Headline today:

Fed Panics, Announces "Coordinated" Daily US Dollar Swap Lines To Ease Banking Crisis

It’s utterly appalling, though sadly no surprise, to see so many in crypto who claimed the moral high ground and core values of decentralization and “be your own bank” coming out of the closet for Big Bro when it comes to bailouts. And all while Uncle Scam is aggressively de-banking the crypto sphere.

Who knew tech nerds were so morally flexible and athletic? Extreme genuflecting and logical somersaults worthy of Olympic gymnastic gold medals in evidence.

Don’t be fooled by an apparent “flight to safety” the past week into crypto. It’s a nice narrative but looks like a bull trap, so consider hedging more the higher it goes.

Meanwhile:

Supreme Court Enters Crypto Era: ‘Tip of the Tip of the Iceberg’

Court hears arguments next week in suits over scam, Dogecoin

Crypto market may be defined by cases winding through courts

SEC agents cannot explain to a federal judge what its policies and attitudes regarding virtual currencies are—or how they are going to impact the industry.

There’s been a rather amazing surge in the Nasdaq too this past week, while among tech bros we find bootlicking apologists for Big Piggery are legion. We do live in interesting times. A flight from banks to tech trash? Expect that not to last either.

Headline:

Cathie Wood's ARKK Recorded Largest Inflows In Years As SVB Collapsed

ARKK is the ETF equivalent of a sewer. It’ll suffer catastrophic outflows by bear’s end.

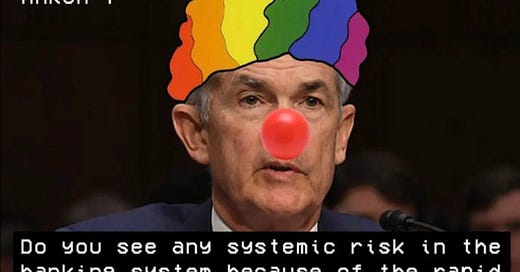

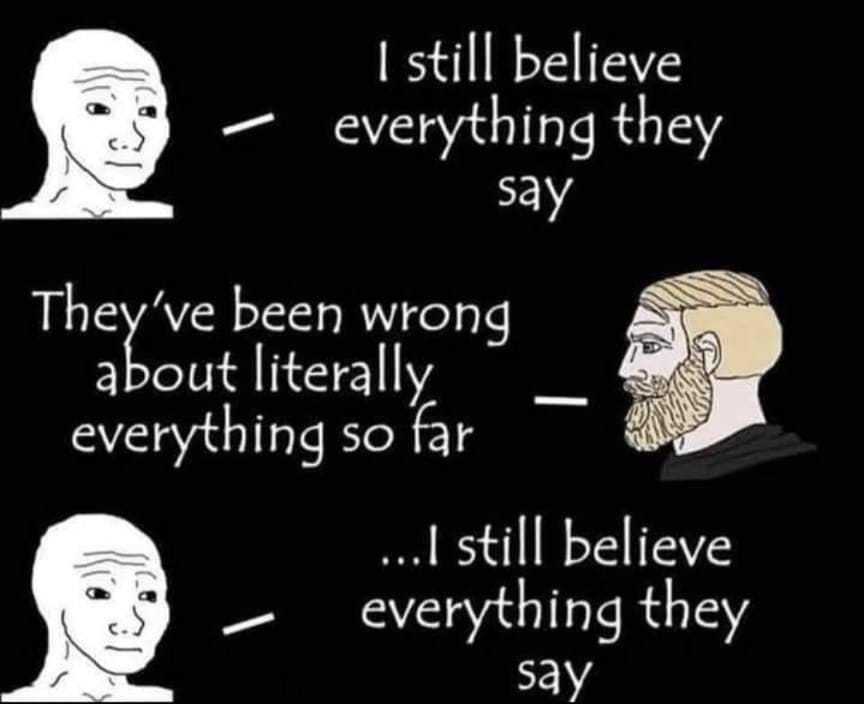

Funny so many “experts” have expressed surprise that a major bank failed (18th largest in US at time of failure, largest to fail since Washington Mutual in 2008). In other words the “experts” know little of banking, and even less of banking history or human nature, but we’re to trust them when they say it’s contained and won’t get worse?

The problem is those tasked with balance and prudence were brainlessly bullish, but now that they’re still totally optimistic and “believe” there’s no further risk… now we should take them seriously. Why?

Today in socialism:

Switzerland Weighs Full or Partial Credit Suisse Nationalization

Gold vs. Swiss franc:

We suffer the pathetic pedantic parsing of Fed statements despite the fact that the Fed’s predictive track record is absolutely abysmal. Sheep fawning over drooling corrupt sheep-herders holding sharpened shears. Stockholm Syndrome writ large.

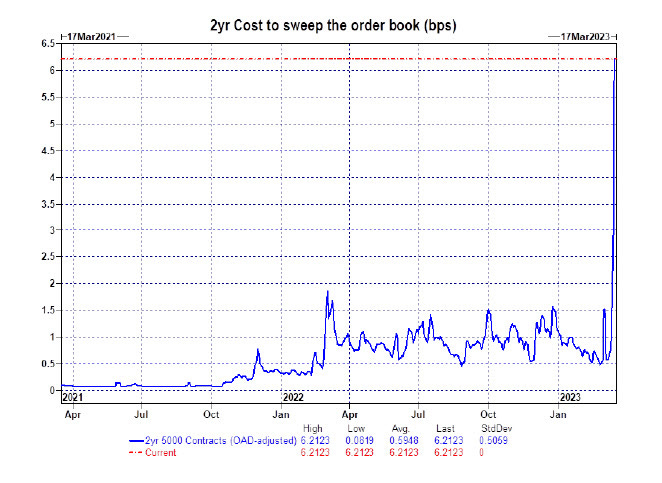

Those who place faith in the Fed to live up to its word were short 2-year debt, meaning they lose money if 2-year debt is bid up (inversely corresponding to rates going down). Those shorts were obliterated last week. Here’s a chart of that 2-yr debt:

“No mercy for the dumb.” - Dr. Hunter S. Thompson

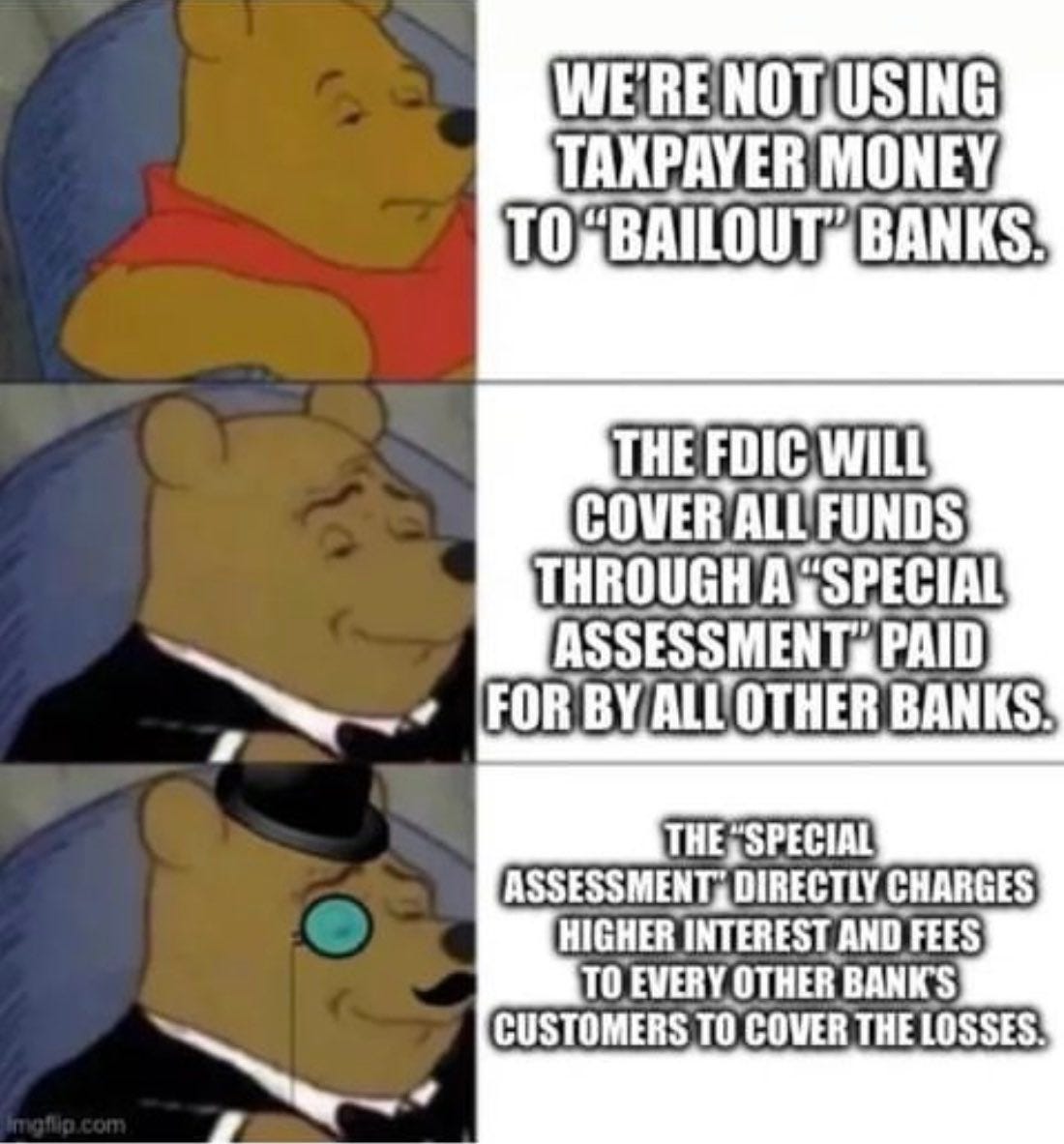

The new steps being taken by the Fed and by the Treasury Department's FDIC are indeed ultimately bailouts for billionaires and other wealthy depositors.

Moreover, this new program will require at least a partial return of quantitative easing. There’s no way to guarantee such huge sums of money without having to fall back on inflationary monetary policy yet again. This also means price inflation won’t be going away. Here is why…

Isn’t it odd that the “authorities” and “experts” keep telling us we can have “confidence”. Only a con requires confidence. If the system were sound, it would require no belief or confidence whatsoever to keep from collapsing.

Point being, the system is a massive con run by proven liars and frauds, which can only work so long as people willfully - for whatever reasons of personal advantage, laziness, or self-sabotage may exist - choose to repeatedly vote for and believe in that system against all prudence and evidence, then throw massive tantrums when TSHTF and lands on their own head instead of someone else’s. Am I right, France?

Gold vs. euro (it’d look exponentially worse vs. former French franc):

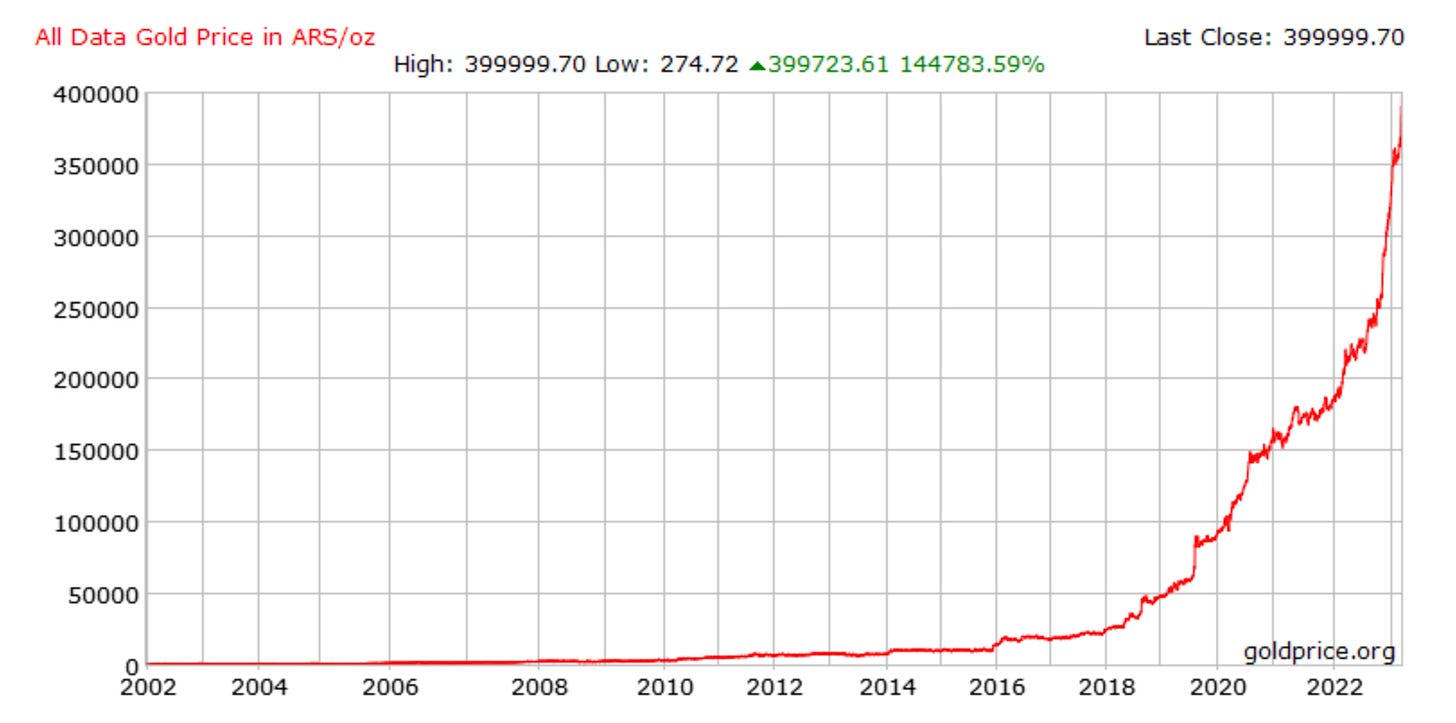

Am I right, Argentina?

Argentina’s inflation tops 100% for the first time since 1991

Real money, gold, up 145000% vs. Argentine peso in 20 years:

Treasury Secretary Janet Yellen and Fed Chair Jerome Powell issued a joint statement today on liquidity.

Liquidity Rules:

If you feel compelled to issue a statement on liquidity, things are not liquid.

If you have to provide hundreds of billions of dollars to maintain liquidity, things are not liquid.

When multiple banks in the US and Europe have to be bailed out to stop runs on banks, things are not liquid.

When governments resort to forced shotgun marriages of banks, things are not liquid.

Like it or not, remember: it ends when there’s widespread pessimism not when the chronically wrong are singing the same ol’ song, and not when markets rally on news of intervention while shameless speculators beg for more Big Bro up our wallets.

Until then the most bullish macro arguments are that governments stealing more from the prudent to backstop irresponsible rampant speculation and drunken-sailor spending of those stolen monies by grifter vote-buying politicians will pump the economy.

Sad, but we must surf the waves we’re given.

h/t The Bear Cave

“Signature Bank Executive Used to Audit Firm” (WSJ)

“Keisha Hutchinson signed off on KPMG’s clean audit of Signature Bank in March 2021, public records show. That June, she was appointed chief risk officer for the New York lender….”

“SIVB: Held-to-Mortem Governance” (NonGAAP)

“This non-disclosure immediately makes me wonder what caused former Chief Risk Officer Laura Izurieta to leave the role and create such a glaring hole in risk oversight during such a critical time…”

BLM's $6 million mansion a clear violation of IRS law, watchdog charges

Irony is that if SVB had a more diverse client base, its failure wouldn’t have happened.

Silicon Valley Bank had a virtually homogeneous client base of tech companies - many hyper-valued and more than a few outright scams - and associated persons.

When 2022 reigned-in a small fraction of that hyper-valuation in tech companies, those companies could no longer get easy money from greedy and gullible “investors” so had to withdraw deposits from the bank. The self-evident rest is now history.

Bonus Mish, and he’s right again:

Please consider these Statements by Christine Lagarde, President of the European Central Bank, on the announcement on 19 March 2023 by the Swiss authorities

CL: “I welcome the swift action and the decisions taken by the Swiss authorities. They are instrumental for restoring orderly market conditions and ensuring financial stability."

Mish Translation: We are praying this will restore order to the mess central bankers made.

CL: "The euro area banking sector is resilient, with strong capital and liquidity positions. In any case, our policy toolkit is fully equipped to provide liquidity support to the euro area financial system if needed and to preserve the smooth transmission of monetary policy.”

Mish Translation: Bank liquidity is pathetically weak, otherwise we would not need to stress the fact we have a toolkit to deal with illiquidity.

Long overdue and should start with everyone at the Federal Reserve including its 400 (seriously 400) PhD economists, though don’t hold your breath for this to happen:

President Biden Demands Clawbacks, Civil Penalties, & Industry Bans For Failed-Bank Execs

Fed Blocked Mention of Regulatory Flaws in Silicon Valley Bank Rescue

Federal government officials wanted a joint statement to include a reference to regulatory shortcomings that they believe helped lead to the bank’s demise.

Iceland put bankers in jail rather than bailing them out — and it worked

For starters, rather than scrambling to mobilize public resources to make sure banks didn't default on their various obligations, Iceland let the banks go bust. Executives of the country's most important bank were prosecuted as criminals.

Note the FDIC denies this report, for what very little that’s worth:

FDIC Demands Signature Bank Buyers Stop All Crypto Business: Report

FDIC regulators have asked banks interested in acquiring failed U.S. lenders like Silicon Valley Bank (SVB) and Signature Bank to submit bids by March 17, Reuters reported.

The authority will only accept bids from banks with an existing bank charter, prioritizing traditional lenders over private equity firms, the report notes, citing two sources familiar with the matter. The FDIC aims to sell entire businesses of both SVB and Signature, while offers for parts of the banks could be considered if the whole company sales do not happen.

The FDIC has also required any buyer of Signature to agree to give up all cryptocurrency business at the bank.

New York-based Signature is a major crypto-friendly bank in the United States. The bank is known for many partnerships in the crypto industry, servicing companies like Coinbase.

The news comes amid U.S. Representative Tom Emmer sending a letter to the FDIC, expressing concerns that the federal government is “weaponizing” issues around the banking industry to go after crypto.

“These actions to weaponize recent instability in the banking sector, catalyzed by catastrophic government spending and unprecedented interest rate hikes, are deeply inappropriate and could lead to broader financial instability,” Emmer said in the letter to FDIC chairman Martin Gruenberg.

More news worth reading in the relevant sections below.

This is an update on my “one and done” portfolio ideas for various themes.

For context click the section’s heading in bold to read the original post, which includes links for info about these positions and companies. Do your own research and be responsible for your own decisions.

Read an initial explanation of my scoring system here.

1. Crypto

ApeCoin +49% at high since called 9 weeks ago, much more if staked

MARA +134% at high, now +100%

As noted previously MARA profits and the core position had been trimmed when it was up ~ 100%, to 1/4 its original dollar value and is effectively cost-free.

ApeCoin remains intact and staked, still withdrawing staking rewards to cash - effectively reducing my cost base - until I measure its technicals as bullish again. At that time I’ll put that cash back into staked ApeCoin.

Pains to admit, but ApeCoin has been underperforming the sector overall. While the super-high APR mitigates this significantly, it’s still a concern.

ApeCoin trades at $4.42 at time of writing. Below $4.20 I’ll either withdraw or hedge the original dollar value until markets calm and I have a renewed bullish signal.

Crypto sold-off significantly after bitcoin reached my original target of $25k. It has since rallied to a 9-month high.

Crypto exposure should be hedged when bitcoin is below $27k in my opinion.

Bitcoin now trades at $28300. If it climbs above $29k I’d move the hedging line up to $28k.

2. Tech

FNGU +134% at high since called 9 weeks ago, now +103%

i22, m22 = both up significantly from last week in what still looks like a bear market rally rolling over.

FNGU holding had been sold down to 1/2 its original dollar value, leaving me with a very fat profit in hand and an effective cost base of less than $zero.

Two weeks ago I stated I’d further reduce it to 1/4 the original dollar value if it dropped below $70.85, which did happen.

3. Cannabis

MSOX i3 m0 is still bearish

slow l/t accumulation only

MSOX closed at $4.61

I’ll top up to a full position above $6.31 and scale up to a triple position over $6.60

When a sector is so beaten down and with so many having abandoned it in frustration and losses, the upside is exceptional and often exponential.

Political winds slowly blowing in a favorable direction, though not without hiccups.

Ironically “SAFE Banking” is no longer just a concern for the cannabis industry.

Patience, process, and prudence are paramount.

4. Gold

GROY i1 m0

Still holding GROY and others mentioned, and the score across the sector remains bearish in the intermediate term though turning positive.

Been waiting? Technical setups are now much more favorable.

Specific to GROY, I’m looking to add warrants when it’s above $2.35

A couple more golden ideas were offered here. I’m still holding both, no stops.

5. Financial

See last week’s change: Five - Financial. Buying Banks in Bulk

BNKU closed the week at $14.46

I’ll add 1/4 of a position for every 20% it drops from there, so:

+ 1/4 at $11.50

+ 1/4 at $9.25

+ 1/4 at $7.40

+1/4 at $5.93

By then I’d have a 2x position at avg. cost of $11.50 and will reassess.

Summary:

I started chipping into BNKU March 15 with every awareness I may be very early.

No stop. My avg. is $15.72

If up significantly sometime soon, great. I’ll book all or most of it.

If BNKU continues much lower I’ll add a 2nd, perhaps 3rd position over time if or when the banking sector is under true duress or the sector’s finally truly oversold.

The approach will be same as with BOIL; willing to go heavily overweight when the timing’s ideal.

6. Uranium

The chart for uranium could not look better. It’s arguably crazy not to be invested in it, and totally irresponsible not to crank up the exposure when the timing’s right.

URA i0 m0, broken 15-month down trend, super bullish > $22

ANLDF long term bullish entry signal in effect, but only buy > 7.5c

DNN technical “strong buy” above $1.35

UEC i0 m0 = wait. For long term investing we want m1 at minimum

UROY not yet at an ideal entry/add point

U.U i2 m0 = long term bullish, not an ideal entry/add point however

SMR bearish possibly turning bullish, ideally wait before entry or add

7 weeks ago:

Keep an eye on Lightbridge too. I’ve been accumulating in expectation of enjoying its next parabolic advance. Ah, the enriching beauty of a good company with a minuscule float in a highly volatile and cyclical sector.

I’ll keep adding LTBR periodically below $5. Above $5 I expect it to skyrocket.

Sector news:

French MPs pave way to dropping legal limit on nuclear in energy mix

Taiwan Shuts Down Another Nuclear Plant, Threatening Blackouts And More Emissions

Taiwan has closed yet another nuclear power plant, risking potentially deadly blackouts this summer, rendering the self-governing island more vulnerable to a Chinese blockade, and threatening a surge in greenhouse gases from one of the world’s top 25 emitters.

The center-left government of President Tsai Ing-wen had already shuttered both reactors at the Jinshan Nuclear Power Plant, Taiwan’s first atomic power station, in 2019. In 2021, her administration halted one of the two reactors at the Guosheng Nuclear Power Plant, the island’s second such plant.

It bears repeating: “No mercy for the dumb.” - Dr. Hunter S. Thompson

7. Seven Sentries: Hedge, or no hedge?

It appears the statistically normal bear market rally into February has ended.

For this “one and done” I went with TZA on March 9th.

It opened the next day at $31.39 and closed the week 15% higher at $36.19

Other than natural gas, which offered a huge return within a week (see #10 below), I’d been selling and urging caution since early February.

No panic selling or capitulation has occurred the past few years in equities. It’ll come.

Stay hedged.

8. Dividends (and oil)

DVN slow accumulation, still not an ideal entry point for full positions.

Oil tumbling to a 52-week low negates any previous bullish setups.

Patience will pay.

MO slow accumulation, not yet an ideal entry point for full positions.

QRTEP is the ticker for Qurate’s 8% preferred shares. QRTEP’s dividend is about 22% based on last week’s close, still at a good entry point for full long term positions.

Sector news:

Global Oil Production Dropped To A 7-Month Low In January

Brazil’s Surprise Oil Tax Puts $20 Billion in Investment at Risk

Shell and other drillers have sued to block the levy, which effectively yanks the welcome mat for oil majors.

9. Battery Metals

Since 5 weeks ago, and still so:

High odds my top pick will be Talga Resources, which I’ve owned and been accumulating the past 18 months with an average cost of $1.14 USD

This report makes the case, however the timing signal to buy/add is not yet in effect:

https://talgagroup.eu-central-1.linodeobjects.com/app/uploads/2023/01/14125115/120822EH.pdf

10. Natural Gas

Natural gas remains very bullish, and BOIL gained 32% a week after I posted on it.

That was three weeks ago though. The past two weeks it lost all that gain and more.

Current score for natgas: i1, m0

Opportunity is knocking once again.

Over time I wouldn’t be surprised to ramp this position up to 3-10x normal sizing, because winning is best done in bulk, though I’ll only add on specific setups.

Ideal timing is when m turns from 0 to 1, however the risk/reward profile here is extreme ergo so is my approach. A key precursor to m moving from 0 to 1 is i changing from 0 to 1, which did occur five weeks back.

Sector news:

America's LNG Boom Has Grown Too Big Too Fast

The US became the world's largest exporter of LNG in 2020, setting a record.

There are concerns that new proposed LNG production facilities could cause market saturation and low prices, as well as competition from low-carbon alternatives.