How good are you at pattern recognition?

Let’s find out, and note the time lines vary …

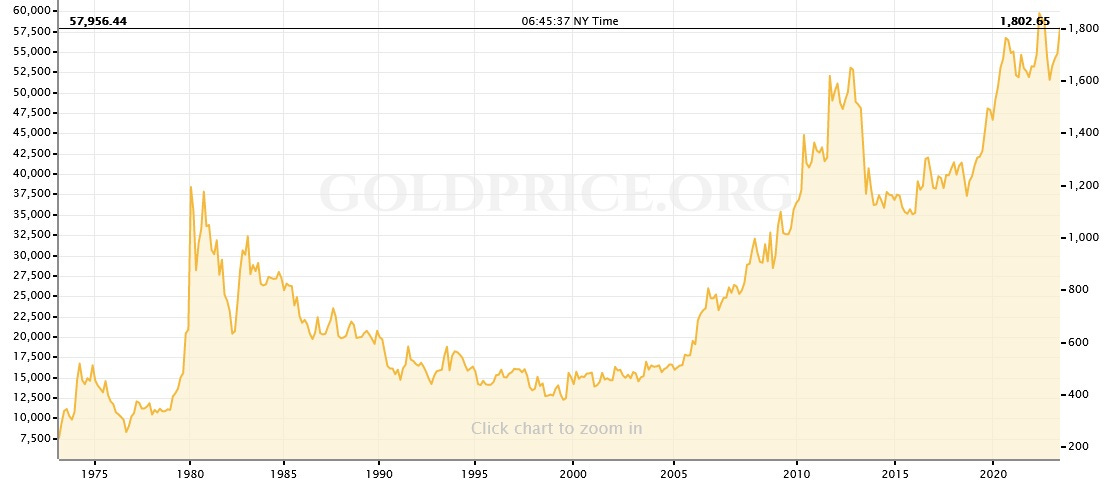

Gold vs. U.S. dollar

Gold vs. Canadian dollar

Gold vs. Swiss franc

Gold vs. British pound

Gold vs. euro

Gold vs. Japanese yen

Gold vs. Chinese yuan

Gold vs. Ukranian hyvrnia

Gold vs. Russian ruble

Gold vs. Hatian gourde

People across the world do have at least one thing in common: non-stop theft of our purchasing power generation after generation. We can’t stop global currency devaluation but we can stop making the same mistakes individually, including the same mistakes our parents and grandparents probably made.

Maybe someday you’ll look back and wish you had not bought gold, or your kids will wish you hadn’t, however the charts above strongly suggest otherwise.

Have faith in history and human nature, or trust your government and central bank to be prudent, capable, principled and honest stewards of whatever national scamcoin you work for. But you can’t do both.

Q1 2023 is in the books, and the year is going well so far.

Against all popular sentiment I came charging into 2023 bullish gold, crypto and tech. Gold, crypto, and tech enjoyed fantastic gains while banking and financial stocks had a terrible 1st quarter. It’s perhaps lucky my financial “one and done” was sold at break-even while its replacement is also flat.

Cautions to hedge, and the related position, couldn’t have been better timed as markets peaked and rolled over into a banking “crisis”. The true crisis of course is primarily in central banking per gross lapses in ethics, credibility and competence.

This is an update on my “one and done” portfolio ideas for various themes, with a different and abbreviated format this week. If a “one and done” theme isn’t included in this post, that means there’s been no change since last recap.

For context click the section’s heading in bold to read the original post, which includes links for info about these positions and companies.

Do your own research and be responsible for your own decisions.

Read an initial explanation of my scoring system here.

2. Tech

FNGU +148% since called 3 months ago

i26, m18 still looks like a bear market rally. I wouldn’t be surprised with another 20-30% upside before it peaks, and if that happens soon I might short the sector.

FNGU holding had been sold down to 1/2 its original dollar value, leaving me with a very fat profit in hand and an effective cost base of less than $zero.

A month ago I stated I’d further reduce it to 1/4 the original dollar value if it dropped below $70.85, which did happen. It then rallied to close the past week at $103.43

Tesla remains a good long term short, one of a great many “meme stonks” and popular “green” delusions still flying far too high on speculative hopium.

4. Gold

GROY i3 m3

Still holding GROY and others mentioned, and the metal’s score has turned bullish now to a degree observed on average once every 20 years.

While no signal is fool-proof and the world seems increasingly volatile and prone to nasty surprises, a signal of such rarity as exists now should never be ignored. It was last in evidence in 2009 before gold doubled over the next two years as silver increased five-fold. Shares in quality explorers gained multiples more than the metals.

Technical setups are extremely favorable however there’s no rush; it’s reasonable to expect a consolidation in the sector, perhaps a pullback, lasting into summer.

Specific to GROY, I’m looking to add warrants when it’s above $2.35

A couple more golden ideas, in silver, were offered here. I’m holding both, no stops.

7. Seven Sentries: Hedge, or no hedge?

For this “one and done” I went with TZA on March 9th.

It opened the next day at $31.39 and gained 20% in 2 weeks before selling-off to close the past week at roughly break-even.

Small-caps are back in the black for the year and crypto continues to maintain its considerable gains, however a lasting advance is typically led by higher-risk sectors and that’s not been the case recently.

Zooming out, no panic selling or capitulation has occurred the past few years in equities but It’ll come so stay hedged.