Market Notes, Adding IXS, Selling GLCC

Great gains in gold today, and in DeFi someday

DeFi

Blackrock CEO Larry Fink, who has the most assets under management of any money manager on earth, in his 2025 Annual Chairman’s Letter to Investors underscores a transformative vision for the financial industry, emphasizing the pivotal role of tokenization in reshaping capital markets.

Everyone alive has seen a slow, steady march toward decentralized finance since birth. From malls to online shopping, from paying with cash to tapping a card, and from standing in line at banks to conducting transactions whenever, wherever, on a phone which itself has evolved radically the past 20 years.

All of these progressions in technology and processes, along with at least a dozen more most people could easily think of that are not listed here, have offered among the greatest investment opportunities in history.

Innovation toward easing and speeding transactions while reducing costs will continue until long after we’re gone.

Why not learn about what’s next and try to profit tremendously from it?

I added IXS token last week, at $0.1225

As noted when I introduced the idea in February, “I’m also budgeting for a significant drop to far lower prices, and if so I’ll be adding. Long term outlook, so long as the projects are growing and people involved are executing their plan.”

While the setup to enter or add is not yet ideal by my metrics, and when it is I’ll write it up again, if you’re well capitalized and eager to add IXS - especially if you’re just starting a position in this idea - now’s a reasonable time to do so.

Its website was recently revamped, and is well worth a visit:

HashKey Chain announced that the tokenized USD Money Market Fund, "CPIC Estable MMF", initiated and managed by CPIC Investment Management (H.K.) Co, Ltd, was successfully deployed on HashKey Chain, with subscription volume reaching $100 million USD on its launch day.

What a big surprise this recent headline is to nobody who regularly reads this publication:

So too this one’s no surprise, and it signals the predicted next trend has emerged:

Microsoft says it’s ‘slowing or pausing’ some AI data center projects, including $1B plan for Ohio

Markets have been moving as expected so far this year, as evidenced by the headlines above.

Given tariffs are the dominant narrative now, expect tariff-related news to continue to whipsaw markets. Since tariffs are not the fundamental reason why stock markets are collapsing so far this year, expect complacency to return once trade war hysteria cools off. This should coincide with a market top before the next major leg lower.

The “magazine cover indicator” counter-signals that fear has peaked for now. If so, keep in mind last week’s statement when we covered market hedges:

“Think ‘bounce’ not ‘bottom’”.

Keep watch on the 30-year yield.

5% is a key level above which true market chaos likely kicks-off.

It’s no coincidence that’s the exact level at which President Trump flinched, or executed the next phase of a predetermined artful plan if you prefer, on tariffs.

Higher yields could collapse the housing market.

Housing affordability is now slightly worse than prior to the "Great Financial Crisis", and to resolve this either wages must spike higher, housing prices must plunge, or some combination of the two must happen with wages relatively outperforming.

Which do you think is more likely?

My stated expectation remains for unemployment to continue rising into 2026, with the recession that’s already underway made “official” in the not-too-distant future.

The U.S. dollar may be the underlying driver.

DXY (U.S. dollar index) has been posting lower highs and lower lows along a fairly steady cadence of peaks and troughs for nearly 50 years, and is now in danger of breaking below a 20-year uptrend channel.

In the 35-year chart below we see the greenback tends to trade within defined channels for extended periods of time. Now a 20-year uptrend channel is in danger of violation, and the dollar index sits not only upon the channel’s lower trend line but also at the lower line of its current down trend and at a line of possible support.

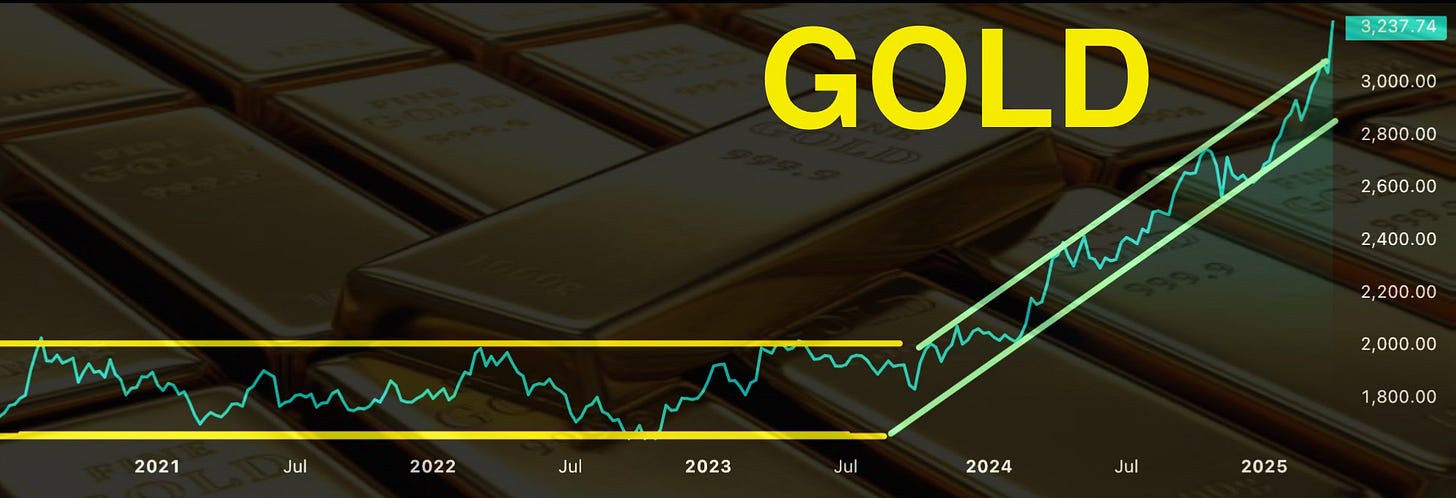

Gold

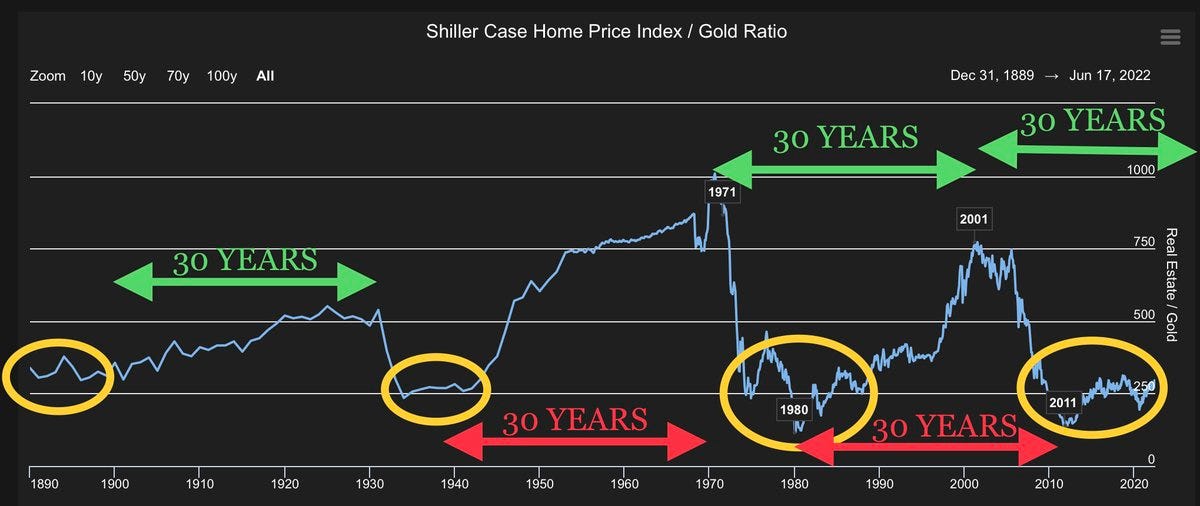

Of course in real money - gold - housing, and nearly everything else, has been costing less by the year.

It’s worth noting gold took-off in earnest when the tech bubble - led by semiconductor stocks - started topping out last summer. That’s no coincidence.

The pivot I’ve emphatically predicted the past year, from a priced-for-perfection generational speculative mania in fantasy CapEx growth driving utterly ludicrous stock valuations, into what I call the reality sector - commodities including real money - is well underway.

I made the next chart in 2022, first sharing it here in my first post on gold during the inaugural week of this substack in early 2023, and several times since. It suggests both that gold - and commodities in general - will continue higher for years to come vs housing.

The gold ratio vs. most “assets”, very much including general equities and government “money”, should similarly continue far higher in the coming years.

I’ve been stridently bullish gold in nearly half the posts on this substack, recently recapping related ideas here.

This chart depicts a pattern that remains perfectly accurate, and there’s no reason to believe cycles that have been in effect for centuries will fail to continue on schedule.

It’s not tough to do the math while adjusting one’s expectations and positions accordingly.

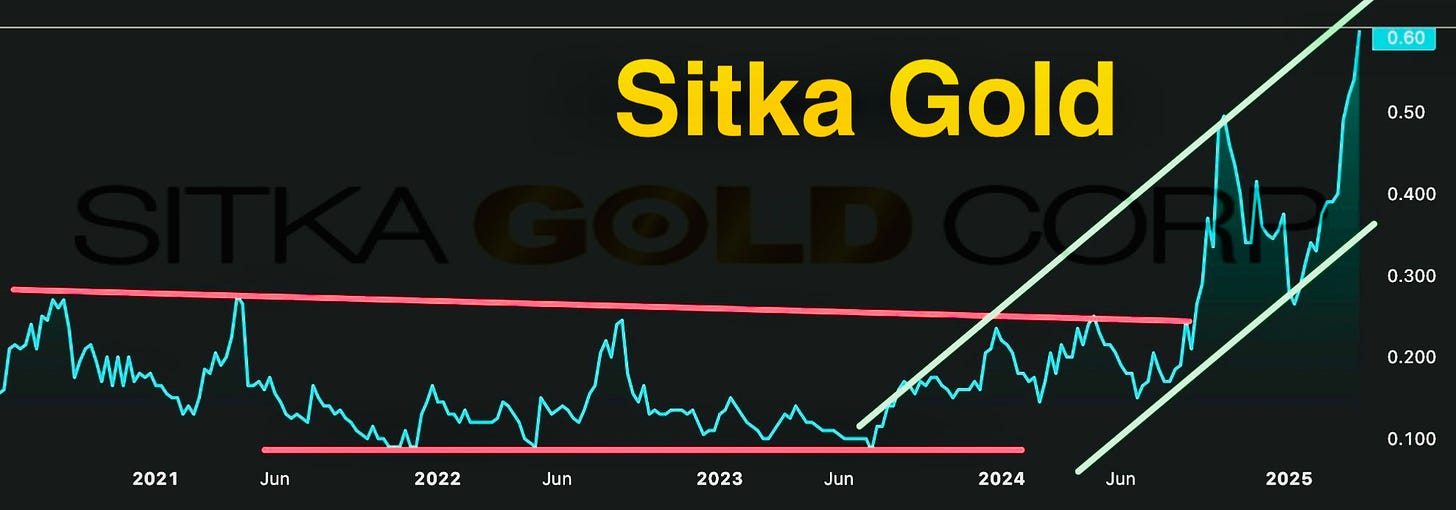

Sitka Gold is up 60% in the 5 weeks since its addition to the suggested gold basket.

Here’s a 5-year chart expressed in Canadian pennies:

Kingfisher Metals, up 27% since last discussed 2 months ago, looks a lot like Sitka prior to its recent spike higher:

GLCC

1 of 2 GLCC positions was closed recently for a gain of 56% including dividends.

The very high yield we’ve been enjoying in the name, 11.5% based on cost of entry in December of 2023, is down to “only” 8% per the big run-up in its price.

With the 2nd GLCC position now up 59% for us, including dividends, and gold on the world’s lips, I’m backing out of GLCC at the open tomorrow - April 14, 2025 - to book this considerable gain while riding remaining gold-related positions.

I’ll probably repurchase GLCC if there’s a considerable drawdown soon, and if so I’ll post to that effect.

Meanwhile I’m certainly not bearish on gold, and a run to $3600 this year is possible but there’s also the elevated possibility of markets tanking entirely. Even if gold were to continue higher in such a scenario, it’s probable that shares in gold companies - as GLCC represents - will not fare well until the situation calms.

Prudence pays.

We cannot know if markets will continue the bounce begun last week.

We do know that gold is God’s money, from the earth itself.

We do know that national currencies are backed by nothing more than mass gullibility and created infinitely at will by career fraudster-liars, unqualified incompetents, and treasonous thieves on a centuries-long vote-buying credit binge.

Their money is the original scam-coin.

Oil needs avg $65 for profitable drilling, $85 for substantial increase in drilling to occur

Natural gas needs $3.80 avg for profitable drilling, $5.10 for drilling to increase substantially

- per Kansas City Federal Reserve Bank, in a recent report

Own real things.

Wish I found you sooner!