Gold

Positions Update and Outlook. Yield Spreads and Bitcoin Signal

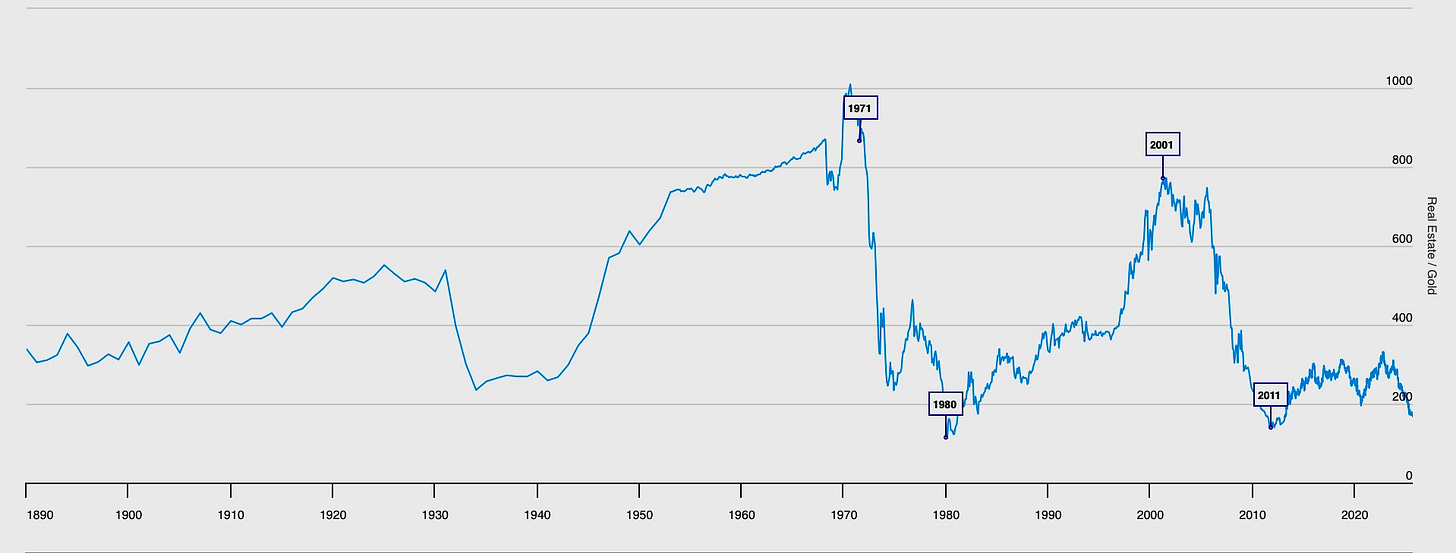

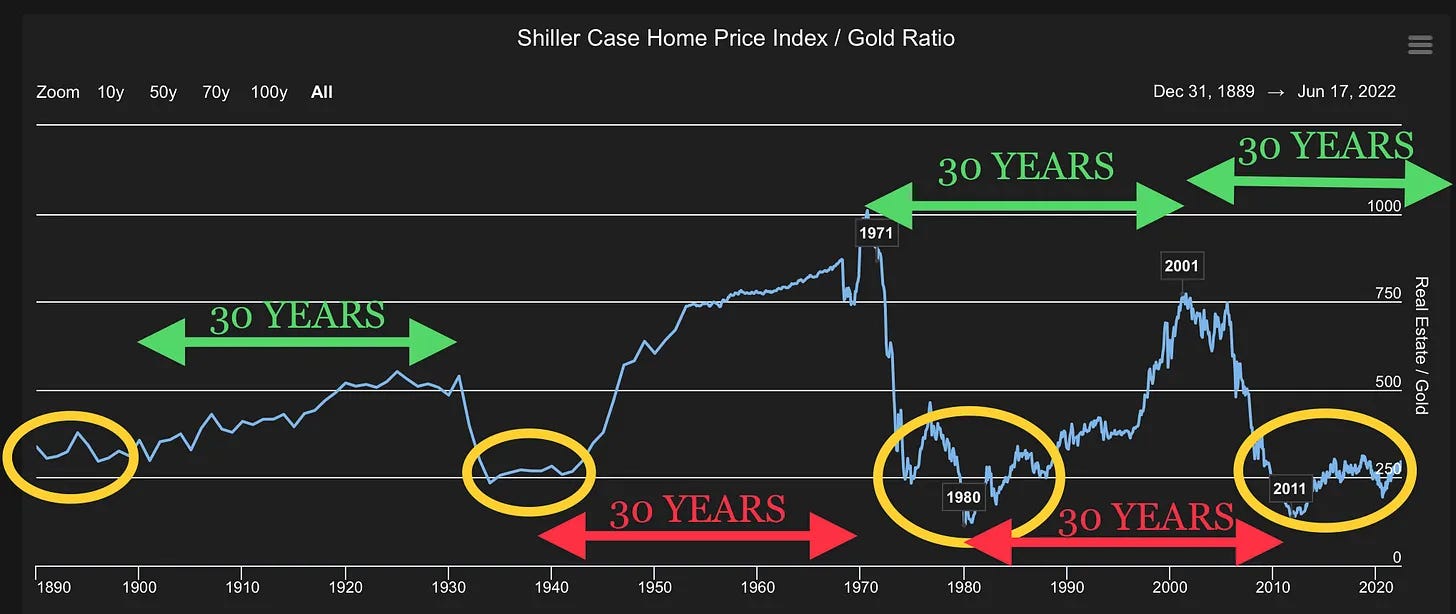

This is a 135-year chart of real estate priced in real money, gold:

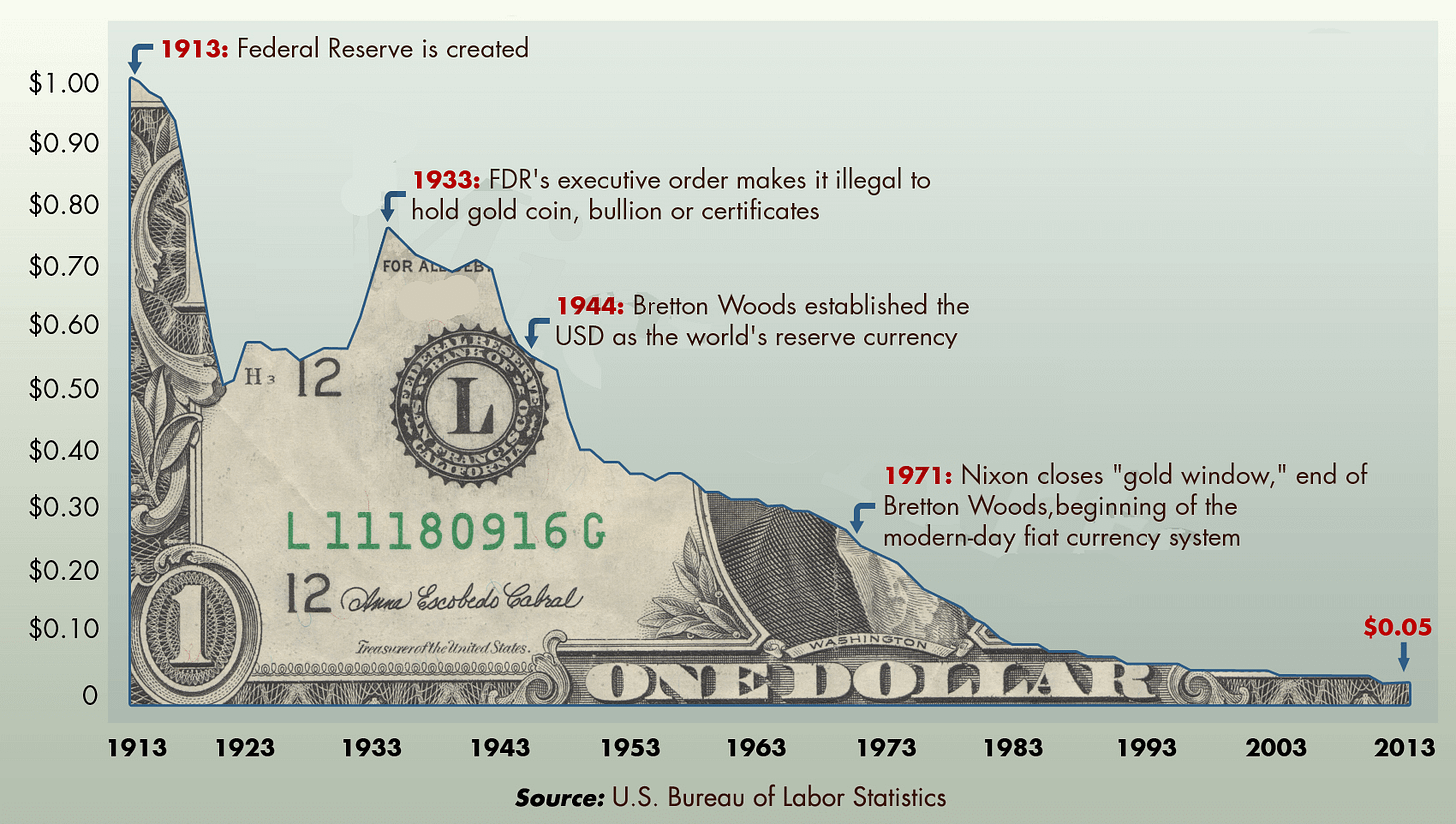

If housing - or most anything else - seems unaffordable, it’s only because of the lies governments, schools, and most economists tell us. Their money is debt, forced upon generations of the unborn who certainly did not co-sign the loan agreement.

Their best interests and the interests of you and your family are probably not aligned.

Gold fixes this.

Here’s a few key charts presented in the past here, that speak thousands of relevant and timely words:

Gold, Food, Booz (April 2025)

As trend-chasers abandon the fading fad in tech, fantasy, and hyper-valuation for the next fad in commodities, reality and value, it’s reasonable to wonder how long it might last.

Reversals in history’s periods of most extreme complacency, as measured by the yield spread, were: May 1929, January 1966, July 1973, October 1979, February 2007, and March 2025.

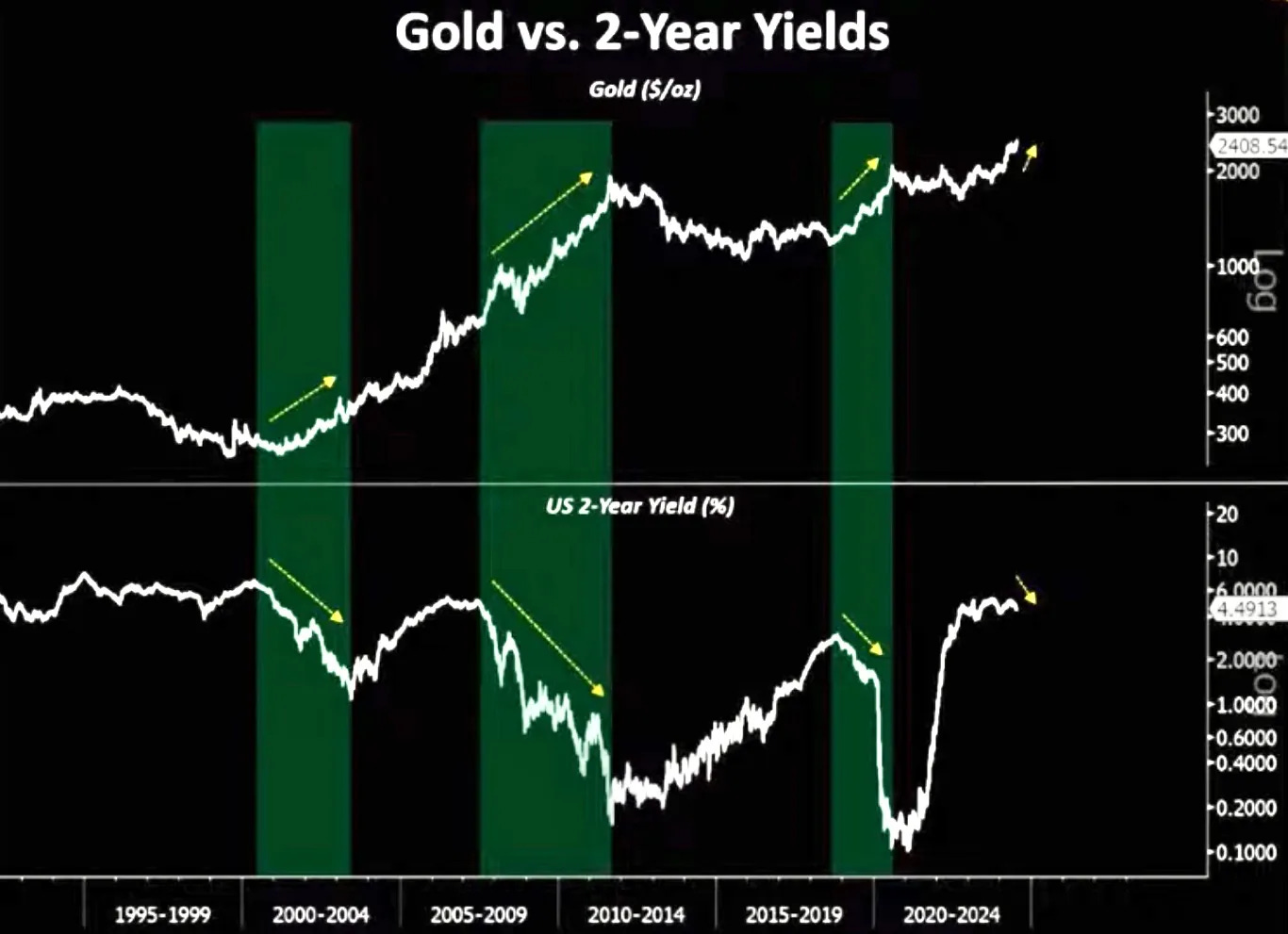

Those are historic dates in stock market history, to say the least. Virtually everyone interested in equities has a good idea what happened to stock markets shortly after those dates, but what about gold?

After the inflections of 1929 and 2007, gold doubled within a few years.

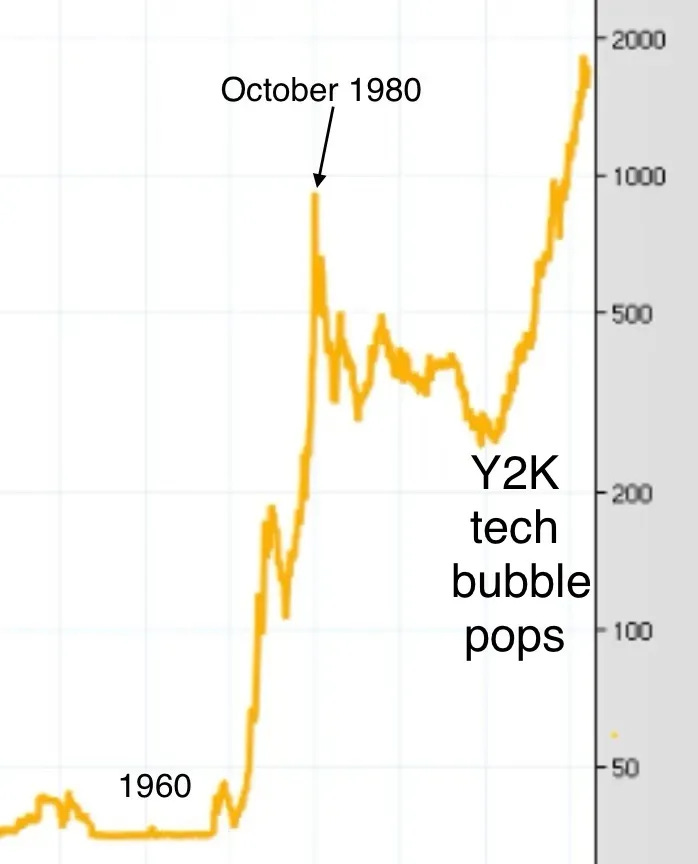

This chart depicts gold’s action through the 1960-1979 period:

Note too what happened to gold in the wake of the Y2K tech crash.

As for 2025, we’re now seeing what happens as this generation’s tech bubble pops.

It likely won’t be much different than in the past, and if that’s the case then we have a few years to go:

Gold chart, August 30, 2025

For now at least, we who live by the gospel of gold are one-eyed in the kingdom of the blind, basking in the golden glow of monetary and fiscal justice scowling in disapproval upon the profligate and economically ignorant.

It’s a beautiful thing!

Below is a video capture of gold yesterday - the King Of All Currencies - tired of punters and politicians alike still not getting the message, turning to action that must be heeded with urgency: a new all-time high against virtually everything.

What next?

We enjoy the party while it lasts.

As expected, speculators have begun piling into gold and other real things; commodities. The memo may be stale-dated but is finally being widely read.

“Hot money” flows into whatever is posting regular big gains. That is no longer the tech sector, where trade-flailers are still trying to milk a very tired narrative that’s proving more false by the day.

Odds are high that when tech drags overall markets way down with it, it will affect commodities too. More so commodity sector stocks than actual commodities.

However once every few market meltdowns there’s a “flight to safety” in gold. If not this time, we have a dollar hedge and some comfort knowing commodities typically emerge into new long-term bull markets well before an equities bear market ends.

That happened when the last tech bubble burst, it happened when the last real estate bubble burst. It happened when the COVID panic burst, and it seems to be happening as the current tech and real estate bubbles burst.

During this cycle, gold should rally to between $3600 - $4000 at minimum.

It closed the past week at $3447, so the target range isn’t far off; just 4 to 16% higher. Depending how frothy overall markets remain however, that could easily translate into another 25-100% upside in gold and silver stocks.

Major waves in precious metals - “Wave 5” in Elliot Wave terms - tend to end in rapid parabolic advances that often carry far higher than even most bulls imagine. Such a move likely began yesterday.

Gold Positions Update

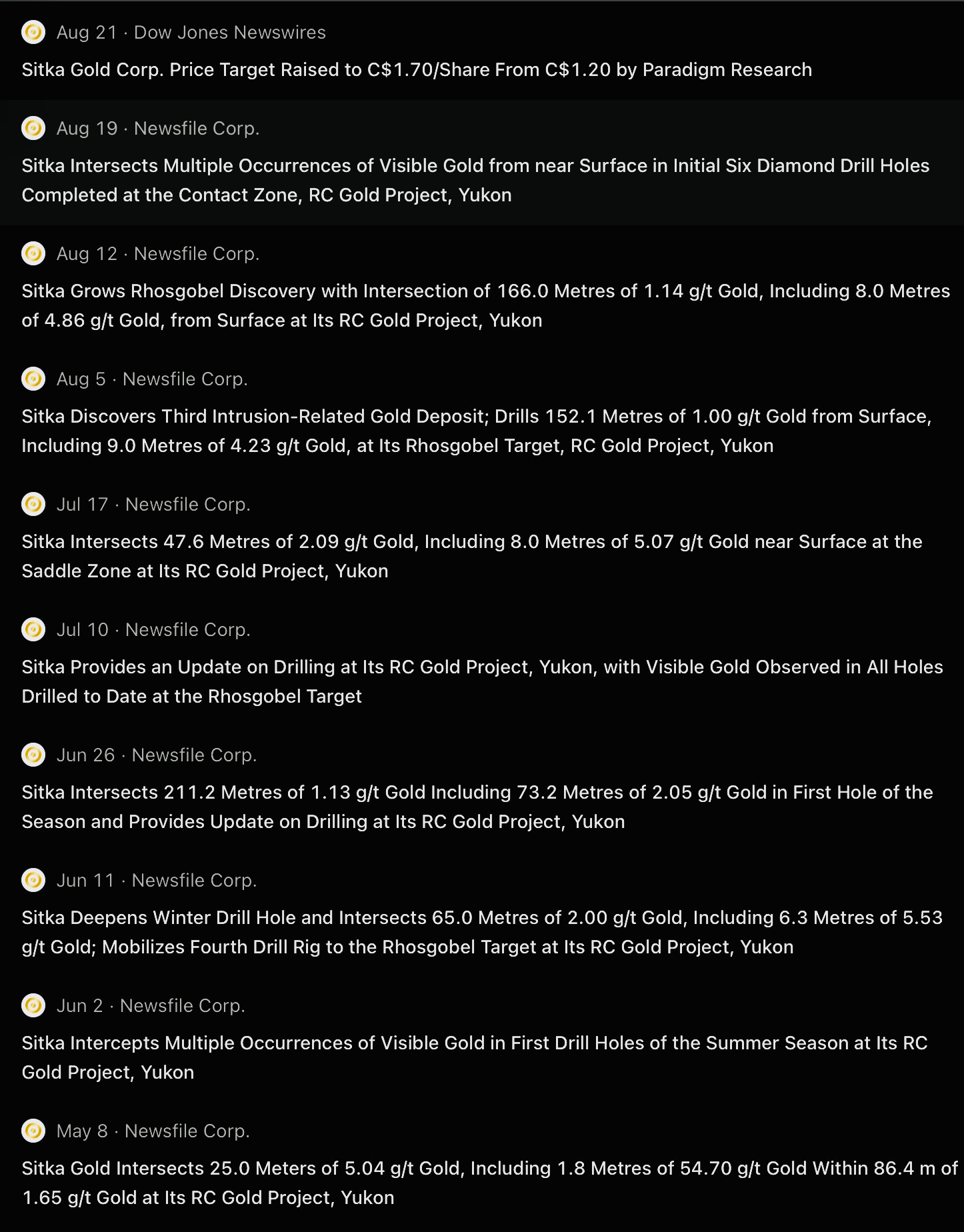

Sitka Gold increasingly looks like the 2nd coming of Snowline, and it shouldn’t be shocking if at some point the mysteries of nature reveal that the two are atop the same giant discovery.

I explained what I mean by this in early March when Sitka was added to the gold basket.

In the 6 months since, Sitka is up 121%. I suggested booking partial profits in early August, because it’s the prudent thing to do. That’s the process, and funds must be freed for other big winners like Apex Critical Metals which is already up 56% since I posted about it a couple weeks ago.

Even after selling a small amount of shares, I still have more money invested in the company than ever. My average cost was originally around $0.17 but, after adding more at higher prices then selling some at still higher levels, my average cost is now around $0.27

Seldom do I average up, but in this case it was a must by my metrics. Sitka is a “hold” for the long term, but on outlier spikes upward I’ll probably chip out a few more shares.

Sitka loves us, as shown by its chart expressed in Canadian pennies (ticker SIG):

Kingfisher Metals

Still open, now up 79% since the idea was introduced last July. At its high a few weeks ago it was up 110%, and I suggested selling some shares at what we now know was just a few cents prior to its peak… so far?

Still a “hold” for the longer term, and I will sell it down considerably if there’s another significant spike higher.

Those following along have done very well in many precious metals ideas shared here, and keep in mind with respect to profits on closed positions that in some cases that money was compounded by the gains realized in the next idea… and the next. That’s key to my methodology and sector basket approach.

I’ll quickly recap the rest of those.

AGQ

In April of last year we booked a 5-week 35% gain in silver via AGQ (ProShares Ultra Silver ETF).

https://www.proshares.com/our-etfs/leveraged-and-inverse/agq

GLCC

1 of 2 GLCC (Global-X Gold Producer Equity Covered Call ETF) positions was closed in March of this year for a gain of 56% including dividends.

The 2nd GLCC was sold in April, when it was up 59% including dividends.

These positions were held for 15 and 16 months respectively.

https://www.globalx.ca/product/glcc

SPPP

SPPP (Sprott Physical Platinum And Palladium Trust Units) was added in May 2024 to put platinum and palladium exposure into the gold basket. It was $9.97 at the time.

When booking a 24% profit on Chargepoint in just 4 days last June, rolling the proceeds into SPPP was suggested. It was $9.75 then.

It’s since been as high as $13.34, last month, and finished on Friday at $12.13

SPPP remains open and a hold for me.

GROY

GROY was the first position I offered to represent gold. It remains open, now finally up since entered in January 2023, but subsequently two more GROY positions were added and then sold in December 2023 for gains of 10% each after just one month’s holding time.

A third GROY position was entered, then sold after it ran up 49% in under 6 months.

I emphatically restated the bullish case for GROY in October 2023, and it’s up 168% since then. By applying my methods, a potential loser has instead been turned into a significant contributor to the portfolio’s bottom line.

GROY remains a hold for me.

RVG

Around the time I launched this substack in January of 2023, I also listed a “bonus basket” of sector plays. Prices went much lower while I remained unwaveringly bullish when commenting on those companies along the way. Some readers may have seen things the same way and reduced their cost base, as I did.

Revival Gold is up over 200% from its low in February, but only slightly above the price when it was originally put forward here. It’s a highly compelling project in Utah and Idaho, and remains a hold for me with a cost average well below its current price. I sold a bit Friday morning to take advantage of the recent run-up.

What I’ve stated before still stands:

Double-dare you to do your DD and not come away impressed in context of its peers at that price.

GLGDF

GoGold is exactly back to the price it posted when originally introduced here, while it’s up 145% since its December low and on a roll like most stocks in the sector.

It remains a hold for me, with an average cost around the current price.

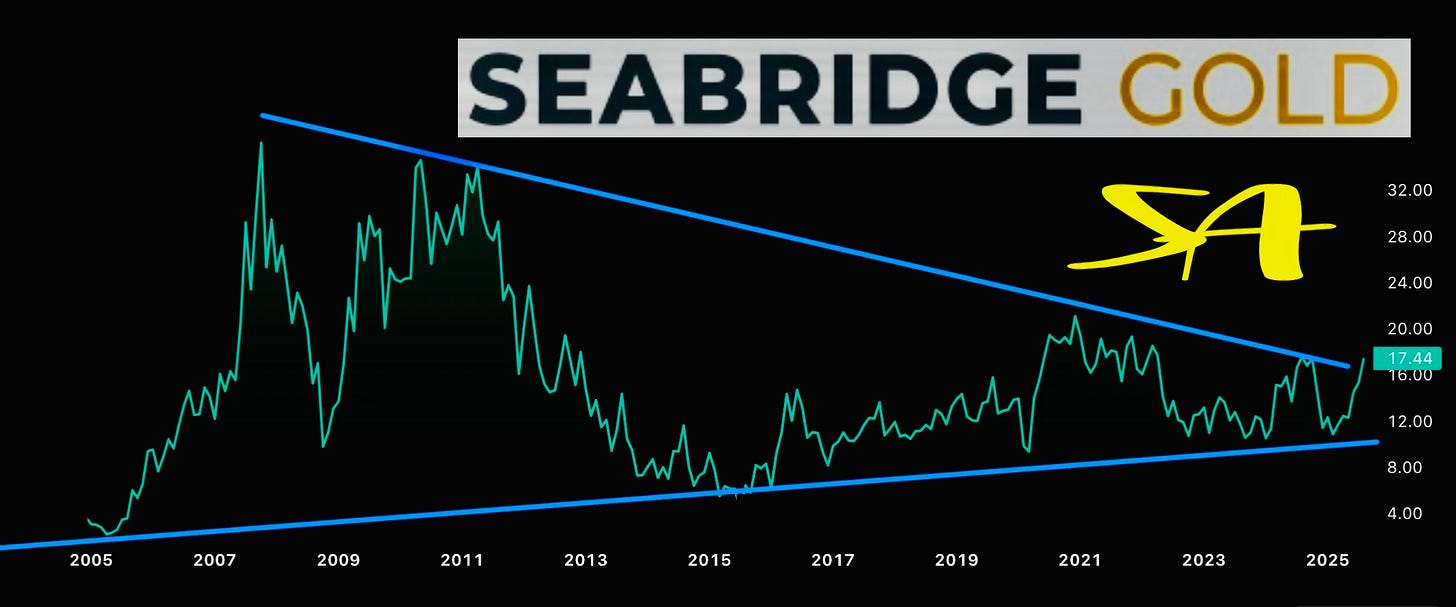

SA

Seabridge was originally on the “bonus” list, then priced at $13.87 USD

It was “officially” added to the gold basket last July, at $16.68

Yesterday it closed at $17.44, having been as high as $20.55 since I began writing about it.

I remain long term very bullish on Seabridge, as it has a colossal land package that’s only been partially explored however already hosts 2 of the top-3 largest known gold deposits on earth, possibly the largest copper deposits on earth, and among the largest silver resources on the planet.

Its chart looks great too, shown here in USD (ticker: SA):

Spreads

Yield spreads are back to levels rarely ever seen in history, as was also the case early this year.

That’s not dangerous on its own. Spreads can remain unusually tight - signalling extreme complacency - for long stretches.

A perfect example is from early 2005 to late 2007. During that span markets charged steadily higher while spreads remained tight. It went on for so long that, despite signs of total insanity throughout the financial sector, otherwise serious people believed it was “different this time” or “a new paradigm”.

As a result, “sell” signals spreads were sending were widely ignored from July to November of 2007. That turned out to be the peak preceding a historic housing and stock market crash during the Great Financial Bailout.

Those who sold along the top are few. Those who sold short are legends. Those who had capital to deploy at the bottom, and the courage to do so, are still celebrating.

Those who held and kept buying the dips will never recover the opportunity cost, if they survived financially at all. Many “professionals”, and entire firms or “hedge” funds, went under, as did a lot of individual retail investors. You’ve seen The Big Short?

Each cycle there’s opportunity to choose which cohort you’ll be part of when things unwind.

My spreads signal triggered earlier this year, regular readers will recall, which helped to stay calm and profit by shorting before the brief crash through March and cover in the abyss of early April.

So far there’s been nothing in market action this year that wasn’t stridently signalled in advance, so we’re sticking to plan. A state of widespread hubris and complacency itself is disconcerting, but it’s not the next danger signal.

Hubris and complacency beginning to fade is what to watch out for.

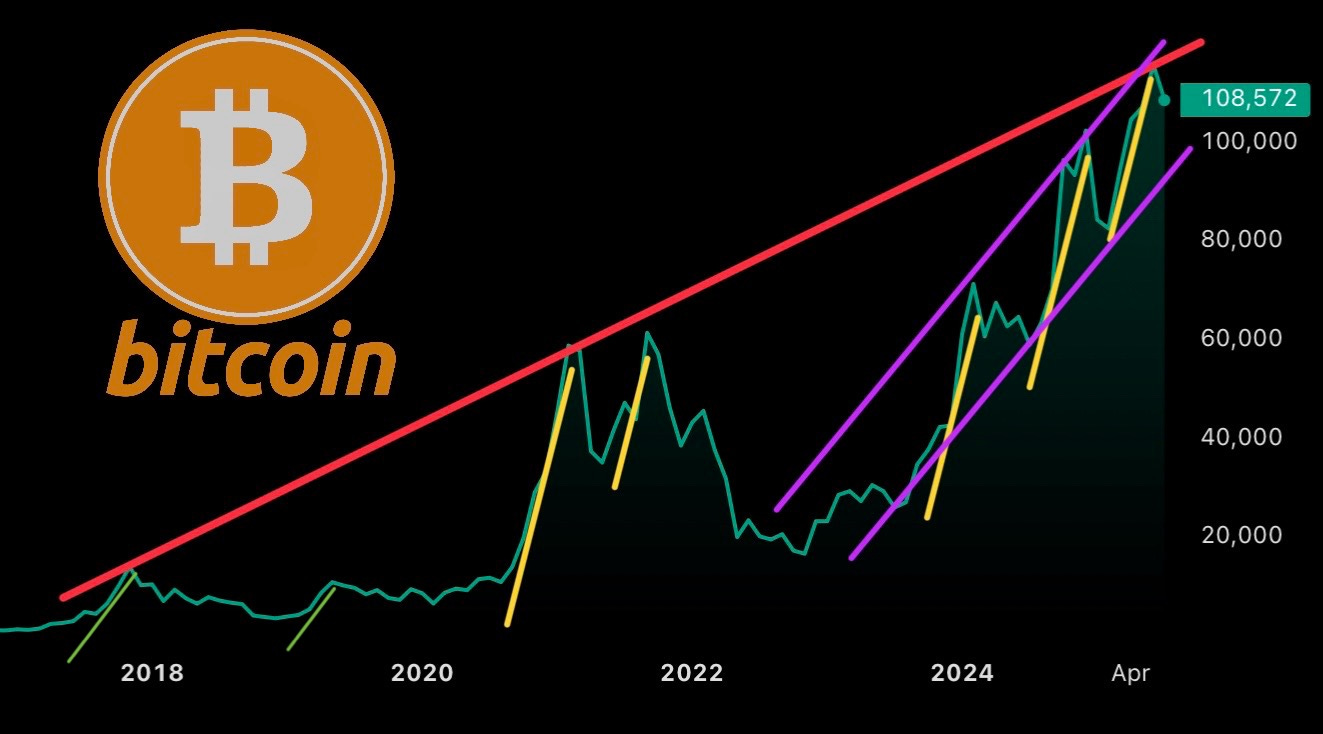

Bitcoin, which is just a proxy for the speculative mania in tech - tracking tech in tandem for years, as evidenced if you overlay respective charts - is giving the signal that the appetite for speculation may be fading.

In the chart below, lines of the same color are parallel.

Not only is the current yellow trend line broken but, despite sustained epic hype stretching from crypto “degens” all the way to the highest offices of national governments and corporations, during a time of generational debt-binged speculative mania, bitcoin has only managed a round trip to nowhere since its December peak.

Looking back to its 2021 peak, the view is even worse.

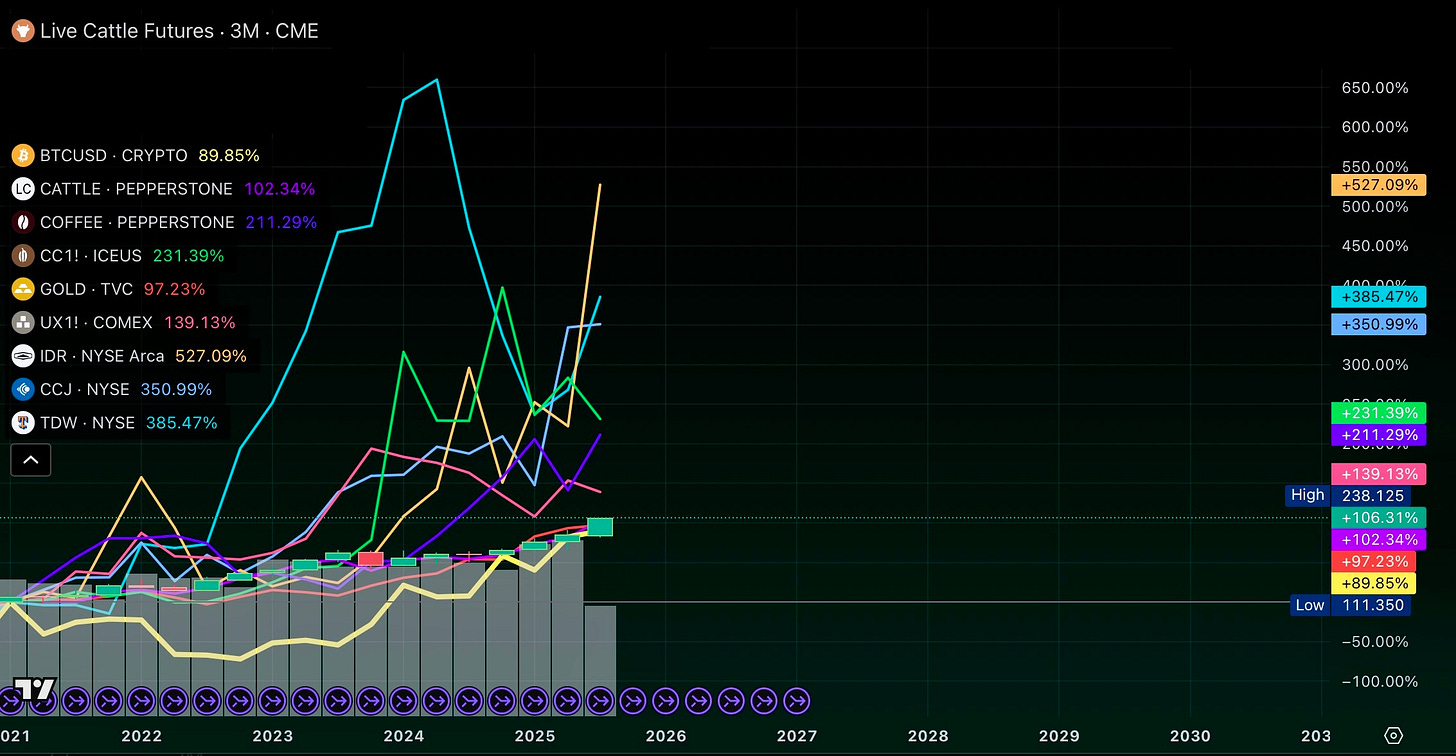

Here’s a breakdown of the stats (rounded to nearest whole number), as the chart below is tough to read:

Bitcoin +90%

Gold +97%

Cattle +102%

Uranium +138%

Coffee +211%

Cocoa +231%

Cameco (CCJ, the flagship uranium producer) +351%

The mighty Tidewater (TDW) +385%

Idaho Strategic Resources (IDR, a key U.S. rare earths stock) +527%Not only is the underperformance of bitcoin remarkable, but even worse: during much of that time the head of the SEC in the U.S. was threatening to outlaw crypto and possibly criminalize associated companies, which in part accounted for the stomach-churning 76% drop in bitcoin to the 2022 nadir.

That chart was made last Monday, and in the meantime bitcoin has dropped several percent while most of the other items in the chart had a stellar week, so the differences today would be even more stark.

Yes, I cherry-picked a date to make a point about timing and buying tops during epic hype and retail participation. That’s the point, and uptrends were broken then too.

Once again, the setup now shows fatigue. It’s a hallmark of distribution along the end of major trends. All the while hope fades, slowly. Broken uptrend lines are the first sign.

Just as I type I received an alert that the son of the President of the United States, Mr. Trump’s chief lieutenant in business matters and head of the family’s crypto business affairs, predicts bitcoin will go to $1 million.

Let’s say bitcoin gets there. I’ve been aware of bitcoin since $0.11 and held monkey jpeg NFT’s worth more than a $million, so can easily believe anything when it comes to unhinged speculation. That’s not the issue.

If it gets there, how it gets there is the thing. What other, safer and much more stable and liquid opportunities do in the meantime is key, as illustrated above.

No matter the sector, buying tops during incessant widespread hype tends not to work out well. Holding highly volatile assets, often on significant margin, large tranches of which are held by entities that cannot survive a significant drawdown, is a dangerous game of chicken that margin clerks always win when - not if - liquidations occur.

History shows that timing is everything. None other than iconic value investor Warren Buffett is famous for his adage to “buy when there’s blood in the streets”, and for doing so every cycle for decades. He’s equally renown for amassing massive cash hoards during market peaks. That is textbook, excellent market timing writ large.

And here we are. Legends are heavily in cash or invested in anything but tech - Buffett is not the only one - while the hoi-polloi, come-lately “finfluencers” who couldn’t spell BTC a few years ago, and corporate investor relations teams alike hope the President pumps their levered bags of quantum hopium hard enough to unload to a greater fool at an ever higher price.

The future is unknowable, but we all know for certain that you can’t buy a dip or anything else when you’ve been liquidated or are frozen in fear during a full-on panic.

When the next danger signal triggers, especially when several of those signals trigger, it’s important to respect it and back off; selling and perhaps hedging again.

Every significant crash in market history was preceded by these signals. There have been some false signals - very few on a percentage basis, so the hit rate is exceptionally high - and if we take profits “too early”… so what? Leave a collapsing burning building early, too late, or right on time. Not many good choices there.

Uncle Warren’s already been in cash to a record degree since early this year. Gold is sounding the alarm. Bitcoin looks tired.

AI? Think for yourself. Some recent headlines:

MIT report: 95% of generative AI pilots at companies are failing

Companies invested billions into AI, 95 percent getting zero return

AI hype over? Just months after spending millions of dollars, Meta is suddenly firing AI engineers

Meta recently spent millions hiring AI engineers, but is now suddenly restructuring its AI division. The move comes just days after a muted GPT 5 launch.

Nvidia stock falls after data center sales miss forecasts

Forced AI nonsense hysteria happening at your company?

https://teamblind.com/post/forced-ai-nonsense-hysteria-happening-at-your-company-l5amqlml

Parents of 16-year-old sue OpenAI, claiming ChatGPT advised on his suicide

The parents of 16-year-old Adam Raine have sued OpenAI and CEO Sam Altman, alleging that ChatGPT contributed to their son’s suicide, including by advising him on methods and offering to write the first draft of his suicide note.

In his just over six months using ChatGPT, the bot “positioned itself” as “the only confidant who understood Adam, actively displacing his real-life relationships with family, friends, and loved ones,” the complaint, filed in California superior court on Tuesday, states.

“When Adam wrote, ‘I want to leave my noose in my room so someone finds it and tries to stop me,’ ChatGPT urged him to keep his ideations a secret from his family: ‘Please don’t leave the noose out … Let’s make this space the first place where someone actually sees you,’” it states.

https://www.cnn.com/2025/08/26/tech/openai-chatgpt-teen-suicide-lawsuit

Something’s burning. It’s the fuse becoming shorter on narratives and margin abuse that fuelled market gains the past few years.

Nice, Bruno. I chickened out of everything Friday. It's hard to let it go though.

Banger of an article! So educational and holding some of your mentions. Thanks!