5. Financial

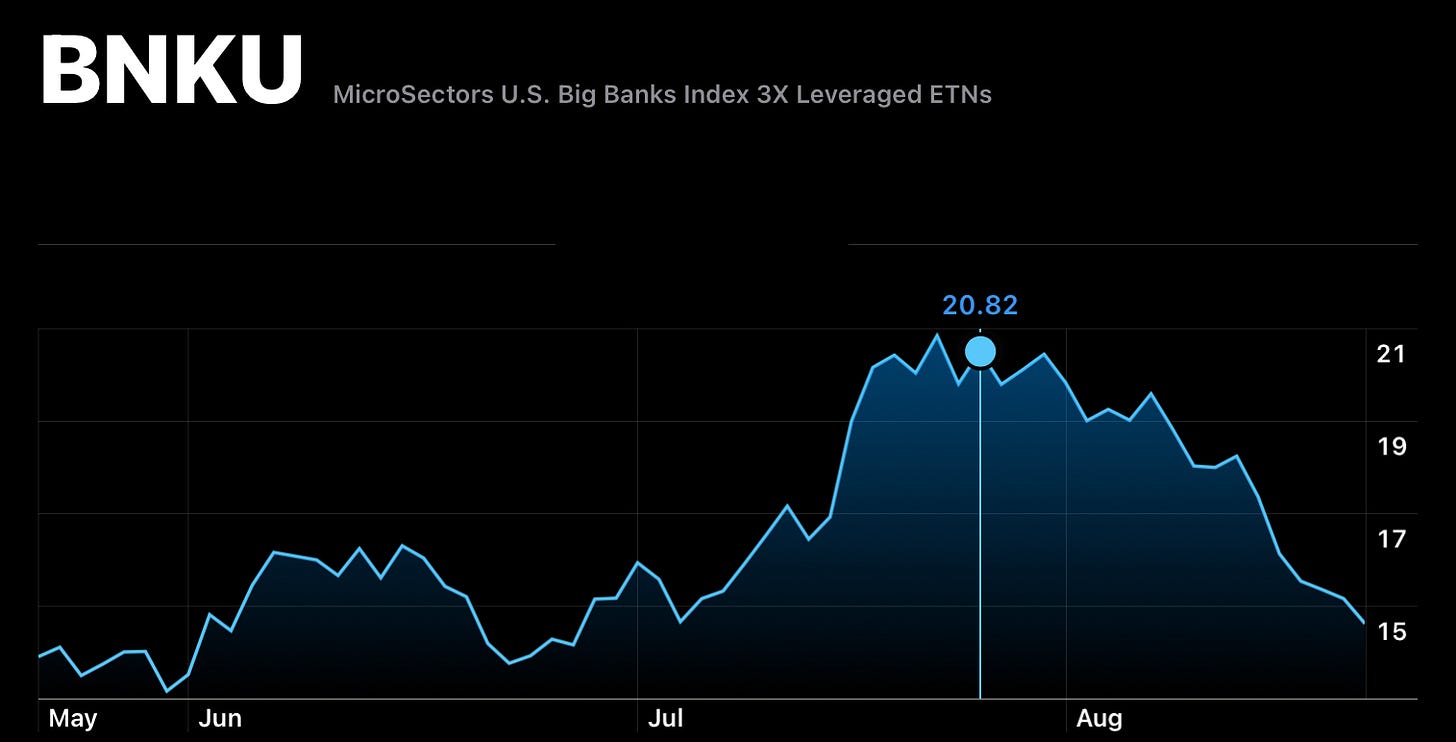

In a post titled “Much Less BNKU, More BOIL and URA-nium” nearly a month ago:

My 3rd BNKU position entered 2 weeks ago has already gained as much as 31% and at today’s close of $20.13 sits 23% higher.

The 2nd BNKU position is up 31% in just 7 weeks, and I’m booking both of those while leaving the original position open.

I’m buying more natgas now via a 3rd position in BOIL.

I’m doubling-up on URA, the Global X Uranium ETF.

The highest close of the past 5 months for BNKU was the day prior to that post, and the 2nd-highest close was the day after.

That’s a bull’s-eye given BNKU is down 27% since then:

URA is up 4% since that redeployment of capital, BOIL up 2%.

I subsequently added a 3rd URA position as noted in “…Uranium Set To Explode”.

Since end of June, BNKU’s i reading declined from 25 to 18, while its m held stable.

Read about my scoring system here.

BNKU Summary:

I started chipping into BNKU March 15 with every awareness I may be very early.

My avg. on the original position is $15.72 with no stop.

Per the original plan if BNKU continues much lower I’ll add a 2nd, perhaps 3rd position over time if or when the banking sector is under true duress or truly oversold.

These levels to add BNKU remain in play since “Surfing Big Waves of Bank Bailouts” posted March 19:

I’ll add 1/4 of a position for roughly every 20% drop.

+ 1/4 at $11.50

+ 1/4 at $9.25

+ 1/4 at $7.40

+1/4 at $5.93

By then I’d have a 2x position at avg. cost of $11.50 and will reassess.

Alternately I might repurchase one or both of my sold positions when its i score turns upward again.

Don’t ignore setups in the uranium sector.

LTBR is back under $5.00

Lightbridge (LTBR): Lightbridge Receives Notice of Allowance for a Pivotal Manufacturing Method Patent in the United States for its Metallic Fuel Rods

Robert Bryce: The Iron Law Of Power Density, Part 2

My August 13 article, “The Power Of Power Density,” is the second most popular article I have published here on Substack. The article struck a chord. Why? I suspect that lots of people want to have a better grasp of the physics that rule our energy and power systems.

As I explained last week, power density is perhaps the most important — and yet least understood — metric in physics. Indeed, many people who work in the energy and power sectors don’t understand it. In addition, the Iron Law of Power Density — which says the lower the power density, the greater the resource intensity — helps us understand why wind and solar energy cannot, will not, ever be able to power our society. In addition to their incurable intermittency and dependence on the weather, they require too much land and other resources.

Given the favorable response to last week’s posting, I am going to expand on it…

Tragic wildfires in Kelowna, BC, Canada:

The photo on the left is from 20 years ago, the one on the right from yesterday.

Guess how much the Canadian (or any) government has spent to prevent or be able to fight cyclical wildfires vs. pure waste, foreign ”aid” into pockets of despots & criminals, scam bailouts, propaganda and political pandering during that 20 years?

Power-pigs do not profit, nor do they gain influence and control, by being proactive… unless it’s proactively frightening people into ceding cash, control and rationality, while learning nothing of history and human nature.

Meanwhile…

Two arson incidents in Yellowknife, four people charged, two sought

A fire in the vicinity of Yellowknife’s Fred Henne park was arson, police said on Wednesday as they announced separate arson arrests on the same night.

The incidents come as parts of Yellowknife are on evacuation alert over an oncoming wildfire, with conditions tinder-dry in the region.

State Official Refused To Release Water For West Maui Fires

With wildfires ravaging West Maui on Aug. 8, a state water official delayed the release of water that landowners wanted to help protect their property from fires. The water standoff played out over much of the day and the water didn’t come until too late.

The dispute involved the Department of Land and Natural Resources’ water resource management division […]

DLNR delayed releasing water requested by West Maui Land Co. to help prevent the spread of fire, sources familiar with the situation said.

Must-read compendium of “green” folly by Mish:

Clean Energy Exploitations and the Death Spiral of an Auto Industry

Bloomberg: China’s Abandoned, Obsolete Electric Cars Are Piling Up in Cities

A subsidy-fueled boom helped build China into an electric-car giant but left weed-infested lots across the nation brimming with unwanted battery-powered vehicles.

The scenes recall the aftermath of the nation’s bike-sharing crash in 2018, when tens of millions of bicycles ended up in rivers, ditches and disused parking lots after the rise and fall of startups backed by big tech such as Ofo and Mobike.

This time, the cars were likely deserted after the ride-hailing companies that owned them failed, or because they were about to become obsolete as automakers rolled out EV after EV with better features and longer driving ranges. They’re a striking representation of the excess and waste that can happen when capital floods into a burgeoning industry, and perhaps also an odd monument to the seismic progress in electric transportation over the last few years.

Further folly fun:

Zero Hedge: Rare Earth Elements And National Security: Reclaiming US Control Amid China's Monopoly

The Center for Strategic and International Studies on July 18 identified China’s control over gallium (a rare earth element) as a national security threat.

Rare earth elements (REEs) are crucial to the U.S. military, but China holds the key. China possesses 36 percent of the world's known rare earth reserves and controls 70 percent of the world's extractive capacity and an astonishing 90 percent of the processing capacity. This dominance in extraction and processing gives China a commanding position in the global REE market, raising concerns about resource security and international dependency.

Everything from F-35 fighter aircraft to cellphones depends on rare earths, as do critical space technologies, electronics, and semiconductors. Of the 50 minerals designated as critical by the U.S. Geological Survey, 17 are considered rare earths. Although the supply of REEs is sufficient to meet defense needs, extracting a small amount of rare earths requires mining a large quantity of waste materials.

In February 2022, the Biden White House issued a statement acknowledging how critical minerals provide the building blocks for many modern technologies and are essential to U.S. national security and economic prosperity. The statement went on to outline steps that the administration was taking to secure the U.S. supply chain. However, the problem remains unresolved.

The War On Cash Centers On "Controlling The Individual"

Ever wonder why you have not been hearing about the penny being dropped or a new dollar coin being introduced?

Today it is all about Central Bank Digital Currencies. These are digital versions of a country’s physical currency issued by central banks. They claim the role of these digital currencies is to support financial services for a nation’s government and its commercial-banking system. Still, it will replace much of the physical currency we use today.

The premise of why this is being done deserves to be scrutinized.

Rolling Stone: The Trillion-Dollar Grift: Inside the Greatest Scam of All Time

Related reading from The Seattle Times: Those funds are overseas now…

It took a matter of weeks for criminals to steal nearly $650 million in state and federal jobless benefits from Washington during the chaotic opening stages of the pandemic in 2020…