after the August low, it’s priced in the middle of that wide range.

Microsoft peaked in July. Nvidia is at the exact same peak it reached last June and July. Same with Apple. Google is slightly lower since then.

Bitcoin, despite months of unprecedented incessant hype from the new “Leader of the Free World” on down to online “rando degens” has gone nowhere in 2.5 months and can’t hold the key $100k level. A small change in a bullet’s trajectory and it would probably be 70% lower.

Dead money, gone nowhere, while many fail to realize the mania in overpromised tech fantasies peaked for this cycle and epic stock promotion spends masquerading on financial reports as AI CapEx no longer succeed in moving the priced-for-everlasting-perfection needle ever further into the red zone.

The dip in rates and certain electoral results extended the inevitable awhile longer.

Now even government is priced for perfection. Imagine that.

Maybe it’s consolidation before the next big burst higher. Maybe. Not.

Uranium - Lightbridge (LTBR)

I’ve been posting about Lightbridge (LTBR) since my first month of publishing, in January 2023:

Keep an eye on Lightbridge too. I’ve been accumulating in expectation of enjoying its next parabolic advance. Ah, the enriching beauty of a good company with a minuscule float in a highly volatile and cyclical sector.

A significant percentage of posts during the 2 years since then have included “I’m still occasionally adding LTBR (Lightbridge Corp.) below $5.00”, sometimes adding “Above $5 I expect it to skyrocket.”

In May of 2023 it hit a low of $3.32, then peaked not 3 months later over 100% higher at $6.70

It trended steadily lower until June 2024’s low at $2.21, peaking the following month over 100% higher at $4.65

September 2024 low $2.24 - virtually identical to the low 3 months prior - and by late October it peaked at $14.20, or 534% higher in just a month.

December 2024 it was back below my $5 line, down to $4.37

Today, February 13 2025, it closed 3.5 times higher (248%) at $15.19

I hope readers have been able to take advantage of this, as I have.

I expect to continue to take advantage of this. Whether we ever see LTBR below $5.00 again is unknowable, but if it gets there I’ll be occasionally adding Lightbridge below $5.00

Process pays.

FOOD COMMODITIES

My last posting was on Food Commodities:

Food Commodities - One And Done #12

A couple months back I stated there’d soon be an excellent entry setup in food commodities.

The idea was far out of favor at the time, which was core to my bullish thesis.

Specifically in corn and wheat, there was extreme bearish sentiment expressed in CoT data while my technical readings screamed “bullish”.

This week’s news:

Funds push bullish CBOT corn bets to highest since April 2022

They’re always late, or wrong.

Some charts of key food commodities, an arrow pointing to the date of my call:

Cocoa

Coffee

Sugar

Cattle

I suggested positions in corn, wheat and the Invesco DB Ag Fund (DBA).

Corn

Wheat

DBA

Factoring the $1.084 dividend paid in December, DBA is up 17% since my post.

Quite good for something so conservative, that’s not typically prone to large moves.

The corn ETF (CORN) is up 13%, and the wheat ETF (WEAT) down about 1%.

If you’re satisfied, book DBA and CORN.

WEAT still has plenty of upside, I believe.

I’ll continue holding all three, as momentum seems set to carry prices higher.

COPPER

Another idea that was totally out of favor at the time, copper, continues to pay off.

I wrote it up just over a year ago, in January 2024:

11. Copper & Basic Materials

With a recession and market plunge virtually certain, isn’t it reckless to buy commodities and basic materials now?

The basket of ideas for copper were:

CPER - United States Index Copper Fund

UYM - ProShares Ultra Materials

COPX - Copper Miners ETF

2.5 months later, COPX and UYM were sold 34% and 21% higher respectively, stating:

Copper itself is up nearly 15% in that time. We’re often force-fed the preposterous old canard that “markets are forward looking” yet these big moves always seem to surprise.

Not wishing a similar surprise in the opposite direction, and after such big quick run-ups in this high-risk market environment, I prefer the composition of CPER to represent my copper holdings so am selling COPX and UYM.

I remain very bullish on copper in the longer run…

Good timing, as it turns out. UYM peaked a few weeks prior, while COPX and copper itself peaked the following month then eventually all three dropped all the way back below my entry point.

After a lot of back and forth the past year, copper has recently been ripping higher. It’s up nearly 21% since December 30; a huge rally in a crucial commodity over such a short period. By contrast, the US dollar is at the same level as December 30.

Copper is now higher than its peak last summer, and with tomorrow being Friday it’s interesting to note that at this price copper would post its 3rd-highest weekly close ever. Momentum is solidly in its favor.

CPER closed today, February 13, at $30.16 or up 27% since my post.

I’ll keep holding it.

CRYPTO, or De-Fi and De-Sci

One day I’ll calculate the epic gains made via crypto flips suggested since the start of this blog early 2023, as the math gets dense having staked fully-hedged Apecoin at a very high rate of yield and converting proceeds into gold during much of that time, and of course gold itself has been going steadily higher and higher and higher.

To say those were extremely unpopular ideas at the time is an extreme statement even by my somewhat outspoken standards.

Since that isn’t something most readers would’ve done, or even known how to do, it’s not very relatable so its real value here was to perhaps open minds.

Get ready to open those minds much wider.

Today crypto-related ideas are all over the place. As a consequence it doesn’t interest me much. After writing about bitcoin since it was 11c, owning it since it was a few hundred dollars, and living through the insanity of NFT’s and Bored Apes (read my related post if unfamiliar), constant lawfare and repeated vows by the former US regime to destroy the sector, and now seeing it turn 180-degrees and go mainstream, right up to the White House and First Family frequently touting bitcoin and even launching their own memecoins, replete with one of my earliest acquaintances in NFT’s DJ’ing at the inaugural ball…

I can’t offer an edge in what’s one of the most globally-popular speculative “asset” classes today, other than to note that when speculative fervor is totally raging it’s time to look elsewhere for an edge as the apparent madness continues for years to come.

“Elsewhere” is de-fi and de-sci.

New to you? You are certainly not alone.

Investopedia:

Decentralized finance (DeFi) is an emerging peer-to-peer financial system that uses blockchain and cryptocurrencies to allow people, businesses, or other entities to transact directly with each other. The key principle behind DeFi is to remove third parties like banks from the financial system, thereby reducing costs and transaction times.

Per Binance:

Decentralized Science (DeSci) is a movement aiming to build public infrastructure for scientific research using Web3 technologies.

Compared to TradSci, DeSci allows for more funding sources, censorship-free collaboration, and open access to research data.

By leveraging blockchain technology, DeSci has the potential to make science more decentralized, transparent, and accessible.

Read more by visiting “What is DeSci?” at Binance Academy.

I’ll expand on these ideas in the future.

For now, learn about the future of de-fi and de-sci by visiting https://www.ixswap.io and https://www.bio.xyz

I already hold both the IXS and BIO tokens, but for purposes of keeping score within this substack these are now added to One And Done #1 - DeFi (rebranded from “Crypto”).

As I type, IXS is $0.27 and BIO $0.15

The way I’m playing it is IXS will have a very significantly overweight allocation within this sector idea, no matter how many different project’s tokens I’ll eventually add. Probably there’ll be 5-7 in total. Maybe more. Depends how many projects, and more importantly project leaders and teams, I find compelling and worth believing in.

I’m also budgeting for a significant drop to far lower prices, and if so I’ll be adding.

Long term outlook, so long as the projects are growing and people involved are executing their plan.

Natgas

BOIL opened at $50.05 on August 20, the morning after my suggested add, factoring for the 1/5 share consolidation in November, and at today’s close is up 40%

Natgas is up a fat 2.5% in evening futures as I type.

If that holds, BOIL would be up another 5% to nearly $74.00

In any case, book it. Close the latest BOIL position.

My prior natgas swing netted a 57% gain in only 1 month.

These swings are augmenting not-so-profitable and still-open longer term BOIL positions which I’ll update down the road.

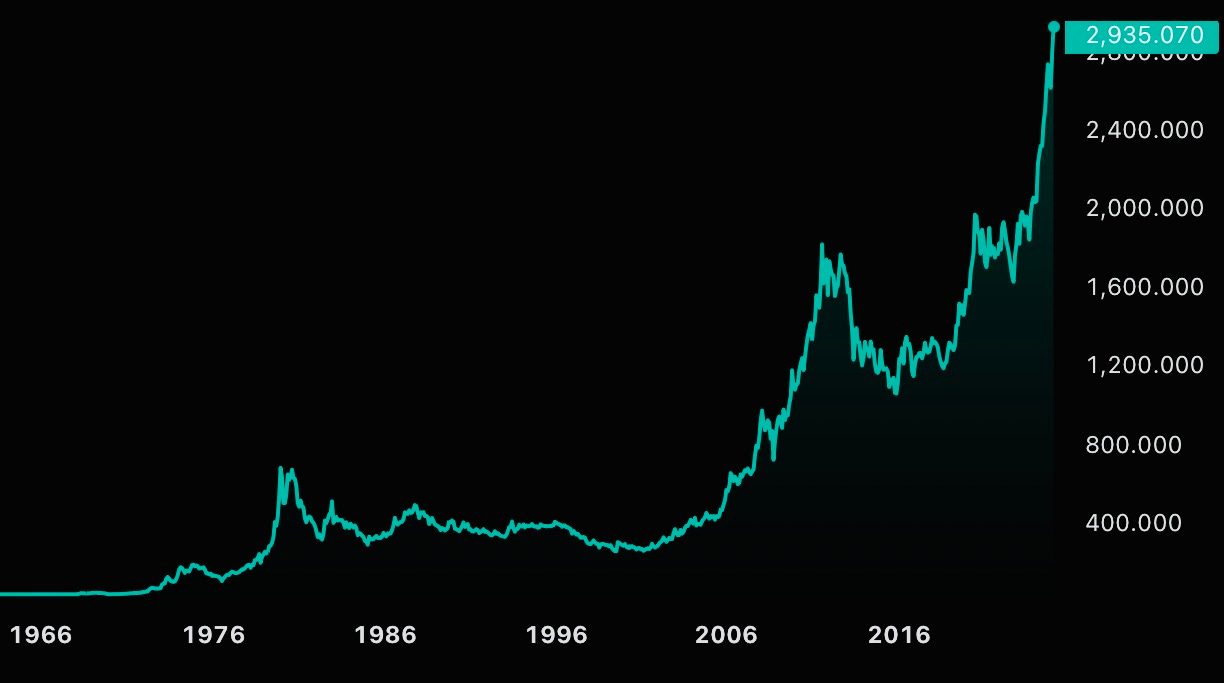

Gold

For all the tech hype over the past year, which didn’t get started until the far-out-of-favor big-tech positions I was super-bullish on in early 2023 were already up massively, gold beat the tech-heavy Nasdaq in 2024 while crushing the S&P and the vast majority of hedge funds and professional investors’ returns for the year.

Just plain ol’ gold, buy and hold. No fees or constant trade-flailing required.

Gold:

I’ve been stridently bullish gold since my inaugural posts, and that hasn’t changed today as it trades at an all-time high against essentially all other assets.

Related news:

China frees possible US$27 billion from insurers to buy gold

The policy tweak makes gold the first commodity that Chinese insurers have been explicitly permitted to invest in

Gold Royalty (GROY) Achieves Record Revenue in 2024

Last July I stated:

If you’re still feeling speculative, an extra gold play to consider:

Kingfisher Metals Corp. closed at 23.5 Canadian cents Friday (ticker KFR), and 0.16 of a US dollar (ticker KGFMF).

Note this is a different company than Kingfisher Mining in Australia.

Kingfisher Metals’ website is

https://kingfishermetals.com

Kingfisher Metals is a forward-thinking exploration company focused on efficiently and systematically exploring district-scale Gold and Copper properties in British Columbia.

I’ve had my eye on Kingfisher Metals for years, as I like its projects. After the recent 1/5 share consolidation to a reasonable sized float, it’s been trading sideways on low volume in a way that’s compelled me to start nibbling at it.

Above the line at 27.5c CAD (~ 21c USD) I’ll probably chase it to buy the last of my budgeted amount. Until then, I’ll add occasionally if it continues to hold up as markets sell down.

I did continue to add, as recently as this week.

I’m no longer concerned with the price levels cited above, rather adding now in the low 20c CAD range (~15c USD) suits me.

Here’s Kingfisher’s chart on its domestic exchange in Canada:

I’ll post comments on other gold positions soon.

‘Til then, keep enjoying the ride while owning things of actual use and value.

Year end *report*.

Here's one for you, to say thanks: Veren. Insider buy (forner board member bought 60K in December increasing his total position to 160K), Alberta investment corporation buying since then, and it was recently spoken well of and in some detail by an oil and gas specialist. Year end this Thursday Feb. 27. (All this from memory, details may be slightly off.). We bought around $8, I bought again this morning around $7.

Hope this will be rewarding for all of us!